- Uniswap price is releasing above a declining trend line originating in mid-May.

- UNI 50 twelve-hour simple moving average (SMA) hovers just 10% above current prices, maybe containing a sustainable rally.

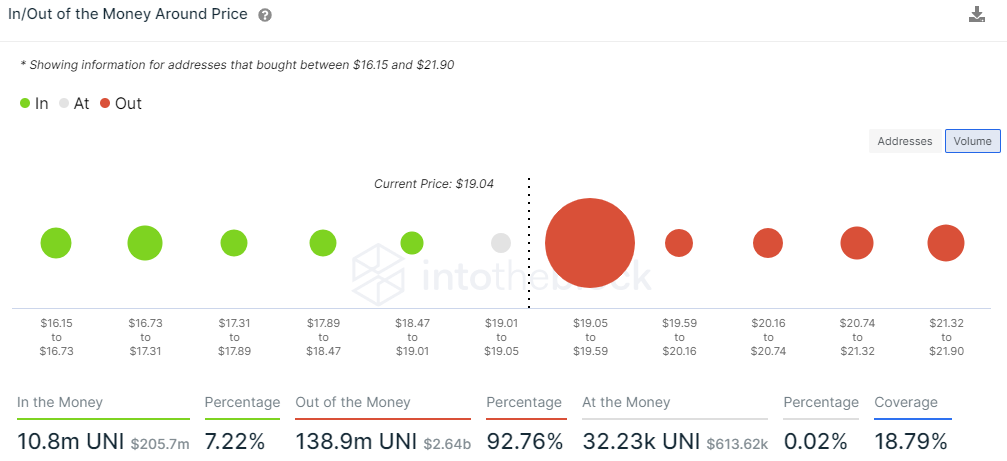

- Based on In/Out of the Money Around Price (IOMAP), the defi token is confronted by significant resistance at current prices.

Uniswap price has climbed almost 40% from the June 22 low and seized the opportunity of an oversold reading on the twelve-hour Relative Strength Index (RSI) to slingshot above a longstanding trend line beginning on May 14. If UNI can close above the trend line on a daily basis, there is a potential for the altcoin to charge higher, but there is still more to prove.

Uniswap price dictates patience and flexibility

Uniswap price dived 70% from the May 2 high of $45.02 to the May 23 low of $13.01, logging one of the smaller corrections in the cryptocurrency complex. The May 23 low, which was not tagged during the weakness in June, was defined by a bullish hammer candlestick pattern. The pattern unleashed an impulsive wave that stalled at the 50% retracement of the May correction, where UNI transacted until collapsing 50% into the June 22 low.

Today, Uniswap price is generating interest above the instructive May declining trend line, a resistance level that suffocated several rally attempts in the first half of June. The developing rally from the June 22 low of $13.90 has looks corrective and is nearing resistance constructed by a price range around the June 12 low of $20.25 and the 50 twelve-hour SMA at $20.82.

Due to the lack of impulsiveness of the rebound, Uniswap price needs to prove itself with a daily close above the June 12 low of $20.25. If UNI accomplishes the requirement, it should find little difficulty overcoming the 50 twelve-hour SMA at $20.82, thereby freeing the digital asset to test the 200-day SMA at $22.76.

A continuation of the rally beyond the 200-day will be a challenge due to the declining 50-day SMA and the nearing bearish Death Cross pattern. The combination will weigh on price, at least in the short term.

UNI/USD 12-hour chart

The cryptocurrency market is having one of the better days in the last month, but the magnitude of resistance stacked in front of the cryptocurrencies recommends evaluating the downside possibilities.

A failure of Uniswap price to hold the May declining trend line at $17.84 will lead to a swift test of the minor trend line beginning June 22. UNI investors can anticipate some support, but the higher probability outcome is at least a test of the June 22 low and potentially a drop to the May 23 low of $13.01.

One metric arguing against continuing the emerging rally is the IntoTheBlock In/Out of the Money Around Price (IOMAP). The metric shows a substantial cluster of resistance (out of the money addresses) from $19.05 to $19.59, where 3.79k addresses hold 124.14m UNI at an average cost of $19.45.

The resistance range indicates that Uniswap price will be unsuccessful in reaching the June 12 low of $20.25.

Compounding the bearish tilt of the metric is that there is virtually no support (in the money addresses) from $19.05 to $16.15, proposing that renewed selling pressure will not face push back until at least the June 22 minor trend line now at $16.33.

UNI IOMAP - IntoTheBlock

With that said, if Uniswap price breaks through $19.59, there is no identifiable resistance to at least $21.90.

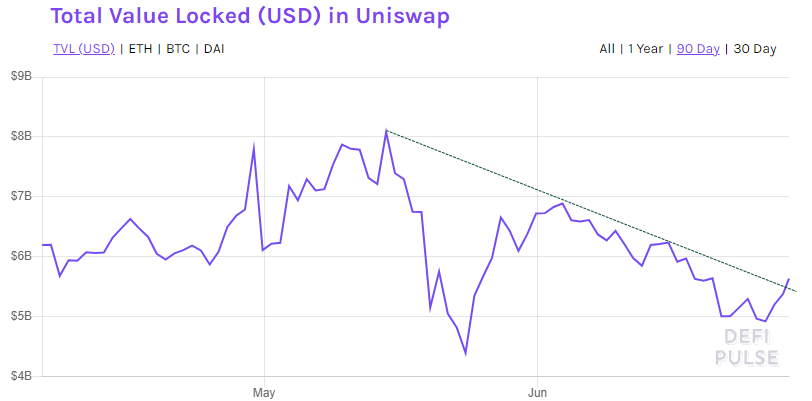

The below chart also highlights a headwind for UNI investors. The decentralized trading protocol's Total Value Locked (TVL) assets have dropped from May 14 high of $8.0b to $4.9b at the June 26 low, representing a 38% decline.

Clearly, the significant momentum in DeFi projects that headlined earlier this year has slowed substantially. However, there may be a green shoot as the Uniswap TVL breaks out above the declining trend line in May.

UNI TVL - DEFI PULSE

Challenges remain for Uniswap price, and it is too early to fasten the seatbelts for an impulsive dash higher. The preference should be for flexibility to let UNI prove itself in the days ahead.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.