Uniswap overtakes Ethereum in fees after acquiring NFT platform Genie

- Uniswap’s recent integration of NFT marketplace aggregator Genie has triggered a rise in activity on the protocol.

- Uniswap witnessed a massive spike in user activity and outperformed Ethereum in terms of fees paid over a seven-day rolling average.

- Analysts have set a bullish target of $8 for Uniswap price in the current uptrend.

Uniswap expanded their products to include both ERC-20 and NFTs after acquisition of the first NFT marketplace aggregator Genie. Uniswap’s web app will soon allow users to buy and sell digital collectibles and art across all marketplaces, fueling a bullish sentiment among users.

Uniswap beats Ethereum in fees, fueling DeFi summer 3.0

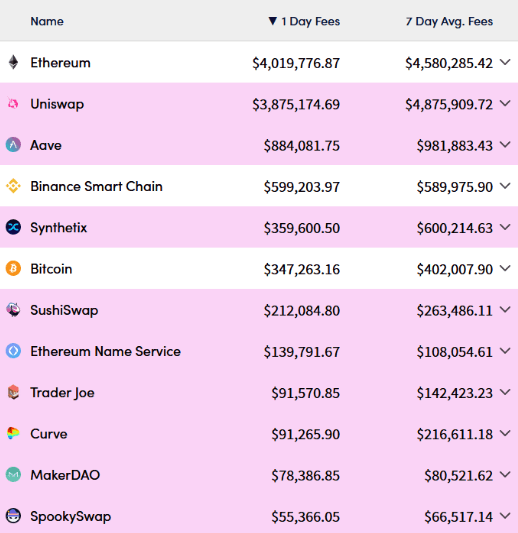

Based on data from Crypto Fees, the average daily fees collected from daily trades between June 15 and June 21 is $4.87 million. Uniswap overtook Ethereum in the daily fees paid over a seven-day rolling average.

On June 15, fees collected on Uniswap hit a high of $8.36 million, while on the Ethereum network it was under $8 million. The DEX on the Ethereum blockchain has witnessed a massive surge in transaction activity and experts cite this as high demand for DeFi in the current crypto bear market.

Fees paid on AAVE and Synthetix have seen a rise, alongside Uniswap and native tokens such as Compound (COMP).

Daily fees across DeFi platforms 7-day rolling average

Uniswap’s acquisition of NFT marketplace aggregator Genie

Uniswap expanded products after its recent acquisition of Genie, offering users the opportunity to discover and trade digital collectibles and art. NFTs will soon be integrated with Uniswap products, starting with the web app, developer APIs and widgets. This would make Uniswap a comprehensive platform for users and builders in Web3.

Uniswap’s recent blog explains that this acquisition is part of the protocol’s mission to unlock universal ownership and exchange.

2/ Starting this fall, you’ll be able to buy and sell NFTs directly on the Uniswap web app.

— Uniswap Labs (@Uniswap) June 21, 2022

And we’ll integrate NFTs into our developer APIs and widgets, making Uniswap a comprehensive platform for users and builders in web3.

Read the full details https://t.co/ovU8zJfGdd

Uniswap price breaks into uptrend, analysts remain bullish

The latest round of acquisitions and updates on Uniswap protocol have fueled a bullish sentiment in the community of holders. Analysts evaluated the Uniswap price chart and identified a bullish trend in the DeFi token.

Brian Bollinger, a crypto analyst, noted a double bottom pattern breakout. Uniswap tested support multiple times and long-tail rejection attached to the candles suggested a high-demand zone. Uniswap price witnessed a bullish breakout past $4.57, accompanied by high volume activity on the protocol.

Analysts argue that Uniswap price has entered bullish territory and that the next resistance levels are $7.50 and $9.80.

UNI-USDT price chart

FXStreet analysts believe Ethereum price could witness a breakout if bulls jump in and set these targets for the altcoin. For more information, watch this video:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.