Uniswap new governance proposal sparks controversy

- Traders and analysts slam Uniswap's latest proposal in favor of making a sizable grant to a specific community analytics provider, Flipside Crypto.

- Crypto analytics providers Dune Analytics and co-founder of DeFiPulse request the community to vote in the negative.

- Though the Uniswap community is divided, there is no negative impact on UNI's price yet.

Uniswap has sparked a controversy among traders and crypto enthusiasts by calling a vote for a controversial governance proposal when there was a lack of community attention.

Uniswap Governance at major crossroads considers granting $25 million to Flipside Crypto

Uniswap is a decentralized exchange protocol governed by UNI token holders. Any address that has over 10 million UNI delegated to it is eligible to create a proposal. The community votes on the proposal over the next three days, once the majority votes are cast, the proposal is queued in the Timelock and executed in a minimum of 2 days.

Uniswap's recent proposal has sparked controversy since the community is voting on a $25 million grant to a specific analytics provider, Flipside Crypto when there are several in the DeFi ecosystem who are delivering analytics for Uniswap without any grant.

Flipside requires the $25 million to produce Community-Enabled Analytics for Uniswap and proposes not to spend it but to utilize it for earning yields every month. If a 30% yield target is achieved, the $15 million (the $25 million is split in $15 million disbursed near instantly and $10 million later) will generate approximately $2.25 million every year.

Flipside Crypto plans to deliver 50% of the monthly yield, $93,750 as bounties for community members, and pay for eight full-time employees to support the development of the analytics platform with the rest.

Scott Lewis, the co-founder of analytics platform DeFiPulse, stated that the incentives on the grant request are misaligned and noted how it has received negative feedback.

Lewis commented on the proposal request in the forum:

The "profit creation" part is a bit of a boondoggle, and eliminates long-run accountability. There is not a good reason $25M must be granted outright IF the goal is to provide low six-figure amounts in bounties.

The part where UNI is utilized for earning a yield has left community members confused; what's more, what happens to the $25 million after the course of the initiative is not yet clear.

The community's biggest concern is that Uniswap's venture capitalists can make the proposal go through with limited accountability if they attach their reputation and resources to the recipient of the funds.

Analyst and investor behind the Twitter handle @iamDCinvestor agrees with Lewis' stand.

fwiw, i don't think people who submit "gov proposals" which i disagree with are bad people

— DCinvΞstor (@iamDCinvestor) August 19, 2021

they are simply using a process which is poorly designed in a way that is rational for them

conversely, it is the job of governance to ensure they benefit for the DAO is maximized

Dune Analytics, an analytics provider, made a public service announcement on Twitter and called out the fact that a proposal to pledge $25 million out of the Uniswap Treasury is on vote, with near-zero attention from the community.

PSA to all $UNI holders

— Dune Analytics (@DuneAnalytics) August 19, 2021

A @uniswap governance proposal that will let @flipsidecrypto manage up to $25M in $UNI tokens and use yield to fund their own operations is about to pass in <24 hours with almost zero community attention.

Please help RT.https://t.co/BHXQGt58EA

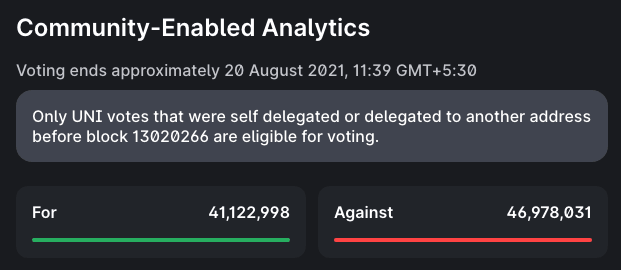

Despite the divide in the community on whether Flipside Crypto deserves the $25 million or not, there is no immediate impact on UNI's price. Earlier today, the proposal had more UNI holders voting for than against; the table has flipped after crypto Twitter's reaction.

It remains to be seen whether UNI holders will let the proposal pass or support the plea of analysts and influencers on Twitter to stand against "self-serving proposals."

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.