Uniswap likely to frustrate traders, UNI bulls most at risk

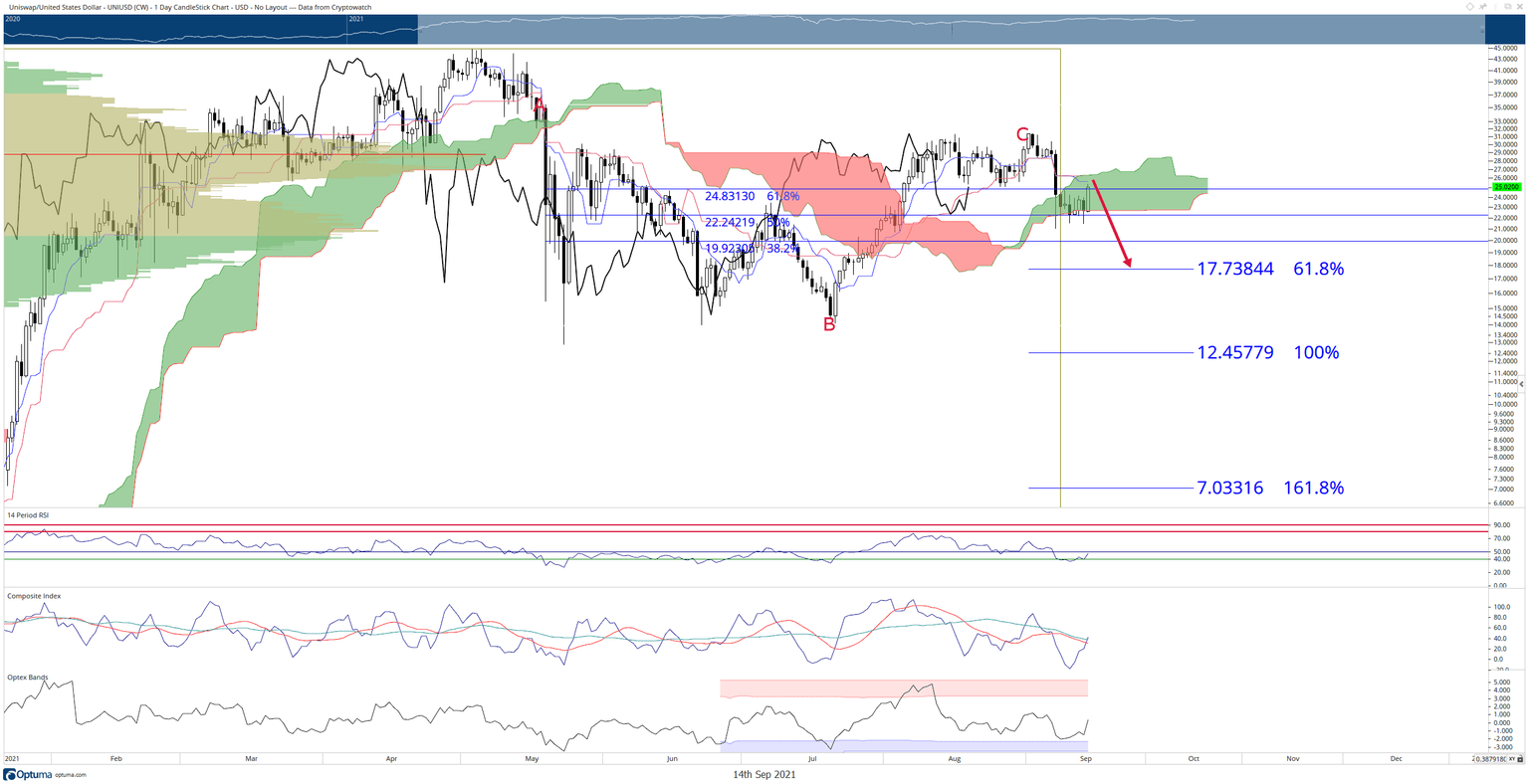

- Uniswap price is trading inside the Cloud.

- Oscillators show bearish divergence is developing.

- Price likely to ping-pong between two near-term resistance and support levels.

Uniswap price has experienced some nice bullish gains throughout the trading session. However, the daily highs coincide with a collection of major resistance levels in the Ichimoku system. Conversely, the strong support at the open of the current daily candlestick is a confluence zone of Fibonacci and Ichimoku support levels.

Uniswap price shows a standard pullback has occurred, a continuation of the prior downtrend likely

Unitswap price has traded higher throughout the day but faced resistance against a collection of important Ichimoku levels. The daily Tenkan-Sen, Kijun-Sen, and Senkou Span A (top of the Cloud) share a value are between $25.75 and $26.20. Just below those zones is the 61.8% Fibonacci retracement level at $24.83. Solana opened the day on top of Senkou Span B (bottom of the Cloud) at $22.66 and just above the 50% Fibonacci retracement at $22.24. With the Chikou Span below the candlesticks and the current rejection against the collection of Ichimoku levels at $26.20, a return to lower traded prices is likely.

The Relative Strength Index shows some hints that support was found at the second oversold level in a bull market (40). Additionally, the Composite Index has crossed above both of its moving averages. Bulls will want to monitor the Composite Index and be warned if it creates a reading above the September 6th value. If the Composite Index creates an equal or higher value than the September 6th value and Solana price is trading below the September 6th high, then a condition known as hidden bearish divergence occurs - a warning that the prior bear trend may continue.

UNI/USD Daily Chart

Bears will want to be mindful of where the Chikou Span is at over the next week. While the Chikou span remains below the candlesticks, near-term bearish price action can be expected. However, if the Chikou Span moves to close above the Candlesticks ($29.66), then any bearish momentum is invalidated and a resumption of higher prices will probably continue.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.