- Uniswap has responded to SEC's Wells notice, according to its founder, Hayden Adams.

- Adams hopes the SEC will reconsider its enforcement action against Uniswap after recent regulatory wins for the crypto industry.

- UNI's on-chain data suggests it needs a 50% rally before seeing significant profit-taking amid signs of potential price spike.

Uniswap (UNI) gained nearly 3% on Thursday as its founder revealed the decentralized exchange (DEX) has responded to the Securities & Exchange Commission's (SEC) Wells notice. Meanwhile, UNI's on-chain data also suggests a price spike may be on the horizon.

Uniswap responds to Wells Notice

Uniswap founder Hayden Adams revealed in an X post on Wednesday that the protocol has responded to SEC's Wells notice. This follows a crypto community member asking if his recent positivity surrounding Democrats becoming allegedly pro-crypto solves the Wells Notice issue.

Uniswap Labs received a Wells notice from the SEC on April 10, in which the regulator accused the decentralized exchange of facilitating unregistered securities trading.

A Wells Notice is a document from the SEC issued upon the conclusion of an investigation stating its intention to take enforcement action against a prospective respondent who can submit a written response to the securities regulator.

Read more: Uniswap price could crash 12% as investors take profits

According to Adams, 80% of the time, the SEC proceeds with an enforcement action one month after a Wells notice. Considering the SEC has yet to take enforcement actions against Uniswap more than six weeks after the Wells notice, Adams hopes the regulator has pivoted.

"I hold out some hope they realize consumers are much better off if they focus on constructive rule making and enforcements against scams (vs enforcement against legit companies building useful tech) - and decide not to proceed," said Adams. He further highlighted that a change in SEC leadership would be the most impactful thing Biden can do to build trust with the crypto industry.

Adams also mentioned he's "preparing for the worst" as the Wells notice still looms over Uniswap.

Considering the SEC's approval of spot Ethereum ETFs on May 23 — which many believe removes potential security status from ETH — and the House of Representatives approving the FIT21, many expected the SEC to wind down on previous legal actions targeted at crypto firms.

UNI may need a 50% rally before seeing significant profit-taking

UNI is up nearly 3% on Thursday as the Uniswap DAO will begin another voting round on "fee switch" proposal on Friday. The "fee switch" proposal will see UNI holders who participate in protocol governance earn a portion of Uniswap's revenue. However, many have also raised concerns that such a move could intensify the SEC's action against the DEX.

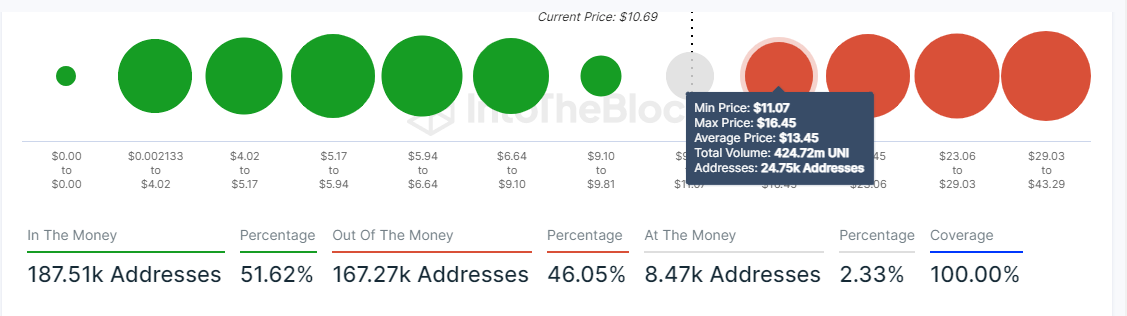

Data from IntoTheBlock shows that 51.6% of UNI addresses are in the money, 2.3% are at the money, and 46% are out of the money.

In/Out of the Money reveals the total number of addresses in profit or loss based on their average cost of purchase. An address is in the money if its current price is higher than its average cost and vice versa if it is lower.

Global In/Out of the Money

UNI's holder's composition also shows that 82% of addresses are long-term holders (1 year plus), 17% bought within the last 12 months, and 2% bought within the past month.

Considering nearly half of UNI's supply was bought at an average price of $13.45, investors/whales are likely to hold onto their positions.

A combination of both metrics and UNI's historical price shows UNI needs to rise over 50% to around $16.45 before it may see significant profit-taking.

UNI 30-day MVRV

In the short term, UNI could see a spike as it often sees a price rise whenever the 30-day average MVRV movement retraces briefly after reaching around 21-26%, according to data from Santiment.

The 30-day MVRV calculates the average profit or loss of addresses that acquired an asset within the previous 30 days.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Axiom’s volume surpasses $100M as meme trading platform war escalates on Solana

Axiom meme coin trading volume hit $101 million for the first time, surpassing other platforms on Solana. Axiom accounts for 30% of the ecosystem’s trading users, followed by Photon and Bullx at 24% each.

Bitcoin aiming for $95,000 as Global M2 money supply surges

Bitcoin (BTC) price edges higher and trades slightly above $85,500 at the time of writing on Tuesday after recovering nearly 7% the previous week. The rising Global M2 money supply could be a favorable signal for both Gold and Bitcoin.

Top 3 gainers Brett, Story and Virtuals Protocol sparkle as Bitcoin eyes $90,000

Cryptocurrencies have sustained a buoyant outlook since last week as US President Donald Trump’s tariff war was paused for 90 days, except for China, propping global markets for lifeline relief rallies.

Three altcoins to watch this week: ALGO, MANA and JASMY show bullish signs

Algorand, Decentraland and JasmyCoin hovers around $0.19, $0.27, and $0.015 on Tuesday after a double-digit recovery last week. ALGO, MANA and JASMY approach their key resistance levels; breakout suggests a rally ahead.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[23.39.11,%2030%20May,%202024]-638527083384283606.png)