UK Parliament to launch an inquiry into NFT markets citing risks, calling it “a bubble”

- The Digital, Culture, Media and Sport Committee will be weighing the risk and benefits of the NFT market.

- The inquiry will reveal whether the NFT space needs more regulation in the UK.

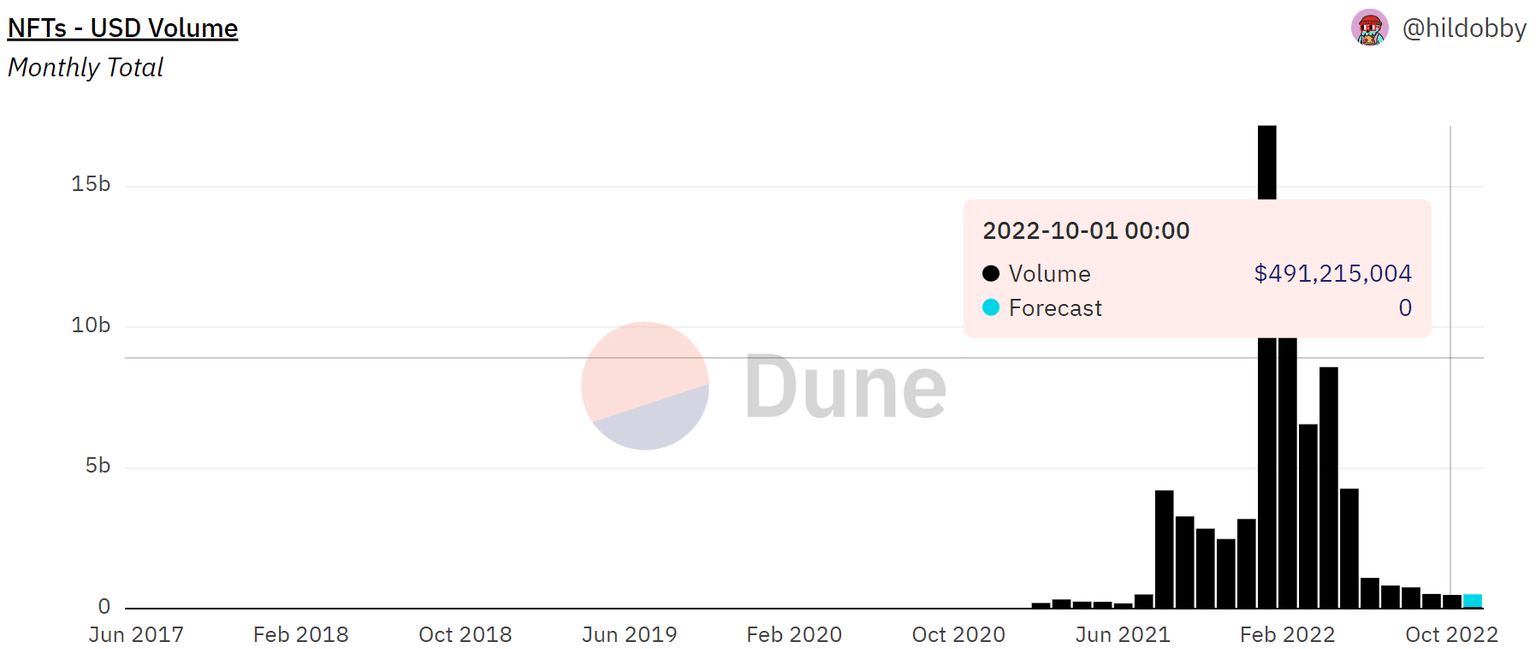

- The NFT winter does not seem to be coming to an end, as the month of October generated less than $500 million in sales.

Non-Fungible Tokens (NFTs), at one point, were the most hyped aspect of the crypto space, with many collections minting millions of dollars from these tokens’ sales. However, as the crypto market conditions worsened, the NFT market also took a hit and is currently struggling to break free from the bearishness.

UK investigates NFT

In an announcement on Friday, the UK Parliament stated that the Digital, Culture, Media and Sport (DCMS) Committee is going to initiate an inquiry into NFTs. The committee will investigate the potential risks, and threats NFTs pose to investors and markets, as well as analyze what benefits can be reaped out of its operations.

Presenting Jack Dorsey’s first tweet’s NFT as an example, the DCMS showcased how overvalued assets may be dumped onto “greater fool” investors. The tweet initially sold for $2.9 million but only racked up a bid of $280 upon reselling. Instances as such led to the government calling the NFT speculation a “bubble”.

Commenting on the same, the Chair of the DCMS Committee, Julian Knight MP, said,

“Our inquiry will investigate whether greater regulation is needed to protect these consumers and wider markets from volatile investments. This inquiry will also help Parliament understand the opportunities presented by an exciting new technology which could democratise how assets are bought and sold.”

According to Knight, the investors are at risk of buying NFTs whose value may burn to ash at any moment. Thus, the investigation is necessary to analyze whether the country needs stricter NFT regulations.

NFT markets at the moment

The UK Parliament alone is not concerned about the loss of value as NFT traders, too, seem to be realizing the same. NFT sales, which had already been declining for the entirety of the year after hitting an all-time high of $17.1 billion in January, recently hit 16-month lows.

In October, the combined value of all NFTs sold was a little under $500 million registering $491.2 million. This shows that not only is the value of NFTs declining, but the demand is reducing as well.

NFT sales in October

Thus inquiries and investigations at this time would only push investors farther away, which could result in NFT sales receding significantly over time.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.