- Shiba Inu price dances between $0.00001180 and $0.00001274 while investors accumulate ahead of its next big move.

- Major support around $0.00001200 implies that SHIB price is ready for a bullish breakout.

- Solid support between $0.00001100 and $0.00001200 places Shiba Inu in a position to rally to $0.00001800.

Shiba Inu price is pivoting within a medium-wide range running from $0.00001180 to $0.00001274. Early this week, the second-largest meme coin was strongly rejected at $0.00001295 while attempting to capitalize on a bullish move targeting $0.00001800. For now, Shiba Inu price is concentrating on defending the demand area highlighted at $0.00001180 in a bid to relaunch its northbound quest to $0.00001800.

Read more: JUST IN: The crypto industry is just fine with the securities laws – SEC Chair Gensler

Whales sink more money into SHIB despite price movement limitations

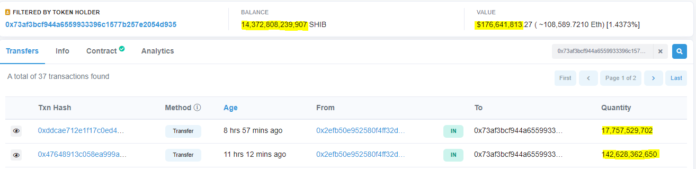

A couple of Shiba Inu investors are catching the market’s attention for accumulating up to 14.9 trillion SHIB tokens. Etherscan.io reports revealed that the two deep-pocketed whales topped up their investment in the second-leading crypto by another 701 billion SHIB tokens on September 7, worth around $8.62 million.

The 75th biggest Shiba Inu whale bundled up approximately 541.32 billion SHIB tokens worth around $6.6 million on Wednesday. According to Etherscan.io, the purchase was completed in one transaction from the crypto exchange – Gate.io.

Shiba Inu Etherscan.io report

At the same time, the 7th largest whale made away with roughly 160 billion SHIB tokens worth around $1.90 million. The whale carried out the transaction in two batches; a colossal $1.75 million order and another one of $218,772. CryptoBasic, a crypto media platform, found out that this whale now holds a staggering 14.37 trillion SHIB tokens. Together, the two whales hold approximately 14.9 trillion tokens.

Shiba Inu Etherscan.io report

Shiba Inu price may start gaining momentum if whales continue their buying spree. Accumulation often occurs as the market consolidates. In other words, large volume holders often push for a price breakout in either direction. With Shiba Inu price likely to uphold support at $0.00001180, a bullish breakout is possible above the upper range limit ($0.00001274).

SHIB/USD four-hour chart

The Stochastic oscillator on the four-hour chart elucidates that a brief rebound observed on Wednesday has run out of steam. Traders looking for new entries must wait for Shiba Inu price to tag the lower range limit ($0.00001180) before betting on a significant bullish climb.

Shiba Inu IOMAP model

The IOMAP on-chain model by IntoTheBlock reinforces fundamental support between $0.00001100 and $0.00001200. Roughly 20,000 addresses scooped up 58.77 trillion tokens in the range.

Holders in this range will focus on defending this support area while targeting an upside move to $0.00001800. As seen on the chart, the many weak hurdles may not hold Shiba Inu price back, at least not for long – making a bullish breakout imminent.

Read more: Shiba Inu’s growing correlation with this asset could hinder its recovery

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto Today: BNB, OKB, BGB tokens rally as BTC, Shiba Inu and Chainlink lead market rebound

Cryptocurrencies sector rose by 0.13% in early European trading on Friday, adding $352 million in aggregate valuation. With BNB, OKB and BGB attracting demand amid intense market volatility, the exchange-based native tokens sector added $1.9 billion.

US SEC may declare XRP a 'commodity' as Ripple settlement talks begins

The US SEC is considering declaring XRP as a commodity in the ongoing settlement talks with Ripple Labs. FOX News reports suggest Ethereum's regulatory status remains a key reference for XRP’s litigation verdict.

Cardano Price Prediction: ADA could hit $0.50 despite high probability of US Fed rate pause

Cardano price stabilized above $0.70 after posting another 5% decline in its 3rd consecutive losing day. Multiple ADA derivatives trading signals are leaning bullish, but the US trade war impact outweighs the positive shift in inflation indices.

Stablecoin regulatory bill receives green light during Banking Committee hearing

The US Senate Banking Committee voted on Thursday to advance the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, which aims to establish proper regulations for stablecoin payments in the country.

Bitcoin: BTC at risk of $75,000 reversal as Trump’s trade war overshadows US easing inflation

Bitcoin price remained constrained within a tight 8% channel between $76,000 and $84,472 this week. With conflicting market catalysts preventing prolonged directional swings, here are key factors that moved BTC prices this week, as well as key indicators to watch in the weeks ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

Details _ Etherscan-637982494163956048.jpg)

-637982492973118752.png)