Two reasons why Zilliqa price is ready for a quick 30% upswing

- Zilliqa price shows a resurgence in buying pressure as it rallies 14% in the last 12 hours.

- This run-up comes after a dip into the $0.097 to $0.121 demand zone.

- A daily candlestick close below $0.097 will invalidate the bullish thesis for ZIL.

Zilliqa price is back in bulls’ control as it restarts its rally. This move comes after ZIL crashed continuously since March 28. Investors can expect this rally to continue due to two technical signals.

Zilliqa price presents a buy signal on two fronts

Zilliqa price has crashed 56% since March 28, pushing its market value from an all-time high at $0.237 to $0.101. This downswing was mainly investors booking profit after a 540% exponential rally.

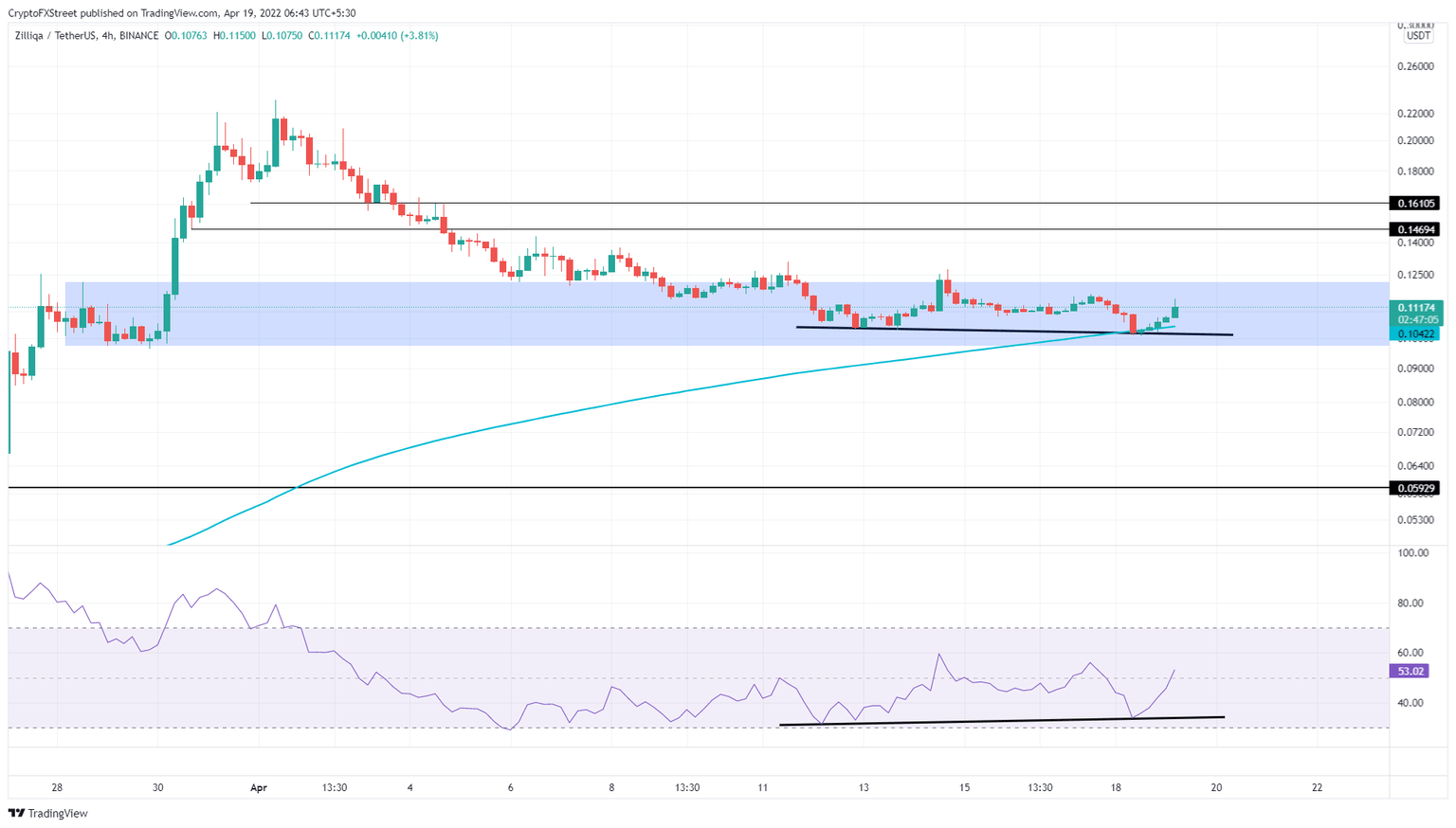

The backstop was provided by the daily demand zone, extending from $0.097 to $0.121 and the 200 four-hour Moving Average (MA) confluence. Additionally, Zilliqa price produced a lower low on April 12 and April 18, while the Relative Strength Index (RSI) produced a higher low, indicating a bullish divergence.

All of these factors played a crucial role in giving control back to bulls. As a result, ZIL has rallied 14% in the last 12 hours or so and is likely to go higher. Going forward, investors can expect a 30% upswing that pushes the altcoin to retest the $0.146 hurdle.

This is where a local top is likely to form, but overcoming this barrier could propel Zilliqa price to tag $0.161, bringing the total gain to 44%.

ZIL/USDT 4-hour chart

While things are looking up for Zilliqa price, a daily candlestick close below $0.097 will invalidate the bullish thesis by producing a lower low. Such a development could see ZIL crash 40% to $0.059, where sidelined buyers can step in and purchase the altcoin at a further discount.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.