TRX price plummets, aiming for $0.05

- TRX price has printed large bearish candles on the 3-day chart

- Tron price displays bearish control on the RSI.

- Invalidation for the downtrend is a rally into the $0.08 zone.

TRX price is severely bearish. Hopeful investors could get themselves in trouble if market conditions sustain.

TRX price is still in a downtrend

TRX price may have fooled many analysts during March as the infamous Justin Sun token had a 30% counter-trend rally. Still, last week's breakout traders are likely to feel more disappointment as the current TRX price has yet to display uptrend confluence.

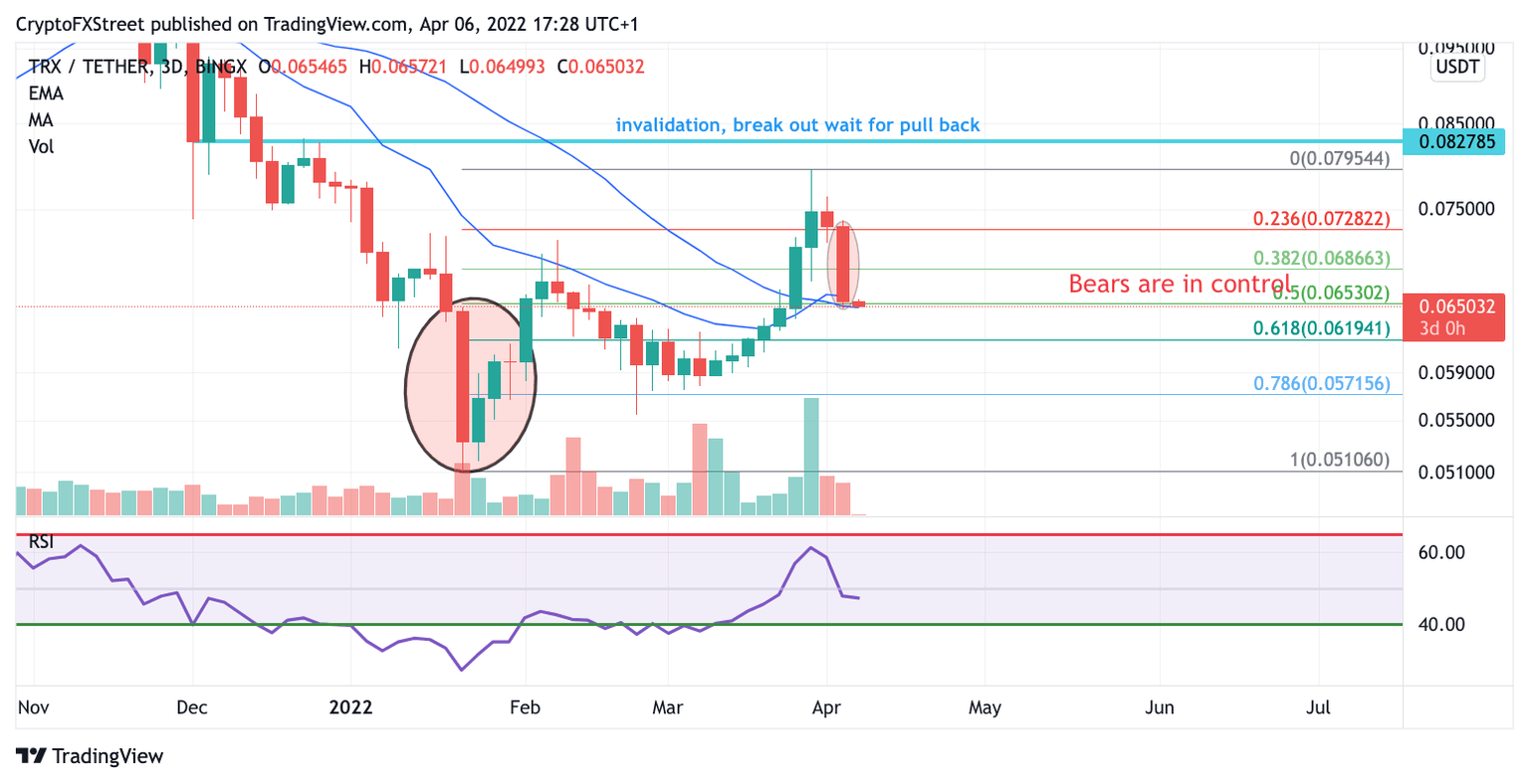

TRX price has printed the largest bearish engulfing candle within this month's rally, with a settled price of $0.065. Traders may be hopeful because there are Fibonacci retracement levels and moving averages around the current TRX price. However, analyzing the entire swing, there is no evidence to suggest any bullish strength. The bears have established the largest candles within the swing, signaling their control over the trend. The Relative Strength Index has also double topped in the sellers' territory.

TRX/USDT 3-Day Chart

TRX price should encourage traders to stay away. There will likely be some choppy price action around $0.065. A pullback with definitive chart patterns could warrant traders to look for a short aiming for $0.06 and the $0.05 swing low. Currently, there is not enough price action from the chart to provide an entry.

Invalidation for the bearish downtrend is quite drastic. The bulls will need to rally more than 27% into the $0.08 highs. If this occurs, our FX analysts will begin forecasting a trade setup to enter the pullback aiming for $0.09 and $0.10 TRX price.

Author

FXStreet Team

FXStreet