TRX price declines despite Tron DAO joining Japan Cryptoasset Business Association

- Tron DAO has joined the Japan Cryotoasset Business Association, leveraging the country's expansive market and user base.

- Japan has a strong and robust financial system, providing a solid framework for the development of blockchain and Web3 in the country.

- The news has failed to rally TRX as the broader market continues to reel from massive liquidations.

TRX, the ticker for the Tron DAO ecosystem, has continued its downtrend after breaking from a week-long consolidation, joining the rest of the altcoin community that is grinding south and following in Bitcoin’s (BTC) lacklustre moves. As top market capitalization tokens show a lack of volatility, the reduced liquidity has spelled open season for manipulators, and now investors are bracing for wilder moves ahead.

Tron DAO joins JCBA

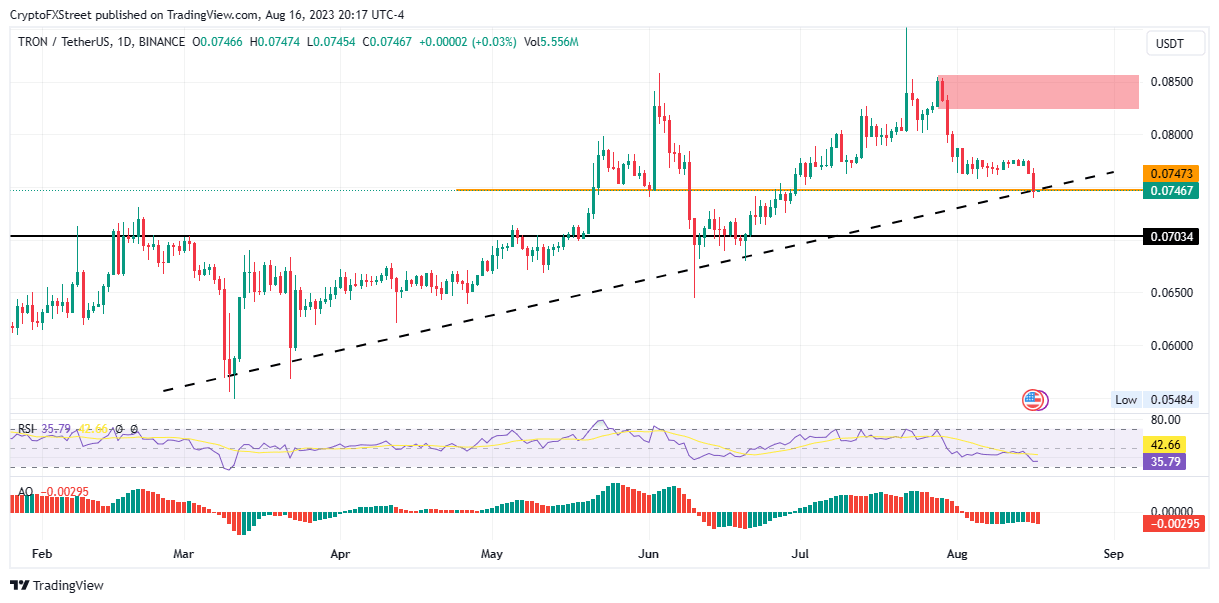

TRX price has extended its downtrend after breaking the $0.0767 support and is now testing the defense line provided by the ascending trendline at $0.0746. Momentum indicators point to a continuation of the current trajectory, and the altcoin may hit the $0.0703 support level soon unless bulls stop sitting on their hands.

The slump is unexpected, considering the Tron DAO ecosystem has recently tapped into one of the world's most vigorous and robust financial systems, Japan, which boasts a solid framework for developing blockchain and web3. Specifically, the network has enlisted into the Japan Cryotoasset Business Associaton (JCBA), according to a report on Chainwire.

#TRON is thrilled to announce we’ve joined the Japan Cryptoasset Business Association. @JCBA_org strives to cultivate a favorable environment for the development of various digital assets like #NFTs, #stablecoins, and more.

— TRON DAO (@trondao) August 16, 2023

We’ll be actively supporting JCBA’s mission,… pic.twitter.com/oI2xBvHeVy

The JCBA touts itself as "A Japanese-based association for stakeholders within the Web3 ecosystem… [committed to fostering] a promising environment for the development of digital assets, including cryptocurrencies, NFTs, and stablecoins." It comprises leading companies in the country's crypto sector and acts as a voice of authority in Japan's digital asset industry.

In matters of the Japanese crypto market, regulations often become a primary concern. NFTs and gaming-focused projects are among the main crypto sectors in Japan, primarily focused on community building, localization, and longevity. These, coupled with the country's easing regulations, have inspired an increase in crypto-fcussed interest in Japan.

Noteworthy, Tron has been consistently working towards enlarging its global footprint, with this move passing as a proactive step to engaging with Japan's regulators. Citing a TRX analyst and enthusiast in a post on giant social media platform X,

Tron became an associate member of the Japan Cryptoasset Business Association (JCBA) to strengthen its position in Japan. This partnership could foster growth, build trust, and deepen Tron's integration within Japan's crypto-economy.

With Tron DAO coming in, the association has up to a selective 134 members in its registry, sourcing from both Web3 and traditional industries based in Japan and internationally. With this network, TRON looks to capitalize on the crypto market in Japan, actively contributing to the association's vision while advancing its own efficiency as a network to achieve a robust user base.

The collaboration, which goes back to as early as August 1, has failed to catalyze a rally for TRX token, with the leading global blockchain, TRON, looking to leverage the opportunity toward growing its reach within the crypto industry in Japan and all across Asia.

TRX price at an inflection point

TRX price is now at an inflection point, torn between a 10% rally or a 5% breakdown. At the time of writing, it is auctioning at $0.0746, marking a 3% drop on the day. Nevertheless, its trading volume is up 25% in the last 24 hours as investors digest the JCBA news.

With momentum indicators pointing to a bullish resurgence, after the Relatve Strength Index detoured from its southbound move, TRX price could maintain above the uptrend line at $0.0747. A bounce north above the $0.0800 level could potentially tag the supply zone marked in red between the $0.0824 and $0.0856 range.

If this order block fails to hold as a resistance level, TRX price could shatter through, rendering it a bullish breaker as the altcoin targets new range highs above the $0.0850 level.

TRX/USDT 1-day chart

Nevertheless, if the current support at $0.0747 fails to hold, expect TRX price to break down, losing the ascending trendline support and facing a cliff toward the $0.0703 level.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.