- Binance Coin price rose 3%, crossing the $635 level on Monday, with rising volumes signaling increased market interest.

- Trump-backed World Liberty Financial launched USD1 on 4 March, a USD-backed stablecoin on BNB Chain but not currently tradable.

- Reports indicate that the project is developing three products, including an on-chain market for lending and borrowing.

Binance Coin (BNB) saw a 3% price increase on Monday, crossing the $635 mark as rising trading volumes signaled heightened market interest. The surge comes amid growing anticipation around a new stablecoin project backed by former U.S. President Donald Trump’s financial venture, World Liberty Financial (WLFI).

Binance Coin (BNB) hits $635 on Trump’s impact

After a prolonged consolidation phase at the weekend Binance Coin (BNB) joined the market rally on Monday.

Binance Coin (BNB) price action, March 24 | Source: TradingView

As seen in the TradingView chart above, BNB price saw a 3.5% price increase on Monday, crossing the $635 mark.

More so, rising trading volume bars on the 24 hour time frame candles signals heightened market interest.

The surge comes amid growing anticipation around a new stablecoin project backed by former U.S. President Donald Trump’s financial venture, World Liberty Financial (WLFI).

Trump-Backed World Liberty Financial (WLFI) launches USD1 stablecoin on BNB chain

World Liberty Financial has officially launched USD1, a USD-backed stablecoin built on the BNB Chain. The move aligns with WLFI’s broader goal of expanding stablecoin adoption and providing a decentralized alternative for global digital payments.

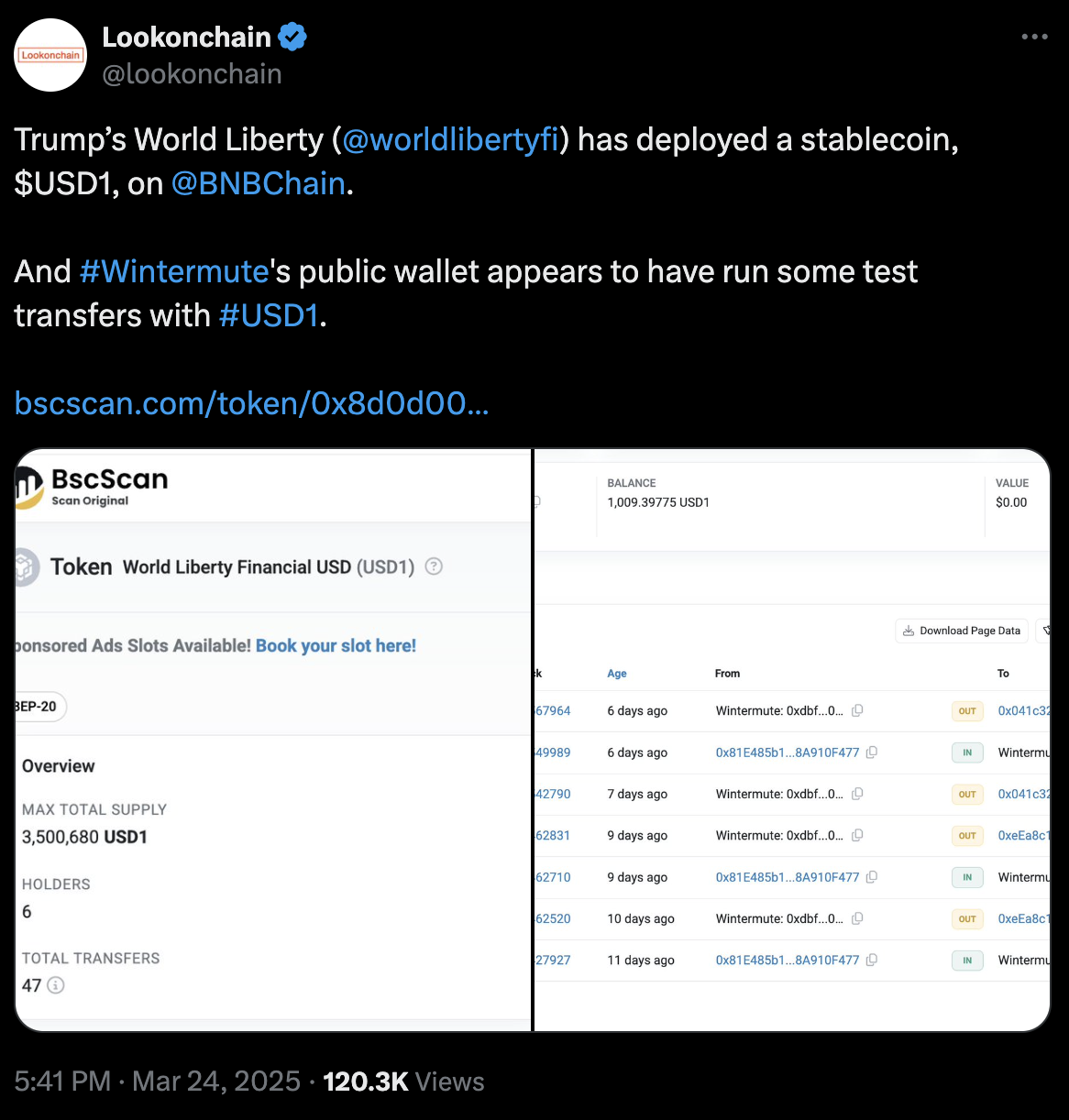

WLFI launches USD1 stablecoin contract on BNB chain | Source: Lookonchain March 24

Blockchain analytics firm LookOnChain identified the deployment, noting interactions between the contract and a wallet linked to crypto market maker Wintermute, suggesting test transfers.

The stablecoin contract was deployed approximately 20 days ago, according to Binance founder Changpeng Zhao.

However, the WLFI team has clarified that the rumored stablecoin is not actively trading yet, warning users to be aware of potential scams.

The USD1 contract remains publicly visible on BNB Chain’s blockchain explorer.

However, with no official confirmation from WLFI or the Trump family regarding the launch, BNB price remains relatively muted compared to rival layer-1 assets like ADA, SOL and XRP, which entered double-digit gains after receiving Trump’s backing with a crypto strategic reserve proposal in early March.

Binance Co-founder Changpeng Zhao reacts to USD1 launch speculations | March 24 | Source: X.com/cz

The USD1 contract remains publicly visible on BNB Chain’s blockchain explorer.

However, with no official confirmation from WLFI or the Trump family regarding the launch, BNB price remains relatively muted compared to rival layer-1 assets like ADA, SOL and XRP received Trump’s backing with a crypto strategic reserve proposal in early March.

The USD1 launch marks Trump’s latest involvement in crypto-related ventures.

In January 2024, Trump launched a memecoin on the Solana network, which surged to a $12.8 billion market cap within 24 hours.

Against this backdrop, USD1’s launch is expected to attract significant attention from institutional and retail investors alike.

WLFI eyes DeFi lending & borrowing market on BNB chain

Beyond stablecoins, WLFI is reportedly developing three financial products, including an on-chain lending and borrowing marketplace.

This initiative aims to enhance liquidity and expand the use cases of stablecoins in decentralized finance (DeFi).

If successful, the platform could further drive adoption of BNB Chain-based assets, potentially pushing Binance Coin (BNB) closer to the $700 milestone in the coming weeks.

BNB Price Forecast: Clearing $660 resistance to confirm $700 target

BNB price continues its steady upward trajectory, gaining 3.4% on Monday to trade at $635.33 as bullish momentum builds.

The daily candlestick chart shows a series of higher lows, suggesting a sustained uptrend. The Donchian Channel (DC) highlights the next key resistance level at $643.72, with a decisive breakout above this key resistance level, potentially paving the way toward $660, a crucial psychological barrier before a $700 price target comes into play.

BNB price forecast | BNBUSD

A surge in trading volume (291.53K) indicates rising investor interest, reinforcing the bullish case.

The Money Flow Index (MFI) at 65.96 remains in neutral territory, suggesting further upside potential before overbought conditions set in.

If buyers maintain momentum and BNB price clears the $660 resistance, the path to $700 becomes increasingly viable, fueled by strong market fundamentals and bullish sentiment surrounding BNB Chain developments.

However, failure to break above resistance could lead to a pullback toward the lower Donchian Channel boundary at $575.36, where buyers may look to re-enter.

A break below $575 would invalidate the bullish outlook, exposing BNB to further downside pressure toward $507, the lower liquidity zone.

For now, the bulls remain in control, with $660 as the immediate hurdle to confirm a sustained rally toward $700.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP gains as traders gear up for futures ETFs debut this week

XRP climbs over 3% on Monday, hovering around $2.33 at the time of writing. The rally is likely catalyzed by key market movers like XRP futures Exchange Traded Funds (ETFs) approval by the US financial regulator, the Securities and Exchange Commission (SEC), and a bullish outlook.

Bitcoin Price Forecast: BTC eyes $97,000 as institutional inflow surges $3.06 billion in a week

Bitcoin (BTC) price is stabilizing above $94,000 at the time of writing on Monday, following a 10% rally the previous week. The institutional demand supports a bullish thesis, as US spot Exchange Traded Funds (ETFs) recorded a total inflow of $3.06 billion last week, the highest weekly figure since mid-November.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.