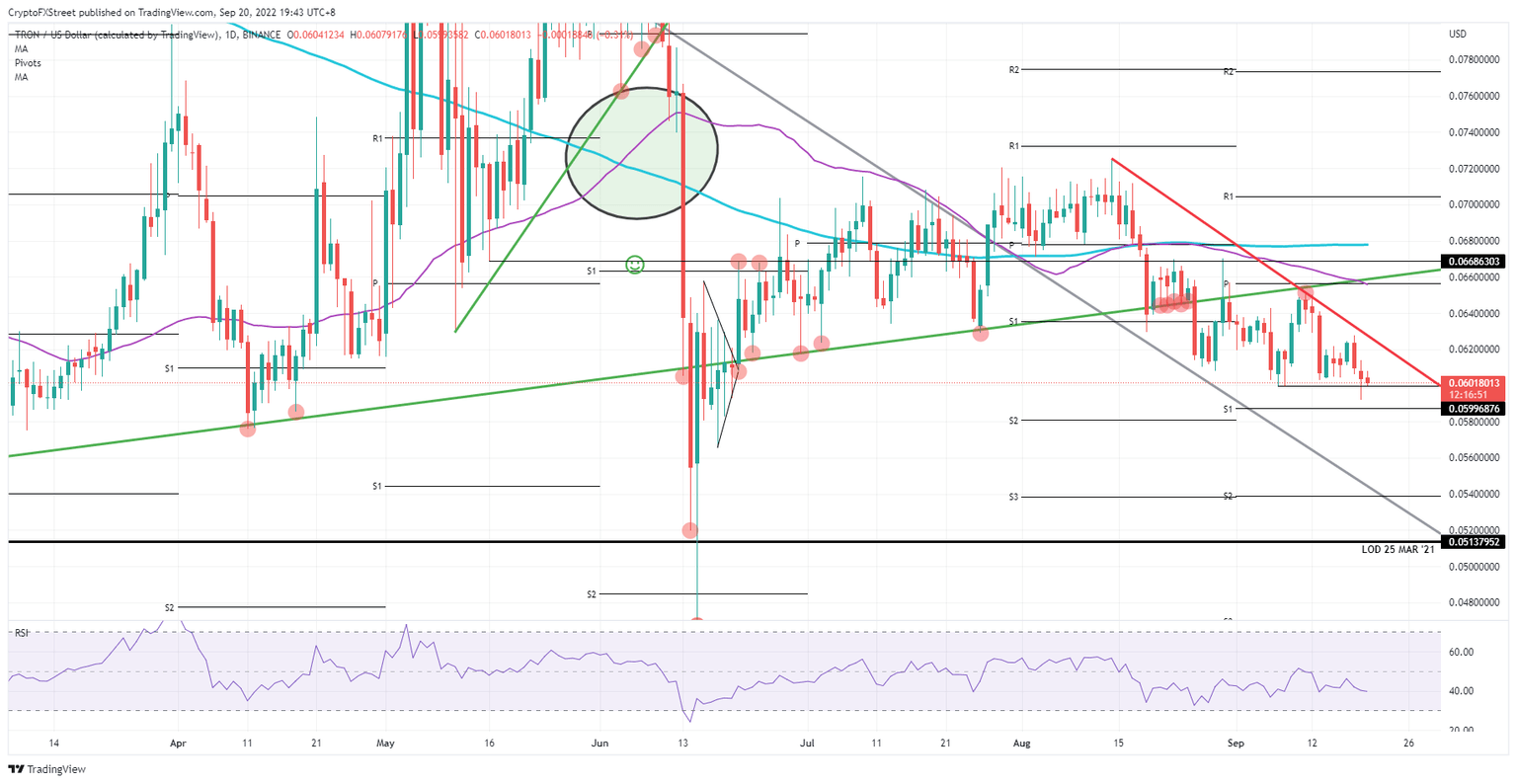

Tron price steady lower as bearish triangle persists

- Tron price slips lower and is set to break firmly below the September lows.

- TRX price already printed a new low on Monday but closed above in a late-minute rally.

- Should TRX price close below the September lows at $0.0599, expect to see a continuation to the downside towards $0.0540.

Tron (TRX) price saw bulls coming in late during the Monday session, trying to eke out a full reversal of the price action and incurred losses. Unfortunately, they failed, although price action did still close above the important low of September at $0.0599. With TRX price heading to the downside again, and with bulls not having much incentive to place long bets – as the red descending trend line from the bearish triangle is still in play – expect to see another leg lower by the end of this week towards $0.0540.

TRX price set to drop 10%

Tron price is still moving within the boundaries of a bearish triangle that got identified at the top of August and saw tests on September 11th and 12th. Since then, price action has been running to the downside, with the low of September at $0.0599. Although bulls were able to buy the dip on Monday and push price action back above that level after it slipped below, the support has been broken and should flash red lights for bulls to get out now before TRX price tanks 10%.

TRX price will confirm the fear in case it closes below that $0.0599 marker this evening. Once that has happened, expect another move lower, with the monthly S1 at $0.0587 passed by quite quickly as TRX price will nosedive to $0.0540. Expect doubt and a possible turnaround as the old descending trendline in grey could trigger a bounce off with the low of March 25th from 2021 underpinning the price action.

TRX/USD Daily chart

Although highly unlikely, a countermove to the upside could still be in the cards. A few shock effects could occur in the market as this week, there are over four big central banks coming out with rate decisions. Each meeting could be a catalyst that pushes price action to the upside, with TRX price set to pierce through the descending side of the bearish triangle and stretching to $0.066, where the monthly pivot and the 55-day Simple Moving Average reside.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.