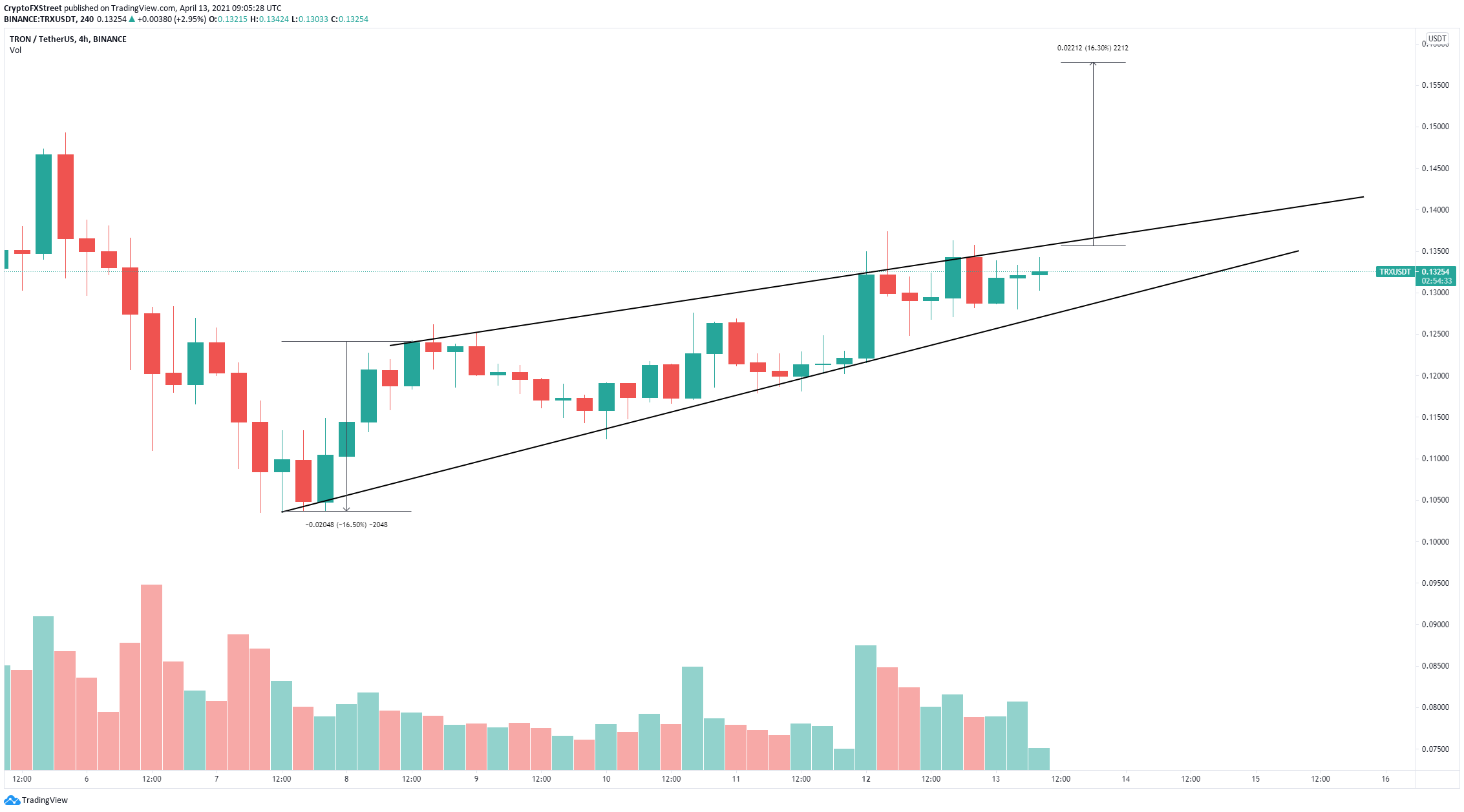

- TRON price is trading inside an ascending wedge pattern on the 4-hour chart.

- The digital asset faces only one crucial resistance level before a breakout to new yearly highs.

- A key indicator has presented a sell signal, which puts the bullish outlook at risk.

TRON has managed to establish a strong 4-hour uptrend since April 7 and faces practically no resistance ahead. However, the TD Sequential indicator has presented a sell signal in the past 12 hours that could shift the odds in favor of the bulls.

TRON price needs to crack only one resistance level for a 16% breakout

On the 4-hour chart, TRX has formed an ascending wedge pattern that can be drawn by connecting the higher highs and higher lows with two trend lines that converge.

TRX/USD 4-hour chart

The digital asset needs to climb above $0.136 for a significant 16% breakout calculated by measuring the height between the beginning of the top trend line and the bottom one. Although the price target is $0.16, TRON could briefly stop at $0.149, the 2021-high.

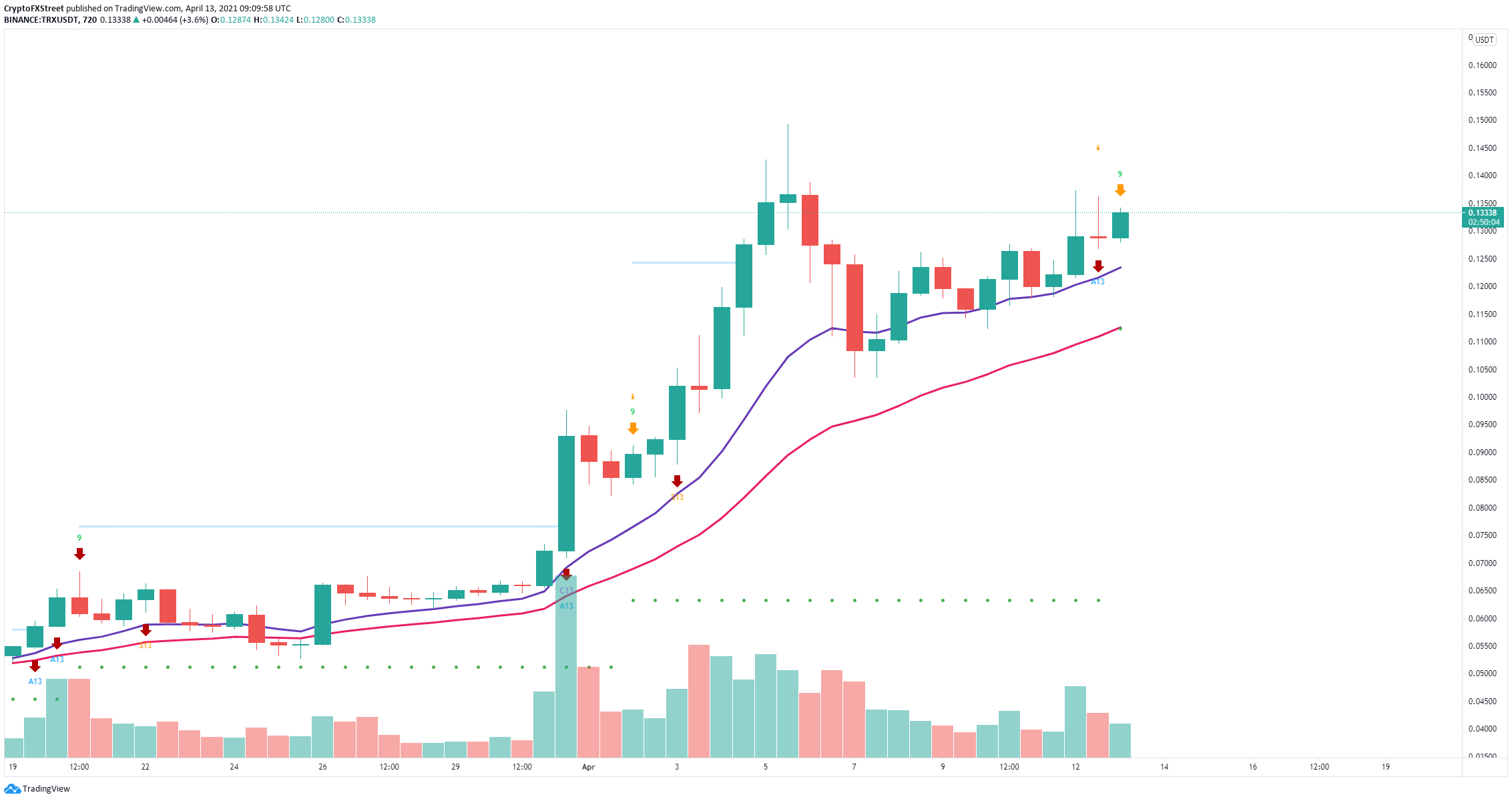

TRX/USD 12-hour chart

However, on the 12-hour chart, the TD Sequential indicator has just presented a sell signal in the form of a green ‘9’ candlestick. If the bulls cannot push TRX above $0.136, the signal will be confirmed.

The nearest bearish price target for TRON is the 12 EMA at $0.123 followed by the 26 EMA at $0.112.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.