Tron Price Forecast: TRX/USD struggles to build uptrend as pressure mounts at $0.022

- Tron’s rejection at $0.022 fuels the bear’s push for losses eying a breakdown under $0.021.

- TRX/USD could revive the uptrend above $0.022 especially if support at $0.021 remains intact.

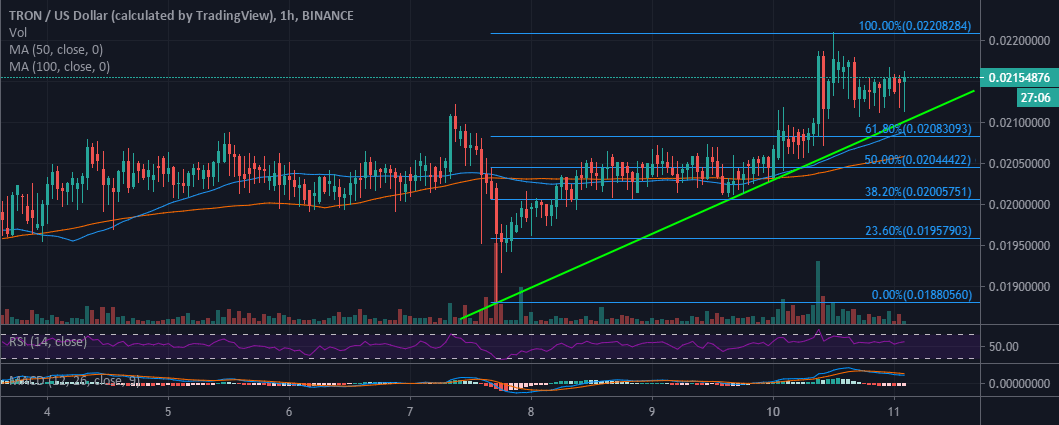

Tron like many other altcoins has been performing relatively well over the last few days. Friday’s unexpected dip to levels slightly under $0.020 occurred after a rejection at $0.021. The positive approach from the bulls saw TRX/USD revive the uptrend with gains building on the initial breakout above the 23.6% Fibonacci retracement level taken between the last swing high of $0.02208 to a swing low of $0.01880.

This bullish action remained consistent throughout the weekend and even on Monday. There was a break above the key 61.8% Fibonacci resistance level which paved the way for gains above $0.022, allowing Tron to print a weekly high at $0.02208.

Consequently, a reversal occurred with TRX seeking balance towards $0.021. Consolidation seems to be building, having confirmed $0.021 as a tentative support zone. TRX/USD is trading at $0.0214 amid the push by the bears for losses under $0.021.

Looking at various technical levels, TRX/USD is settling for a sideways trading action, however, technical indicators show that sellers are determined to cause damages to the progress made since Saturday. The RSI is holding well above the midline in addition to the MACD’s position above the mean line. The slightly bearish divergence from the MACD highlights the grip by the bears but with support at $0.021, TRX/USD could easily revive the uptrend above $0.022.

TRX/USD 1-hour chart

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren