TRON price averts bearish fate, 15% gains on the horizon

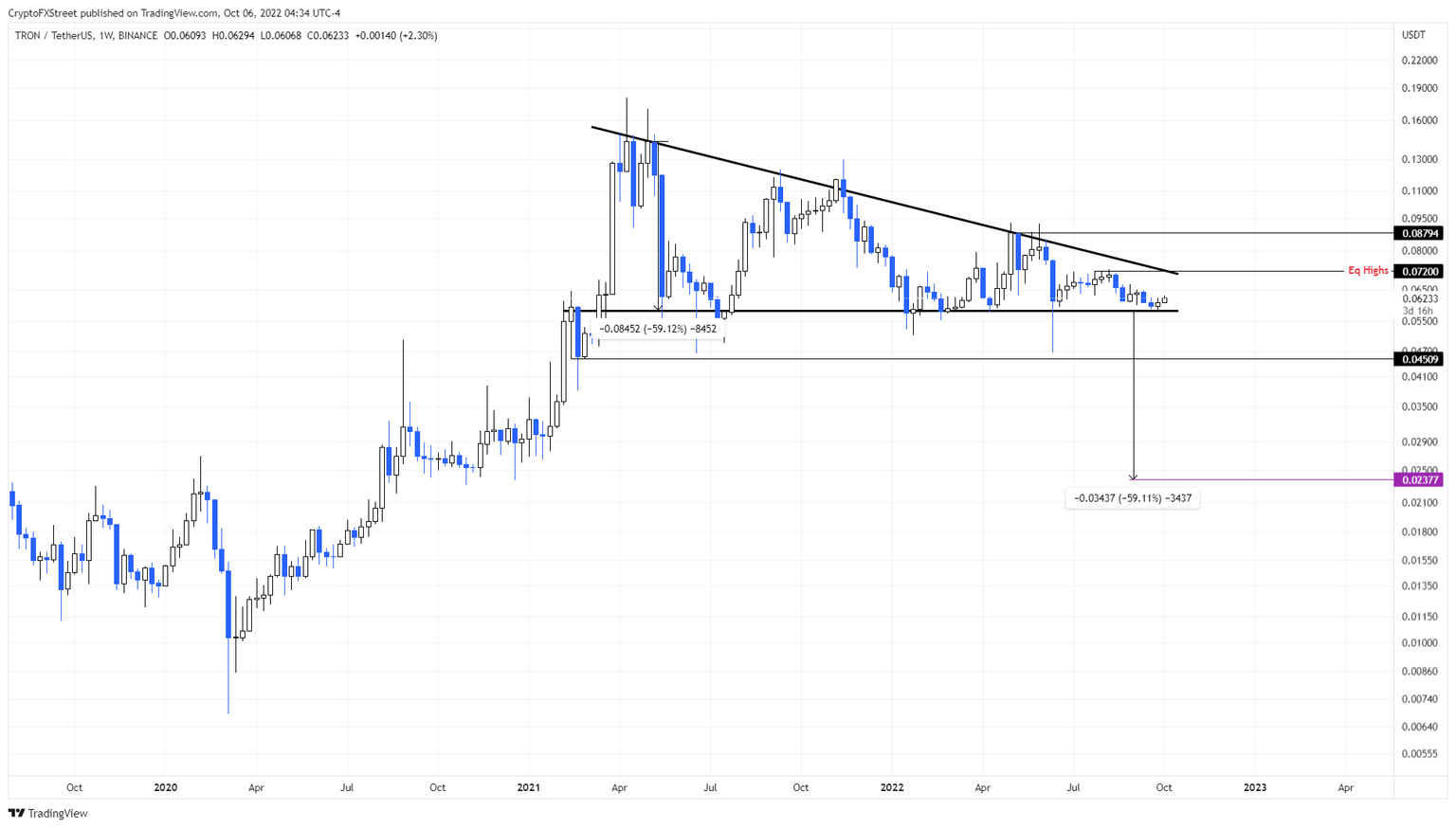

- TRON price is bouncing off the descending triangle’s baseline at $0.0581.

- A resurgence of buying pressure could result in a quick 15% upswing to $0.072 but could extend to $0.0879.

- A weekly candlestick close below $0.0581 will invalidate the bullish thesis for TRX and potentially trigger a crash.

TRON price shows a tight consolidation that has been ongoing for roughly one and a half years. A breakout from this setup could result in an explosive move south. Although TRX came close to embarking on such a move, buyers seem to have come to the rescue, triggering a U-turn.

TRON price continues to get squeezed

TRON price has been trading inside a descending triangle setup of four lower highs and four equal lows, for more than 500 days, from between March 22 and October 5. This technical formation forecasts a 60% downswing if the base line is broken, obtained by measuring the distance between the first swing high and swing low to the breakout point at $0.0581.

However, a weekly candlestick close below the horizontal support level is required for confirmation. TRON price retested this level on September 26 but failed to break through and is currently bouncing off, indicating that the buyers are coming in to purchase TRX at a discount.

Going forward, investors can expect this trend to continue, especially with improving market conditions for trend-setting leading crypto Bitcoin. As such, price may well rise up and sweep the equal highs at $0.072. This run-up would constitute a 15% gain from the current level and is likely where the upside is capped for TRON price.

TRX/USDT 1-day chart

On the other hand, if TRON price confirms a weekly close below the support level at $0.0581, it will trigger a bearish breakout from the descending triangle. Since this setup forecasts a 60% downswing, investors should be prepared for a massive sell-off.

However, investors can expect a slowdown in the selling pressure at around the $0.0450 support level.

Note:

The video attached below talks about Bitcoin price and its potential outlook, however, this is still relevant as it is likely to influence TRON price.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.