- Tron is finally saying goodbye to Ethereum as the network officially launches its mainnet.

- TRX/USD is stuck within a contracting triangle; breakout in the pipeline.

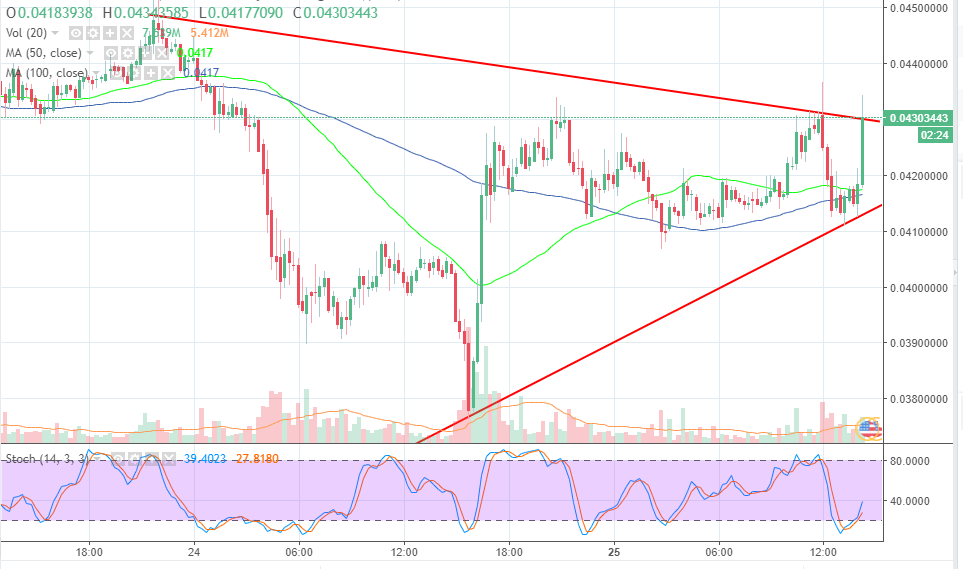

Tron price is trading within the narrow end of a contracting triangle while there is a bullish trend that is battling to break out of the triangle. During the previous declines, Tron traded below $0.037 before bouncing back to restore the value above $0.040.

Tron is finally saying goodbye to Ethereum as the network officially launches its mainnet today. The Independence Day launch was streamed live and founder Justin Sun was also present. Tron is also going to launch its “Virtual Machine” on June 30 alongside a secret project to be revealed on the day of the launch. Justin Sun said during the official mainnet launch:

“I think one of the most important values of Tron is we delivering our products and mission on time. So as you see, we delivered our testnet on the March 31st, our mainnet on May 31st, and officially are launching our mainnet on June 25th. The next very important milestone is July 30th- we will deliver our official virtual machine. All the decentralised exchanges and applications on the Tron platform are plugged into the Tron ecosystem. July 30th we will launch one of our secret projects”

Technically, Tron price is using the support from both the 50 SMA and the 100 SMA (above $0.041). TRX/USD has run into resistance at $0.0043, besides it is seeking for support above $0.042. The stochastic on the 15’timeframe chart has recovered from the oversold and is at 50%. The gap between the moving averages is narrowing to signal that the buying power is present. The support at $0.041 will continue to hold, but in case of extended declines, $0.040 will stop the declines.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

World Liberty Financial confirms launch of USD1 stablecoin

President Donald Trump-inspired World Liberty Financial (WLFI) confirmed on Tuesday that it will launch its USD1 stablecoin, which it claims will be backed 1:1 with the US Dollar. This comes after the DeFi platform initiated several test transactions using the stablecoin on the Binance BNB Chain.

Crypto Today: BTC stalls below $90k, Binance ecosystem surges as Trump’s WLFI launches USD1

Cryptocurrency markets are down 1.75% on Tuesday, with a $60 billion outflow bringing aggregate valuation below $3 trillion. Bitcoin price failed to break out above as Trump’s hints at secondary tariffs triggered skittish sentiment across global markets.

Crypto Morning: SEC, FINRA eye crypto, Tornado Cash users demand justice, RWA hits $10 billion TVL

Crypto continues to remain under the oversight of US financial regulators, the Securities & Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), according to a Law360 report on Monday.

Bitcoin stabilizes around $87,000 as it displays a classic beta response to traditional markets

Bitcoin stabilizes around $87,000 on Tuesday after extending a recovery over the past two days. A Crypto Finance report highlights that the crypto market followed the broader risk momentum, displaying a classic beta response to traditional markets.

Bitcoin: BTC stabilizes around $84,000 despite US SEC regularity clarity and Fed rate stability

Bitcoin price stabilizes around $84,000 at the time of writing on Friday after recovering nearly 2% so far this week. The recent announcement by the US SEC that Proof-of-Work mining rewards are not securities could boost BTC investors' confidence.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.