- Tron’s total revenue for Q3 is $577 million, the highest since the protocol’s inception.

- Token terminal data shows TRX generated $567 million in fees, outpacing other blockchains.

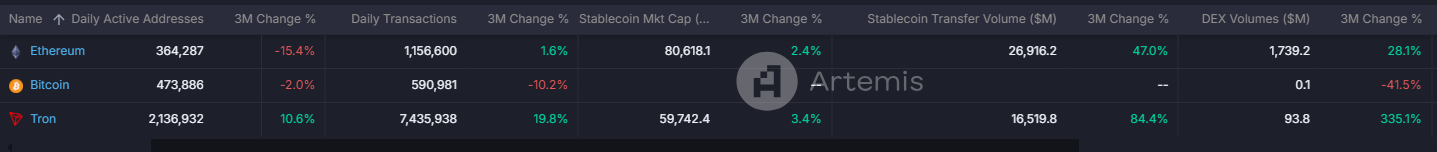

- Tron has performed better than Bitcoin and Ethereum in daily active addresses, daily transactions, stablecoin transfer volume, and DEX trading volume.

The Tron network (TRX) generated the highest revenue in the third quarter since its inception, outperforming leading cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

Tron posts highest quarterly revenue ever

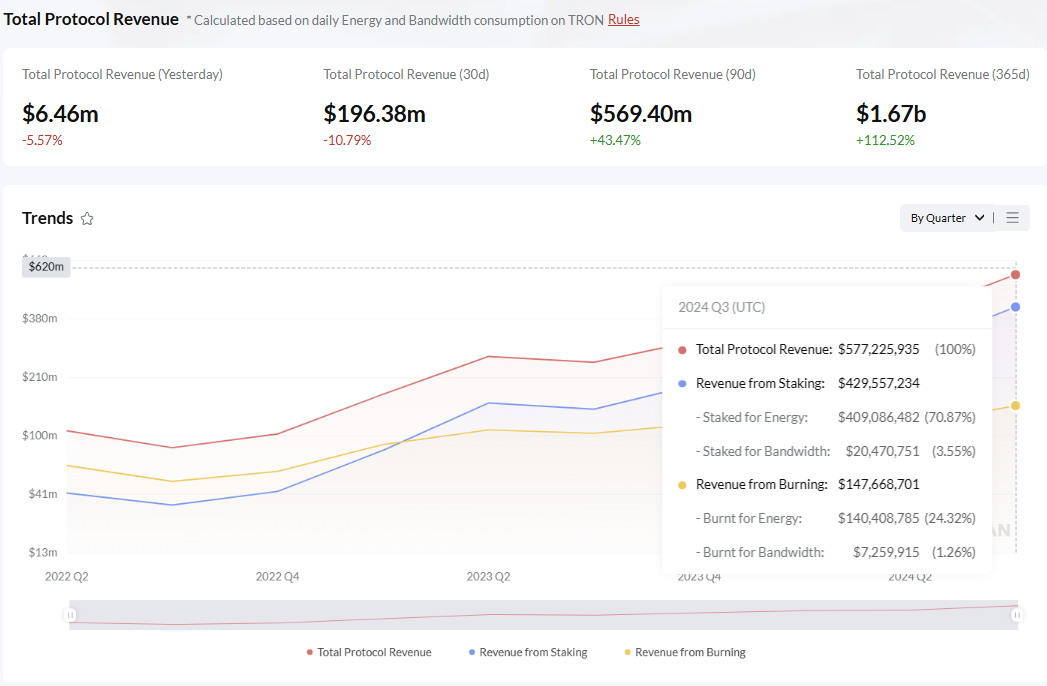

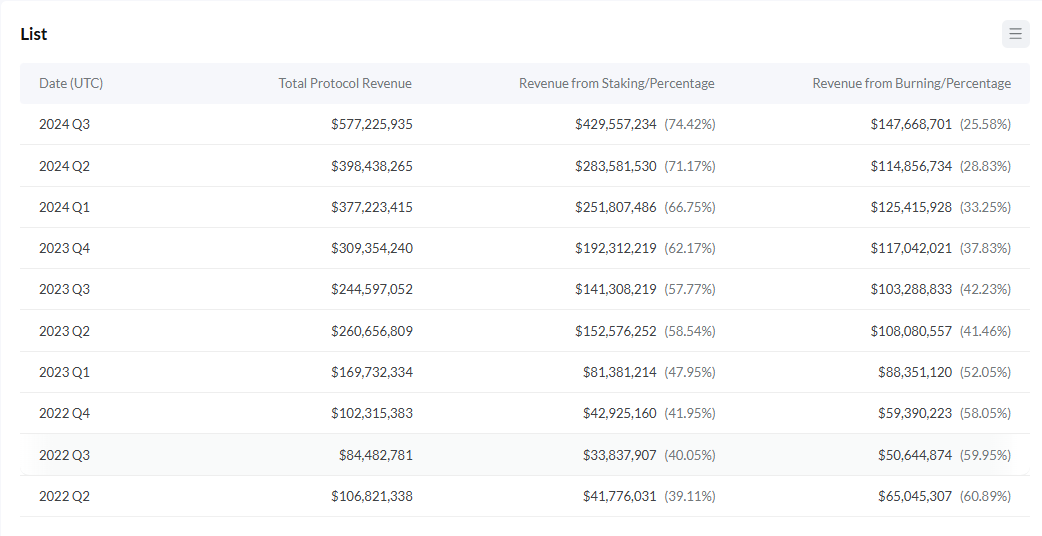

TronScan data shows that Tron generated a total revenue of $577.25 million in the third quarter, the highest since the protocol’s inception. This represents a 43% increase compared to Q2.

The 74% of the revenue was derived from staking, while the remaining 26% came from burn mechanisms. The success of TRON’s memecoin platform, Sun pump meme, has also contributed to this performance, adding $8.4 million since its launch.

Growth in revenue and fees has also been attributed primarily to the booming activity in stablecoins, with TRON now commanding over 34% of the stablecoin market, which amounts to $60 billion, according to DefiLlama.

Justin Sun, the founder of TRON, tweeted, “We are confident that Q4 will see even more growth compared to Q3!”

Tron Revenue chart

Quarterly revenue chart

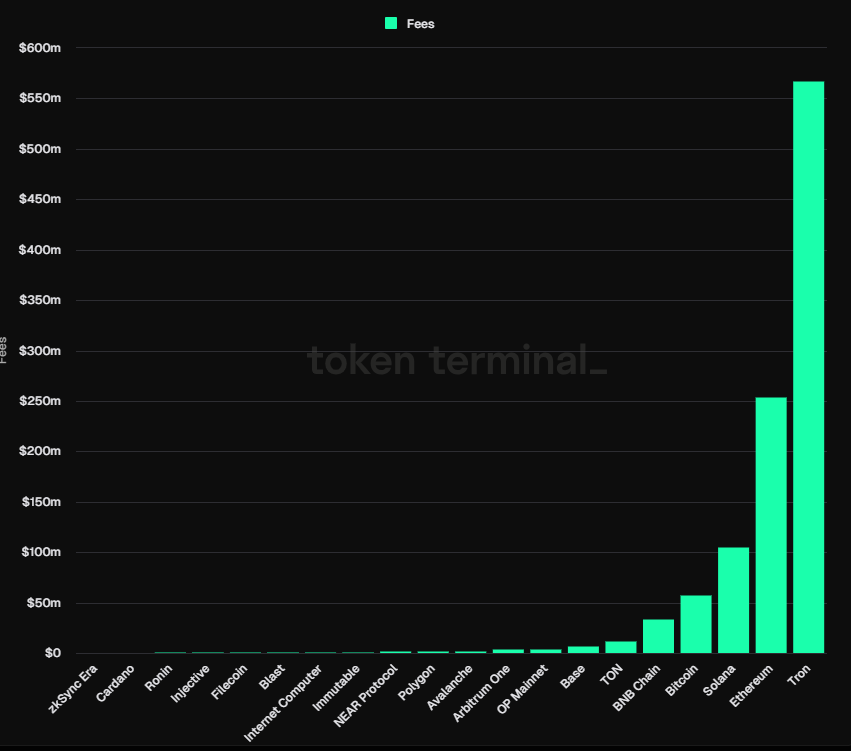

Crypto aggregator platform Token Terminal data shows that Tron’s fee generation over the past three months outpaced other blockchains. During this period, Tron generated $567 million in fees, more than double than Ethereum ($253 million), five times morex more than Solana ($105 million) and 9x more than Bitcoin ($57 million), suggesting that Tron’s blockchain gains more traction than other blockchains.

Fee chart

Comparing Tron’s on-chain metrics with those of Bitcoin and Ethereum over the last three months shows that Tron outperforms in daily active addresses, daily transactions, stablecoin transfer volume, and DEX trading volume.

Comparison chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto Today: BNB, OKB, BGB tokens rally as BTC, Shiba Inu and Chainlink lead market rebound

Cryptocurrencies sector rose by 0.13% in early European trading on Friday, adding $352 million in aggregate valuation. With BNB, OKB and BGB attracting demand amid intense market volatility, the exchange-based native tokens sector added $1.9 billion.

US SEC may declare XRP a 'commodity' as Ripple settlement talks begins

The US SEC is considering declaring XRP as a commodity in the ongoing settlement talks with Ripple Labs. FOX News reports suggest Ethereum's regulatory status remains a key reference for XRP’s litigation verdict.

Cardano Price Prediction: ADA could hit $0.50 despite high probability of US Fed rate pause

Cardano price stabilized above $0.70 after posting another 5% decline in its 3rd consecutive losing day. Multiple ADA derivatives trading signals are leaning bullish, but the US trade war impact outweighs the positive shift in inflation indices.

Stablecoin regulatory bill receives green light during Banking Committee hearing

The US Senate Banking Committee voted on Thursday to advance the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, which aims to establish proper regulations for stablecoin payments in the country.

Bitcoin: BTC at risk of $75,000 reversal as Trump’s trade war overshadows US easing inflation

Bitcoin price remained constrained within a tight 8% channel between $76,000 and $84,472 this week. With conflicting market catalysts preventing prolonged directional swings, here are key factors that moved BTC prices this week, as well as key indicators to watch in the weeks ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.