- Project Atlas, according to “will allow TRON to surpass Ethereum on daily transactions and become the most influential public blockchain in the world.”

- Tron price is still walloping in selling pressure. Besides, it is currently testing July lows at $0.0311 after breaking below June Lows at $0.033.

For some time now, Tron Foundation and the founder of Tron, Justin Sun have been teasing the community with a project that came to be known as the “Tron secret project.” However, during the launch of Tron Virtual Machine (TVM) on July 31, Justin Sun promised to reveal the identity of the project and also shade some light on it. Consequently, Sun announced on Twitter today that the secret project is called Atlas.

Project Atlas, according to Sun “will allow TRON to surpass Ethereum on daily transactions and become the most influential public blockchain in the world.”

The project is being developed to integrate Tron platform and the recently acquired BitTorrent. The Tron management is currently involved in the development of the Project Atlas to ensure that all the first computing, as well as the updated blueprint, are accomplished in the first 3 months before the announcement is made. More details on the working of the project and even the official launch date are going to be released before the end of this month.

Project Atlas will be very instrumental in the future of BitTorrent. For instance, it will be used to make BitTorrent feature of being a free peer-to-peer service platform event better. In addition to that, Tron intends to introduce rewards for users using the platform to seed torrents that contribute towards the growth of the torrenting ecology.

Tron price analysis

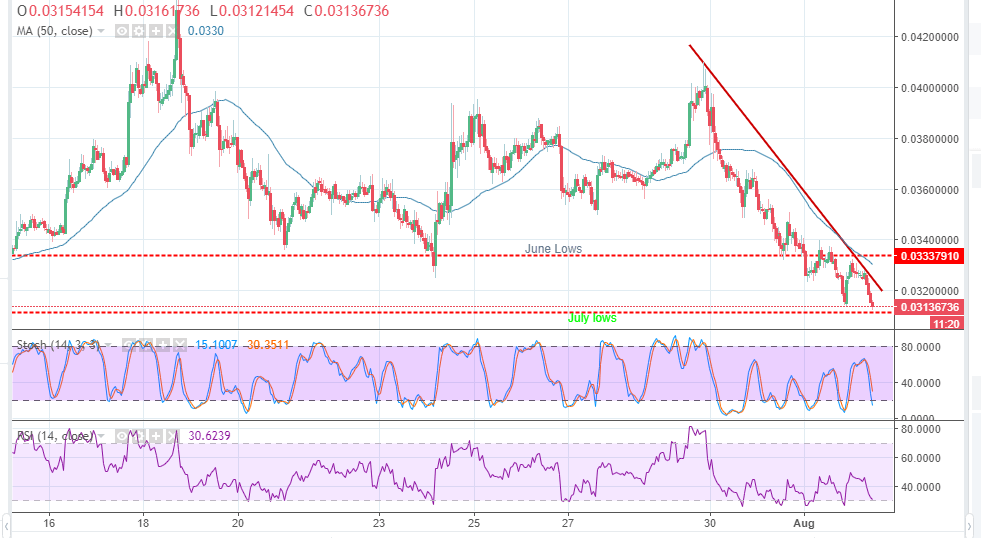

Tron price is still walloping in selling pressure. Besides, it is currently testing July lows at $0.0311 after breaking below June Lows at $0.033. The descending trendline is currently limiting upward movement at $0.0320. It is important that buyers put their best foot forward to avoid a drop below the lows of July. Otherwise, TRX/USD is on the verge of another break down to the area at $0.030.

The trend I strongly bearish, similarly, both the stochastic and the Relative Strength (RSI) is almost into the oversold region to show that the sellers are in control. A support above $0.31 will be in favor of the buyers. A trend reversal will, however, be limited at $0.032 (trendline resistance) and the key resistance at $0.333. But trading above $0.034 could see a spike towards $0.036 in the medium-term.

TRX/USD hourly chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Is Altcoin Season here as Bitcoin reaches a new all-time high?

Bitcoin reaches a new all-time high of $98,384 on Thursday, with altcoins following the suit. Reports highlight that the recent surge in altcoins was fueled by the victory of crypto-friendly candidate Donal Trump in the US presidential election.

Shanghai court confirms legal recognition of crypto ownership

A Shanghai court has confirmed that owning digital assets, including Bitcoin, is legal under Chinese law. Judge Sun Jie of the Shanghai Songjiang People’s Court shared this opinion through the WeChat account of the Shanghai High People’s Court.

BTC hits an all-time high above $97,850, inches away from the $100K mark

Bitcoin hit a new all-time high of $97,852 on Thursday, and the technical outlook suggests a possible continuation of the rally to $100,000. BTC futures have surged past the $100,000 price mark on Deribit, and Lookonchain data shows whales are accumulating.

Shiba Inu holders withdraw 1.67 trillion SHIB tokens from exchange

Shiba Inu trades slightly higher, around $0.000024, on Thursday after declining more than 5% the previous week. SHIB’s on-chain metrics project a bullish outlook as holders accumulate recent dips, and dormant wallets are on the move, all pointing to a recovery in the cards.

Bitcoin: New high of $100K or correction to $78K?

Bitcoin surged to a new all-time high of $93,265 in the first half of the week, followed by a slight decline in the latter half. Reports highlight that Bitcoin’s current level is still not overvalued and could target levels above $100,000 in the coming weeks.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.