Traders must watch out for this bull trap SafeMoon price is forming

- SafeMoon price intraday looks promising.

- Nevertheless, SFM price has been struggling to close above the 55-day SMA, so traders should act with caution.

- An initial pullback may eventually lead to gains as the market soft patch could end this week.

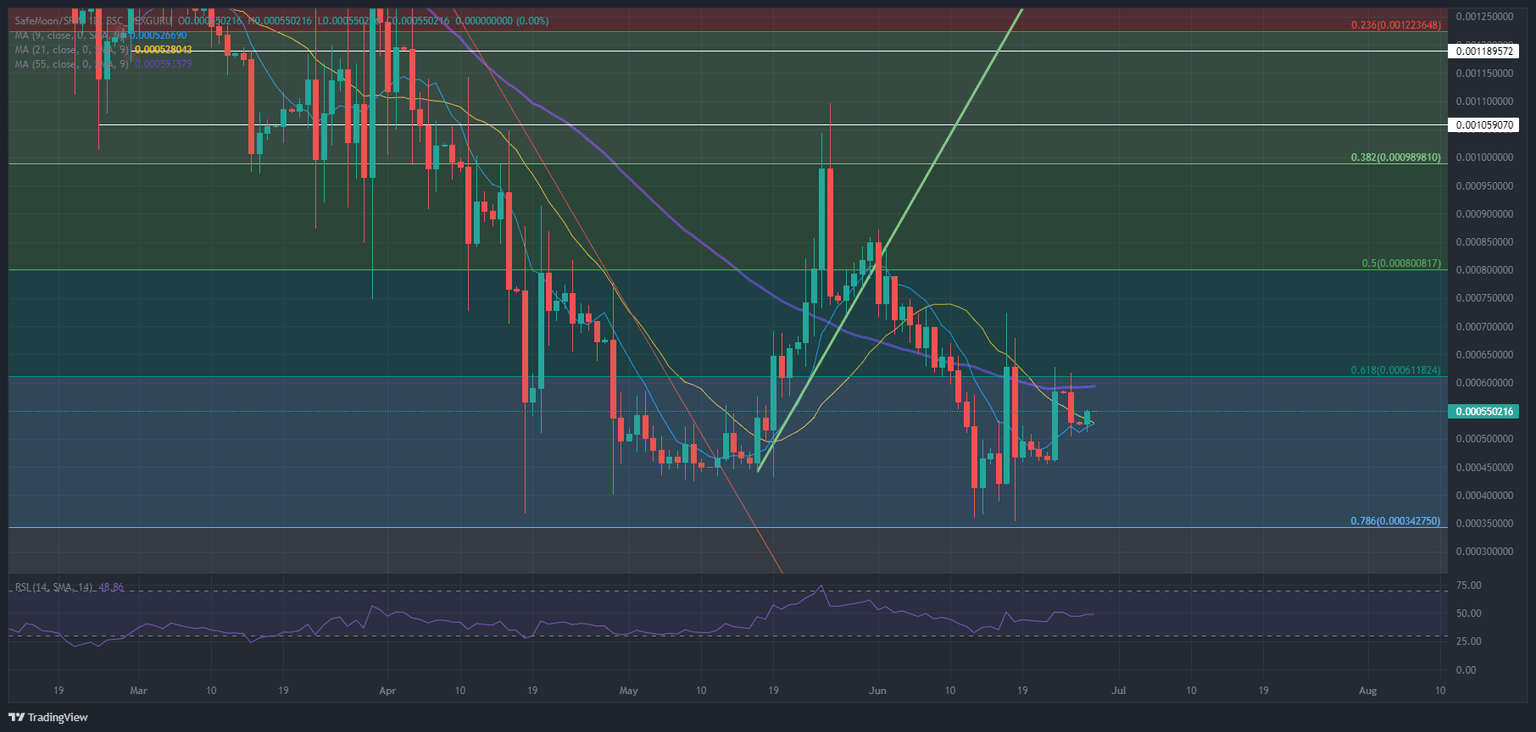

SafeMoon (SFM) price looks promising today for a pop higher and a test of the technical moving average at around $0.000600000. With the current soft patch in global markets, tail risks are still very much present and could flare up at any moment, triggering a violent turnaround with risk sentiment shifting back to safe havens and away from cryptocurrencies. SFM price will probably fail to close above the technical moving average and trigger a drop back to $0.00050000 as price action consolidates towards a breakout later this week.

SFM price set to consolidate within this soft patch

SafeMoon price could jump and hit $0.000600000 in the coming trading session as bulls try to retest the 55-day Simple Moving Average (SMA), as happened in previous days. The risk, however, is that bulls remain in their positions for too long and get washed out as price action retraces lower and bears come in to defend with everything they have got. A daily close above the MA would be a necessary prerequisite for further rallies in SFM price, but the additional 61.8% Fibonacci level could cap further progress and be a bridge too far.

SFM price holds roughly 10% hypothetical gains before it hits that 55-day SMA. As it rises, the Relative Strength Index (RSI) will get dragged higher, limiting further upside potential. Add to that the mentioned pressure from the 61.8% Fibonacci level at $0.000611824, and a double belt of resistance is identified.

SFM/USD daily chart

Downside risks come from markets speculating that peak inflation has been reached and a recession is on the way. A few data releases from last week showed signs that a recession is potentially coming closer, with sentiment numbers in manufacturing and services dropping but consumer confidence still elevated. Should economic data this week further confirm that narrative, expect to see the rough patch quickly reverse with markets in a cramp again and SFM price dropping from its current position towards $0.000500000. There is even the possibility that SafeMoon price could slide lower on a risk-off wave towards $0.000342750 and the 78.6% Fibonacci level, coming in as a safety net below.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.