A crypto trader has locked in massive profits from buying the native token of a new platform called Ethervista, the latest decentralized exchange and token minting marketplace to launch on Ethereum.

The trader purchased $5,000 worth of the VISTA token immediately following the launch of the Ethervista protocol. This purchase netted them roughly 5% of the total circulating supply of VISTA tokens, which went live for trading on Aug. 31.

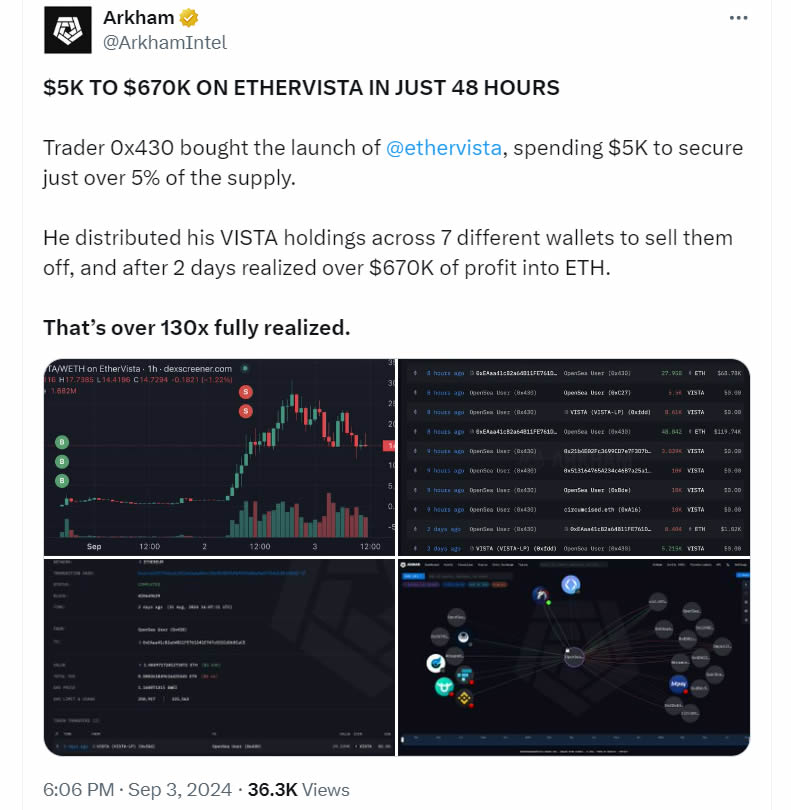

The trader then distributed his VISTA holdings across seven different wallets to sell them off, realizing over $670,000 in profit in (ETH $2,376) after just two days, according to a Sept. 3 X post from crypto intelligence platform Arkham.

Source: Arkham Intelligence

Ethervista is a new token minting marketplace to go live on Ethereum enabling users to create and launch their own tokens, primarily memecoins.

Ethervista: Ethereum’s “answer” to Pump.fun

Ethervista has been described by some crypto pundits as “Ethereum’s answer” to its Solana-based rival Pump.fun — a memecoin launchpad that has generated outsized adoption since its launch in January.

The retro-themed Ethervista platform offered a “fair launch model” with 100% of its native VISTA tokens allocated to liquidity providers and locked for five days in a bid to prevent early rug pulls.

It has deflationary tokenomics with a one million supply cap and continuous token burns to reduce supply and raise the price floor.

However, some have reported failing transactions when trying to remove liquidity.

Crypto researcher Stacy Muur noted the liquidity lock but added that "it's the ETH/USDT pair, not a newly created token that needs anti-rug protection,” adding that there was no disclaimer to let users know.

Unlike traditional DEXes and marketplaces, Ethervista charges fees in native ETH, which are distributed to liquidity providers and token creators.

Since it uses ETH for network fees, the platform’s gas usage has surged making it the third largest consumer of gas, behind Uniswap and Tether, over the past 24 hours with 22.5 ETH, according to Etherscan.

Ethervista was spawned out of the need to fill a gap in the Ethereum DeFi space and to compete with rival networks Solana, Base, and Tron which have attracted millions of dollars in revenue from hordes of memecoin degens in recent months.

The Ethervista platform has witnessed massive attention from crypto market participants, with the native token’s market capitalization reaching as high as $30 million just two days after it launched, according to DexScreener data.

VISTA prices. Source: DEXscreener

VISTA prices have surged 33% over the past 24 hours reaching $21.19 at the time of writing, according to CoinGecko. The new token hit a peak of $28.80 on Sept. 2, just a couple of days after launch however, the liquidity unlock on Sept. 4 could cause volatility.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Solana revenue hits multi-month lows as Pump.fun competition, Ethervista, launch on Ethereum

Solana's (SOL) daily revenue hit a six-month low on Monday, accompanied by a drop in its daily transaction volume. The rapid decline reflects a drop in trader interest following the launch of Pump.fun competitors Ethervista on Ethereum and SunPump on the Tron blockchain.

Ethereum exchange reserve increased by 163K ETH in five days amid price consolidation

Ethereum (ETH) is down over 2% on Tuesday following an indication of selling pressure due to an uptick in its exchange reserve. However, other on-chain metrics indicate mixed investor sentiment amid ETH's price consolidation.

XRP breaks past key resistance, Ripple announces plans for Ethereum-compatible smart contracts

Ripple (XRP), a cross-border payment remittance firm, made several key announcements in Japan and Korea on September 3. One of the key announcements was the plan for an Ethereum-compatible sidechain on the XRP Ledger.

Bitcoin recovery faces challenge at key resistance zone, gains likely temporary

Bitcoin (BTC) trades at around $59,000 on Tuesday after a slight recovery the day before. However, this rebound might be short-lived as it nears a crucial resistance barrier. Institutional interest is growing, driven by VanEck’s optimistic Bitcoin forecast, a strategic partnership between Metaplanet and SBI VC Trade, and increased wallet holdings.

Bitcoin: Will BTC continue its ongoing decline?

Bitcoin (BTC) trades above $59,000 on Friday, but it has lost 7.5% this week so far after being rejected around the daily resistance of $65,000. The decline is supported by lower demand from the US spot Bitcoin ETFs, which registered a net outflow of $103.8 million, falling Bitcoin's Coinbase Premium Index, and a spike in Network Realized Profit/Loss.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.