Top Weekly Gainers And Losers: Arbitrum token launch led the crypto market’s bearish week

- XRP and Litecoin price emerged as the only few top cryptocurrencies to note any gains over the last week.

- Arbitrum launched its ARB token this week and became the biggest loser as holders ran to sell their airdrop.

- Optimism took a hit as well, facing competition from the ARB launch, declining by nearly 16.5%.

The crypto market noted a rather bearish tone over the last seven days owing to the Federal Reserve hiking the interest rate by 25 basis points (bps). However so, some recovery was expected towards the end of the week, which only took place for a few altcoins as Bitcoin price stood virtually unchanged at $27,466.

Top Gainers of the week - XRP, LTC, ADA

While most of the cryptocurrencies struggled to climb on the charts, XRP and Litecoin price managed to paint the most gains at 12% and 9.6%, respectively. Cardano price, on the other hand, did not note any significant increase from its trading price from a week ago but still managed to rack in almost 3% gains.

XRP

Going forward, Ripple investors would need to watch the support level at $0.417 as falling below it would push the XRP price toward the critical support at $0.387. Losing it would thus result in a decline to December 2022 lows of $0.330.

XRP/USD 1-day chart

However, if the altcoin manages to breach the resistance level at $0.475, it would be able to breach the critical resistance at $0.506, enabling the XRP price to invalidate the bearish thesis and chart a four-month high.

LTC

Litecoin price, in the span of a week, rose to trade at $93, inching closer to the critical resistance at $97. Flipping it into support would give LTC bulls a chance to rally the price above $102.99 and mark new 2023 highs.

LTC/USD 1-day chart

On the other hand, if LTC were to crash by 14% and fall through the critical support at $79, it would invalidate the bullish thesis. This could lead to the altcoin falling to March lows of $69, registering a 25% decline.

ADA

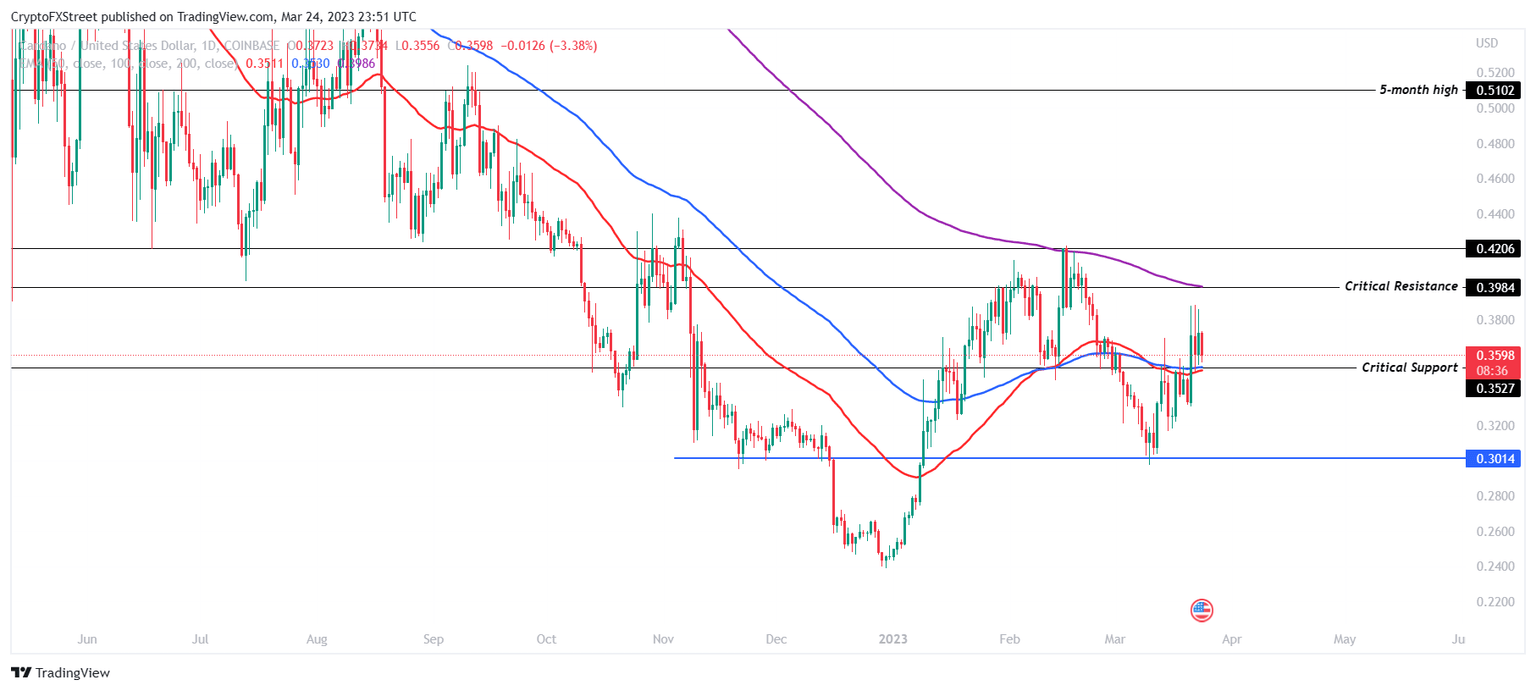

Cardano price noted the least rise of the three altcoins and is still hovering near the critical support at $0.352. Losing this support level would leave ADA vulnerable to a crash to March lows of $0.3019.

ADA/USD 1-day chart

Although, if buyers pull through and the altcoin bounces off $0.3019, it could rise toward the critical resistance at $0.3984. Breaching the same would invalidate the bearish thesis and set ADA up for a rally to $0.4206 to mark new year-to-date highs.

Top Losers of the week - ARB, IMX, OP

The launch of the ARB token was expected to be a huge deal for Arbitrum, but soon upon the launch, holders rushed to sell the token, resulting in an 89% plunge. Optimism, on the other hand, took a hit through the week for being a competition to ARB, falling by 16.29%.

Immutable price falling by 27% was surprising since the same just announced a partnership with Polygon this week during the Gaming Development Conference.

OP

Optimism price slipped through $2.42 to flip it into an immediate resistance level this week, inching closer to the critical support at $2.14. Falling through this level could push OP towards March lows of $1.8 and turn the 100-day Exponential Moving Average (EMA) into resistance.

OP/USD 1-day chart

Nevertheless, if the Arbitrum fever passes, buyers would be able to push the altcoin back above $2.42 to set it up for recovery. Breaching the critical resistance at $2.75 would invalidate the bearish thesis and enable OP to rise to 2023 highs of $3.10.

IMX

Immutable is facing a similar situation as the altcoin is close to falling through the critical support at $1.03. IMX could drop to March lows of $0.81 if this were to happen.

IMX/USD 1-day chart

But if a recovery rally pulls Immutable price back above the critical resistance at $1.24, it would have the opportunity to rise to 2023 highs of $1.53 and invalidate the bearish thesis as well.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.