Top three AI-related tokens yielding highest gains year-to-date: AIOZ, AR, FET

- Artificial Intelligence has been a top-performing sector in cryptocurrencies this year, per Blockworks data.

- AIOZ, AR, and FET rank among the AI tokens with the highest yield year-to-date.

- AI tokens’ market capitalization exceeds $21 billion on Wednesday.

The Artificial Intelligence (AI) sector in the crypto market has a few protocols whose tokens have generated significant yields for users since the beginning of 2024. AI is one of the best-performing crypto asset classes in 2024, according to BlockWorks data.

The top-performing assets are AIOZ Network (AIOZ), Arweave (AR), and Fetch (FET) as the AI supply chain has been focused on utility.

The overall market capitalization of the AI category of tokens is above $21 billion, per CoinGecko data, at the time of writing.

Top performing AI tokens so far this year

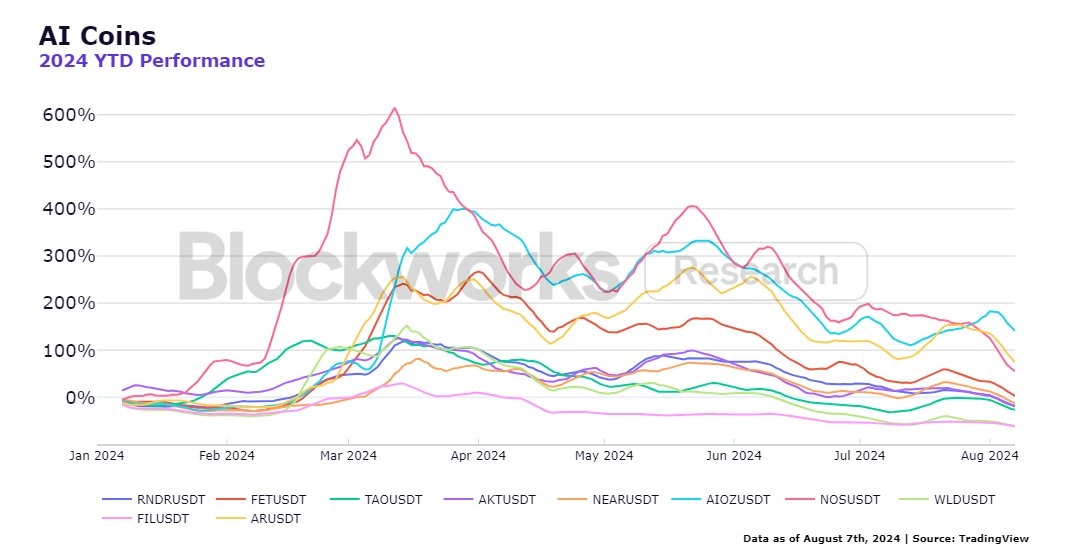

Blockworks data shows the 2024 year-to-date performance of ten cryptocurrencies from the AI sector. Render (RNDR), FET, Bittensor (TAO), Akash Network (AKT), Near Protocol (NEAR), Nosana (NOS), Worldcoin (WLD), Filecoin (FIL) and Arweave (AR) are seen in the chart below.

The AI tokens yielded the highest gains in March. Since then there has been a decline, but the year-to-date performance for top AI tokens ranges from 20% and more than 200% gains, per Blockworks.

The YTD performance of these tokens:

AIOZ: 214.95%

AR: 142.61%

FET: 33.81%

Even as the top 3 tokens suffered a correction in their prices in August 2024, the YTD gains of these assets are the highest in the category, per Blockworks data.

AI coins YTD performance

AIOZ Network

AIOZ Decentralized Content Delivery Network (dCDN) is a protocol that powers Artificial Intelligence computation, data storage and data streaming for decentralized applications (dApps) within the ecosystem.

The latest development in AIOZ Network is its collaboration with the University of Arkansas on an AI project to advance medical imaging, announced on August 15.

We are excited to announce the collaboration between @AIOZNetwork and the University of Arkansas (@UArkansas) on an AI research project to advance medical imaging.

— AIOZ Network (@AIOZNetwork) August 15, 2024

Together, we will address the challenge of 3D reconstruction of surgical tools during the endovascular procedures… pic.twitter.com/z9zEbBlCt6

The AI token gained popularity among traders as AIOZ network offers low transaction fees compared to most other applications, instant finality helps speed up live streaming, and tokens can be earned by staking. Users can make payments to dApps within the network using AIOZ tokens and the peer-to-peer network offers better scalability and cost-efficiency than other AI video-streaming services.

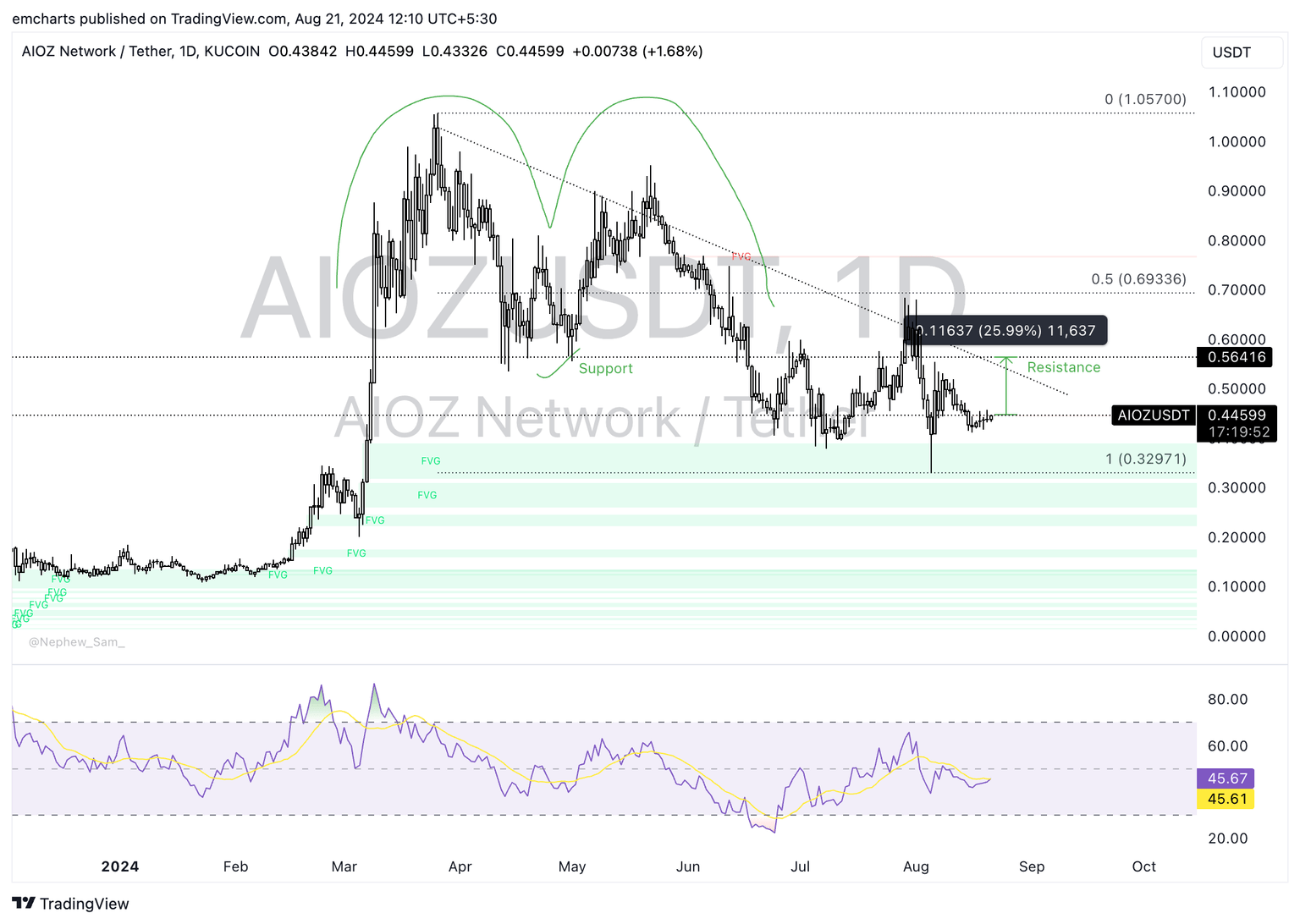

AIOZ rallied nearly 2% on Wednesday, trading at $0.4459 at the time of writing.

AIOZ could extend gains by nearly 26% and hit key resistance at $0.5641, the neckline of an inverted W formation in the AIOZ/USDT daily chart.

The Relative Strength Index (RSI) reads 45.67, inching closer to the neutral level.

AIOZ/USDT daily chart

AIOZ could find support in the Fair Value Gap (FVG) between $0.3179 and $0.3891.

Arweave

Arweave describes the network as the open library of the internet. AO is a project by Arweave, a hyper-parallel computer that offers temporary data storage utility on the chain.

Arweave is popular for its data permanence, however, with the new update, it offered time-bound storage too, providing a solution to more developers and users looking for the utility.

Introducing ArFleet: Temporary data storage on Arweave.

— ao (@aoTheComputer) August 16, 2024

Arweave is renowned for its data permanence. Now it offers time-bound storage, too -- opening up new markets and opportunities for $AR and the permaweb.

Launch: 8/29 1100 EST

Testnet access limited. Grab your spot pic.twitter.com/6D7TBTwJMF

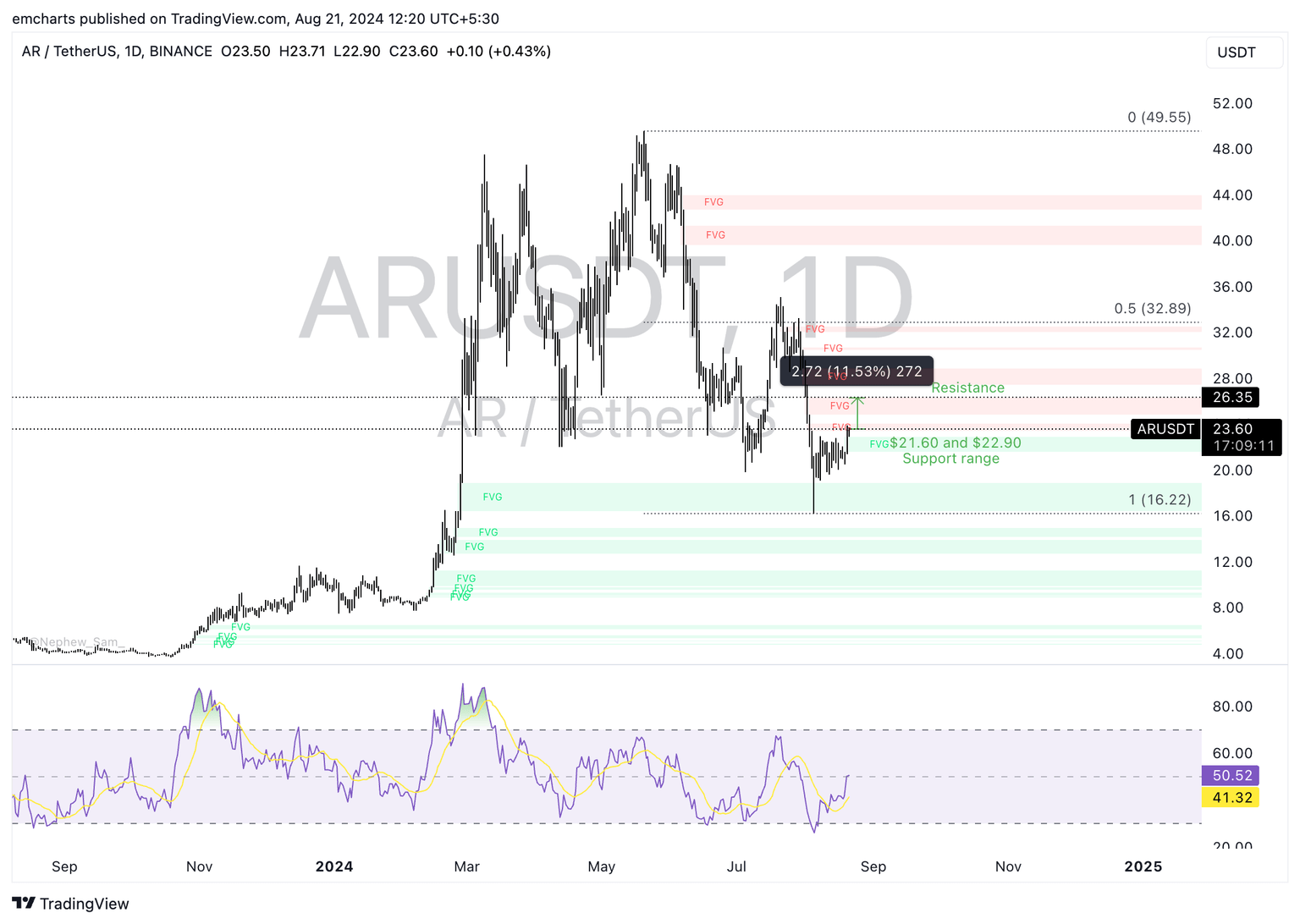

AR trades at $23.56 and the AI token’s price is nearly unchanged on Wednesday.

AR is likely to rally 11.53% towards the next key level, $26.35, the upper boundary of a Fair Value Gap (FVG) in the chart below. The Relative Strength Index (RSI) reads 50.52, at the neutral level.

AR/USDT daily chart

AR could find support in the FVG between $21.60 and $22.90, and the August 5 low of $16.22 in the event of a price correction.

Fetch

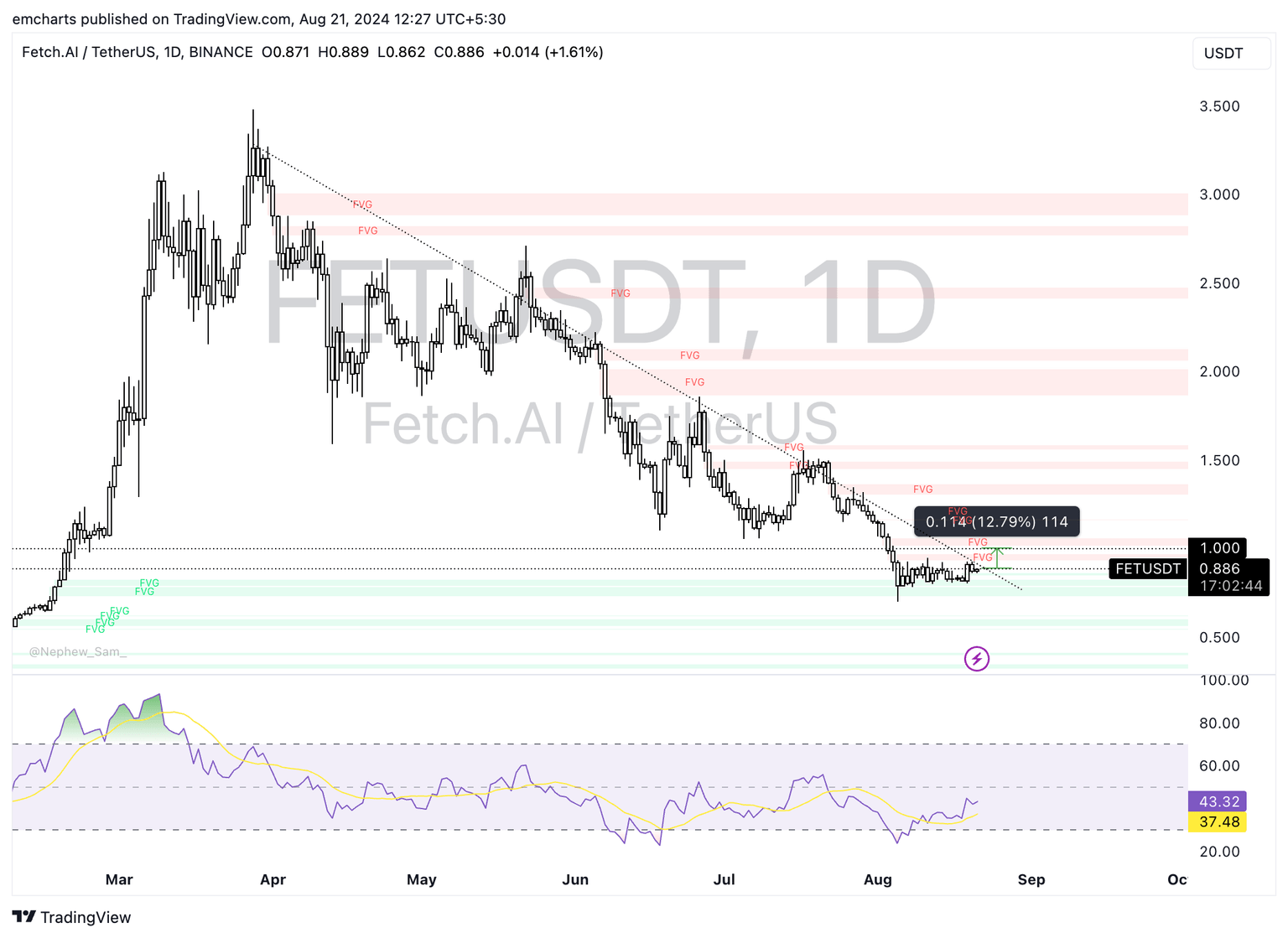

FET trades at $0.886, extending gains by nearly 2% on Wednesday. The AI-backed blockchain helps users create a decentralized digital economy within a single ledger.

The AI token’s price has been nearly unchanged in the last seven days, per TradingView data.

FET/USDT daily chart

Fetch’s token could extend gains by 12.79% towards $1, a key psychological level for the asset. Since the steep correction in the last week of July and early August, $1 has emerged as a key level for FET.

The Relative Strength Index (RSI) reads 43.32, FET is recovering from the oversold condition on August 7.

FET could find support at the FVG between $0.85 and $0.86 in the event of a correction.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.