- Bitcoin begins the journey to $60,000 after settling above $50,000.

- Ethereum reclaims the ground above $1,800, action to $2,000 still an uphill task.

- Ripple is on the brink of an upswing to $0.65 if XRP price breaks above the ascending parallel channel.

Bitcoin has finally made a 'meaningful' spike above $50,000. The recent move occurred after the flagship token tested support at $48,000. Meanwhile, bulls are focused on higher levels towards $60,000, but BTC is dancing slightly above $50,500.

The leading smart-contract token, Ethereum seems to have settled above $1,800, but the rest of the journey to $2,000 remains bleak. As for Ripple, recovery of the lost ground beyond $0.6 is another uphill task. On the other hand, Dogecoin's technical picture continues to look bearish, implying that the 'Elon Musk' effect is gradually fading away.

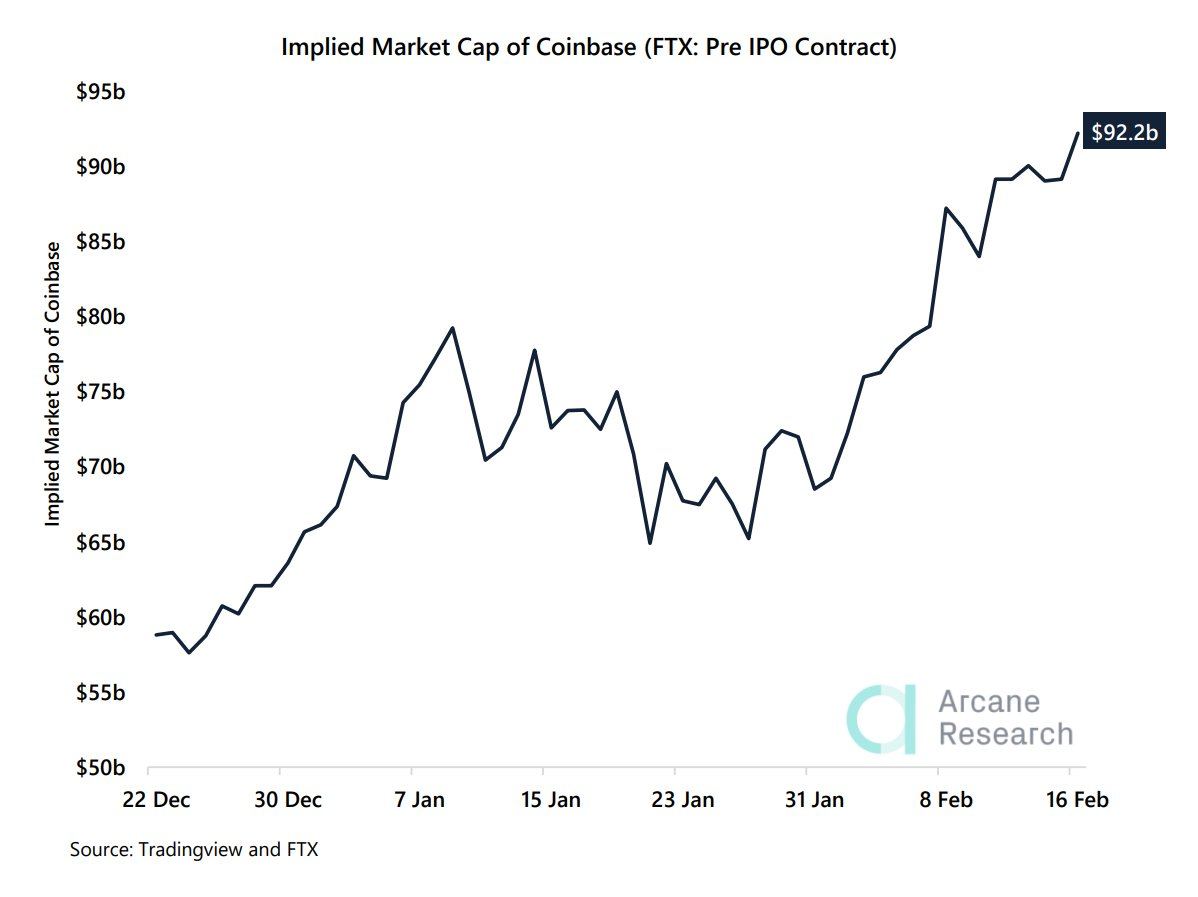

Coinbase pre-IPO valuation is 10% of Bitcoin's market cap

Coinbase, the most prominent cryptocurrency exchange in the United States, is listed on Nasdaq. According to Arcane Research's statement, FTX Official has given the company an "implied valuation of $92.2 billion." Note that this valuation is nearly 10% of the prevailing Bitcoin market cap.

Coinbase Implied market cap

Bitcoin is hovering above $50,500 as bulls remain glued on the anticipated upswing to $60,000. The Relative Strength Index shows that the trend has a bullish impulse. Besides, the price has just broken above the ascending parallel channel, insinuating price discovery toward $60,000 is catching momentum.

BTC/USD 4-hour chart

As explained, Bitcoin is primed for a leg up because it is yet to hit overbought conditions. However, the MVRV Z-Score shows that a spike above $50,000 will quickly bring Bitcoin to this level, leading to a correction before another all-time high.

Ethereum bulls build upon $1,800 support

Ethereum has made little progress since it broke above $1,800. The path to $2,000 is becoming challenging by the day, but the recent upswing appears to have secured support at $1,800. At the time of writing, Ether is doddering at $1,810 while bulls focus on lifting the price higher.

On the downside, Ethereum is sitting above the 50 Simple Moving Average (SMA), cementing the bull's position in the market. Holding above this key indicator will allow buyers to focus on levels heading to $2,000.

For now, the least resistance path is upward based on the RSI (4-hour chart). Movement into the overbought region will validate the much-awaited upswing.

ETH/USD 4-hour chart

It is worth keeping in mind that Ethereum staying above $1,800 does not guarantee price action to $2,000 because more resistance may hinder movement at $1,880 (an all-time high). On the other hand, losing ground above $1,800 will be detrimental to the progress made, perhaps may lead to losses eyeing $1,700.

Ripple inches closer to a breakout

XRP bounced off short-term support at the 4-hour 100 SMA, allowing bulls to take control over the price. This led to a spike above $0.5 while paving the way for potential gains past $0.6.

At the time of writing, Ripple is teetering at $0.54 as bulls fight the crucial resistance at the 50 SMA in conjunction with the descending parallel channel's upper boundary. If XRP slices through this zone, action may intensify, sending the price toward $0.65.

XRP/USD 4-hour chart

On the downside, Ripple is supported by the channel's midline as well as the 100 SMA. Rejection from the 50 SMA will force Ripple to retest the near-term support. If declines extend, buyers will be looking toward $0.45 (lower boundary of the channel) and $0.4 for refuge.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Axiom’s volume surpasses $100M as meme trading platform war escalates on Solana

Axiom meme coin trading volume hit $101 million for the first time, surpassing other platforms on Solana. Axiom accounts for 30% of the ecosystem’s trading users, followed by Photon and Bullx at 24% each.

Bitcoin aiming for $95,000 as Global M2 money supply surges

Bitcoin (BTC) price edges higher and trades slightly above $85,500 at the time of writing on Tuesday after recovering nearly 7% the previous week. The rising Global M2 money supply could be a favorable signal for both Gold and Bitcoin.

Top 3 gainers Brett, Story and Virtuals Protocol sparkle as Bitcoin eyes $90,000

Cryptocurrencies have sustained a buoyant outlook since last week as US President Donald Trump’s tariff war was paused for 90 days, except for China, propping global markets for lifeline relief rallies.

Three altcoins to watch this week: ALGO, MANA and JASMY show bullish signs

Algorand, Decentraland and JasmyCoin hovers around $0.19, $0.27, and $0.015 on Tuesday after a double-digit recovery last week. ALGO, MANA and JASMY approach their key resistance levels; breakout suggests a rally ahead.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20-%202021-02-17T145300.721-637491621419539821.png)

%20-%202021-02-17T151352.407-637491621375161976.png)

%20(97)-637491621344377706.png)