Top meme coin gainers FARTCOIN, AIDOGE, and MEW as Trump coins litmus test US SEC ethics

- The US regulatory shift ushers in a new market era, spotlighting legal and ethical issues with Trump-branded meme coins.

- Investors turn to meme coins amid an elusive altcoin season and a crypto market weighed down by macroeconomic pressure.

- Fartcoin bulls relentlessly push to reclaim $1, ArbDoge AI explodes on improving market sentiment.

Cryptocurrencies have been moving in lockstep since Monday, largely reflecting sentiment across global markets as United States (US) President Donald Trump's tariffs and trade wars take on new shapes and forms each passing day. Investors in digital assets are also adjusting to the dynamic macroeconomic environment with a focus on meme coins like Fartcoin, ArbDoge AI (AIDOGE) and Cats in a dogs world (MEW).

How President Trump-branded coins test US SEC ethics

The improving regulatory landscape in the US is a major step towards a progressive industry championed by President Trump's administration. Still, the President's close association with cryptocurrency projects, including meme coins $TRUMP and $MELANIA, launched under the umbrella of Trump's family's World Liberty Financial, does not fail to highlight key ethical issues and their implications.

The Securities and Exchange Commission (SEC) is at the forefront of the progressive change in cryptocurrency regulations in the US after a history marred by aggressive enforcement. Under the leadership of former Chair Gary Gensler, the Commission was accused of overreaching its authority, targeting crypto entities like Ripple and Coinbase, lacking a clear regulatory framework, stifling innovation, and creating uncertainty.

However, Gensler's exit has seen the SEC turn a new leaf. For instance, the staff received a circular on February 27, which clarified that meme coins do not constitute securities under federal law in the US. The statement added that these tokens would be "akin to collectibles," understood to derive value primarily from social sentiment and speculative demand rather than from profit expectations tied to managerial or entrepreneurial effort, Forbes reported on Wednesday.

All things considered, this marks a great step towards regulatory clarity in the crypto industry. Still, the timing of the move puts the SEC's ethics into question, especially with President Trump's family's involvement in crypto and the launch of meme coins $TRUMP and $MELANIA, nonfungible tokens (NFTs), digital collectibles, stablecoin projects like WLF1 and Bitcoin mining activities all under World Liberty Financial.

Several lawmakers, including Senator Elizabeth Warren and other select Democratic Party members, have highlighted elements of conflict of interest. The SEC's actions are seen as offering cover to World Liberty Financial, alleged to have a valuation of almost $1 billion.

Fartcoin price uptrend remains steady

Fartcoin's price consolidates between support at $0.81 and resistance at $0.96, underscoring the mundane trading environment in the market. As previously reported by FXStreet, the meme coin broke out following the validation of a bullish cup and handle pattern, with a 66% target, equal to the distance from the neckline at $0.6 and the pattern's bottom at $0.21, extrapolated above the breakout point. Fartcoin hovers at $0.9 at the time of writing on Thursday amid a bullish outlook above $1.00.

FARTCOIN/USDT daily chart

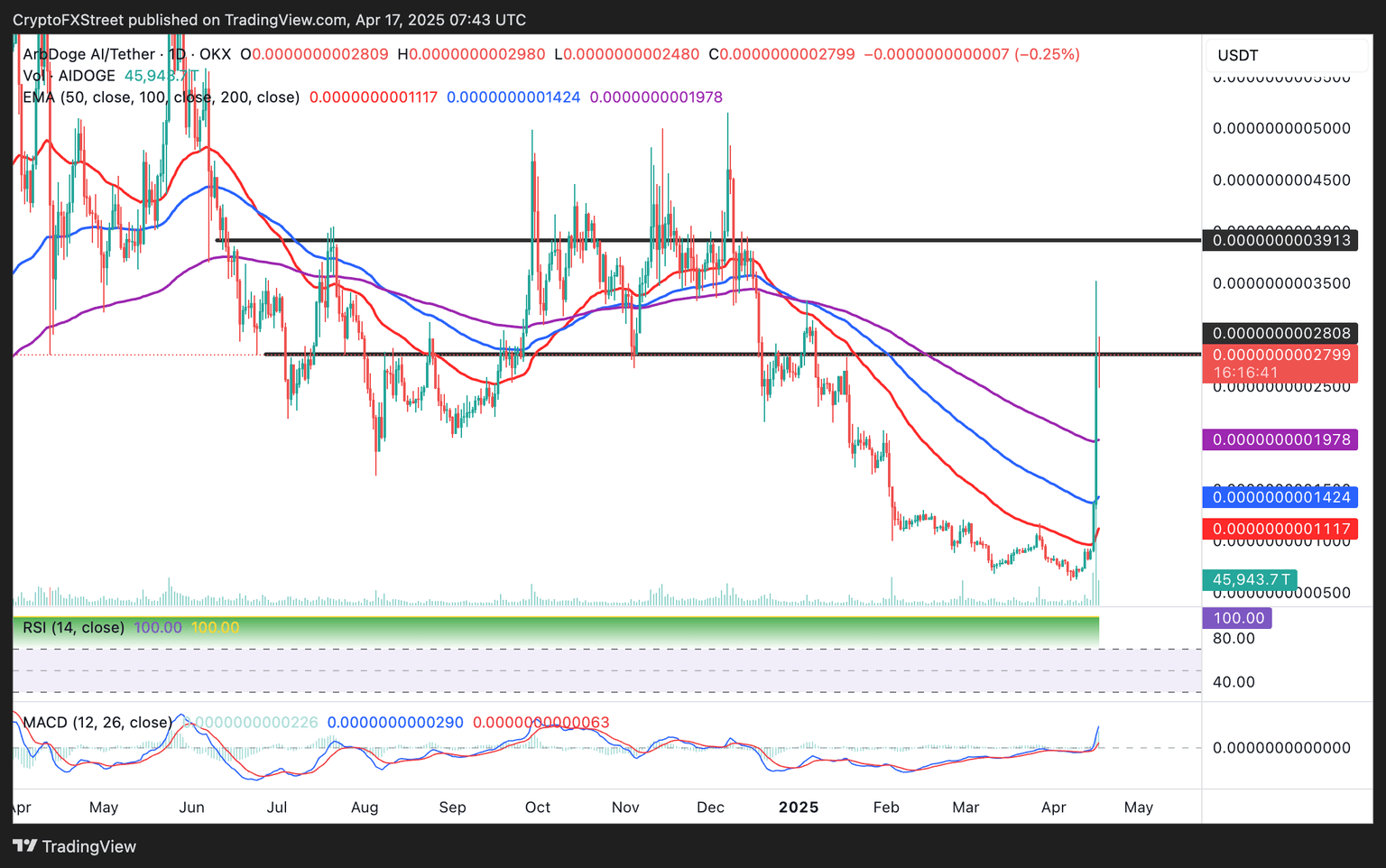

ArbDoge AI posts double-digit gains

ArbDoge AI, a meme coin in the Arbitrum ecosystem, bolted in double-digit gains following a hack on its X channel. AIDOGE surged tremendously, unlike other hacks, often resulting in the price tumbling. The token's bullish momentum is largely attributed to strong community sentiment. However, traders must exercise caution, as a reversal could be imminent if investors start taking profits.

AIDOGE/USDT daily chart

MEW stalls, slides below the 50-day EMA

MEOW, a Solana blockchain-based meme coin, moved higher in the last 24 hours, reaching highs near $0.0024. The meme coin briefly settled above the 50 Exponential Moving Average (EMA) on the 8-hour chart but could not breach resistance at the 100 EMA. This hurdle and traders' profit-taking ignited a reversal, with the token trading at $0.0022 at the time of writing.

MEW/USDT 8-hour chart

As the Relative Strength Index (RSI) indicator grinds below a descending trendline, the path of least resistance could stay downward, suggesting that MEW may soon retest support at $0.0019.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren