- Weekend crypto trading volume has declined sharply in 2024 thus far.

- The current market cycle is mirroring the 2020/2021 cycle.

- Bitcoin has several tailwinds that prime it for a potential rally in Q4.

In a recent report, K33 Research outlined how the crypto market has evolved in H1 and the key trends to watch out for in H2.

How crypto performed in H1

With the first half of the year gone, crypto research firm K33 Research released key insights that have shaped the crypto market in 2024. Here are a few noteworthy trends that investors need to watch out for:

- The crypto market is showing a high correlation to the timings of traditional markets in 2024 despite its 24/7 nature. According to K33 Research, only 12% of the weekly crypto trading volume occurred during weekends, compared to an average of 22% between 2012 and 2023. A possible reason for the change could be the launch of spot Bitcoin ETFs, which have altered market dynamics. As a result, investors need to begin watching out for increased volatility than in normal crypto weekends.

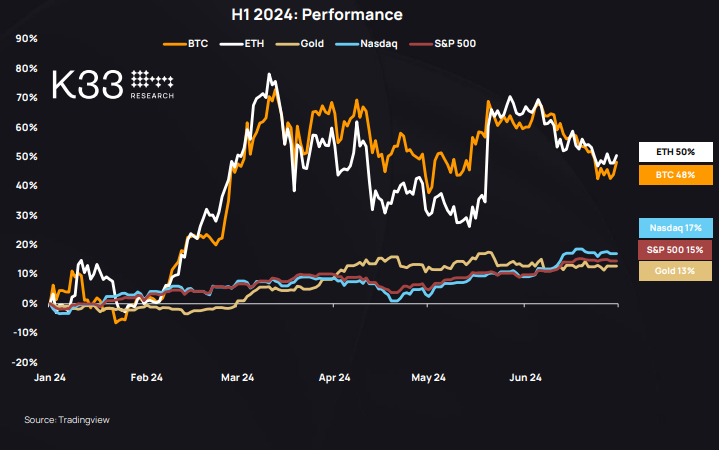

- Bitcoin and Ethereum outperformed gold, Nasdaq and the S&P 500 in H1 with a 48% and 50% price growth, respectively. In comparison, Nasdaq, gold and the S&P 500 only grew by 17%, 13% and 15%, respectively. Bitcoin's growth obviously stems from the massive capital that has flowed into spot Bitcoin ETFs. These products raked in 252,488 BTC in H1.

BTC, ETH, Gold, Nasdaq, S&P 500 H1 Performance

- The current market cycle sort of mirrors the 2020/2021 cycle, where momentum cooled in Q2 after Bitcoin retraced from its all-time high. This is visible in Bitcoin's ranging price and daily average volume, which has dried up since seeing a spike in March.

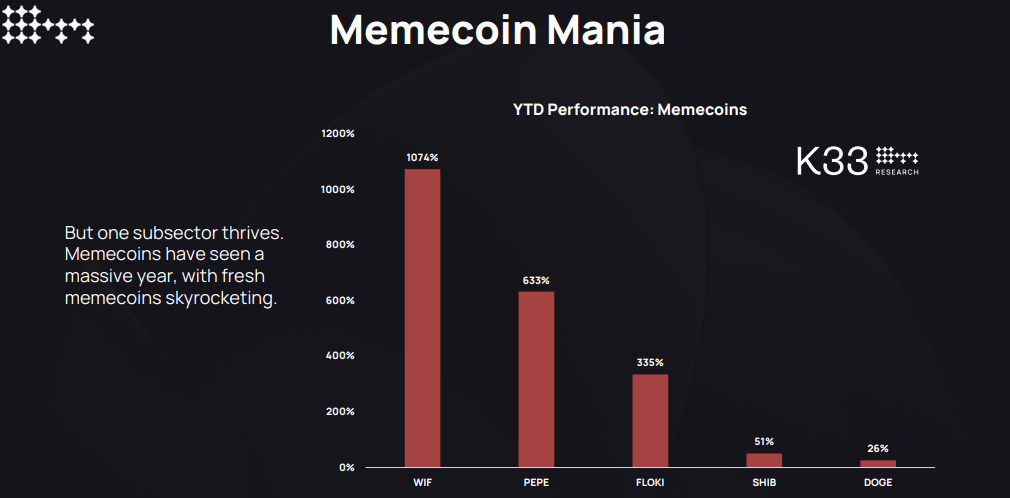

- Altcoins have been heavily affected, with most tokens returning to their 2022 lows. However, meme coins are outliers, as their rally during the March meme coin frenzy saw them posting impressive H1 gains. Newer meme tokens like dogwifhat (WIF) and BRETT were standout performers growing by 1074% and 12,000%, respectively. Meanwhile, older meme projects like DOGE, SHIB, FLOKI, and PEPE increased by 26%, 51%, 335%, and 633%, respectively.

Meme coin YTD Performance

How will the market shape up in H2?

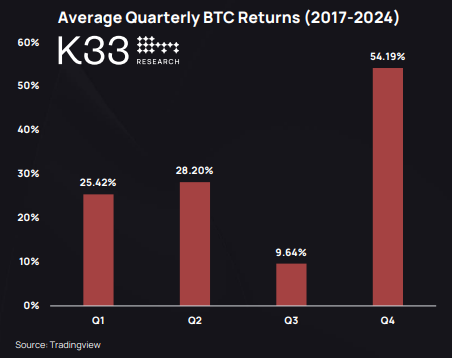

Historically, Bitcoin is weakest in Q3 and strongest in Q4. K33 Research expects Bitcoin to repeat the same pattern, with headwinds from Mt. Gox, the German government, and miners' supply pressure outweighing demand. Potential tailwinds in Q4 from a possible Trump victory in the US elections, lower interest rates, and FTX cash distribution may see BTC gain strength.

BTC Average Quarterly Returns

Additionally, Ethereum ETFs could spark a massive rally in ETH as investors are currently underpricing its impact on the top altcoin. Bitwise chief investment officer Matt Hougan predicted that ETH ETFs could attract up to $15 billion in the first 18 months of trading. As a result, Ethereum-related altcoins, especially DeFi-based, may rally alongside ETH.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin falls below $94,000 as over $568 million outflows from ETFs

Bitcoin continues to edge down, trading below the $94,000 level on Thursday after falling more than 5% this week. Bitcoin US spot ETFs recorded an outflow of over $568 million on Wednesday, showing signs of decreasing demand.

Altcoins Tron and Toncoin Price Prediction: TRX and TON show signs of weakness

Tron and Toncoin prices extend the decline on Thursday after falling more than 6% this week. TRX and TON face rejection from key levels, suggesting double-digit cash ahead. Traders should be cautious as both altcoins show signs of weakness in momentum indicators.

BNB Price Forecast: Poised for a decline on negative Funding Rate

BNB price hovers around $696.40 on Thursday after declining 4.58% in the previous two days. BNB’s momentum indicators hint for a further decline as its Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) show bearish signals.

Ripple's XRP eyes recovery following executives' dinner with Donald Trump

Ripple's XRP is up 2% on Wednesday following positive sentiments surrounding its CEO Brad Garlinghouse's recent dinner with incoming US President Donald Trump. If the recent recovery sentiment prevails, XRP could stage a breakout above the upper boundary line of a bullish pennant pattern.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.