Top Altcoins Of The Day: DeFi tokens Decentraland, Fantom and Optimism led the bulls on Monday

- Bitcoin price hovered around the $22,400 mark as the broader market cues remained slightly bearish.

- Decentraland price led the altcoins with a 6% rise in 24 hours to trade at $0.615.

- Fantom and Optimism followed suit, each rising by more than 4% in the span of a day.

The best-performing altcoins today once again turned out to be the native tokens of various Decentralized Finance (DeFi) protocols or chains. Bitcoin price virtually remained unmoved, trading at $22,403, while the altcoins took charge of the market with only a very few tokens sustaining bullishness by the end of the trading session.

Decentraland price takes the lead

Decentraland price rose by nearly 6% to trade at $0.615 at the time of writing. The altcoin managed not to decline to its immediate support level of $0.549. MANA is now set to reclaim the support of the 50-day Exponential Moving Average (EMA), which would help it push past the barrier at $0.641.

Flipping it into a support floor would give the boost MANA needs to rise to the critical resistance at $0.707. Breaching this level is necessary to initiate a sustainable recovery.

MANA/USD 1-day chart

But if the support level of $0.549 is lost, MANA would become vulnerable to a significant decline. Not only would the bullish thesis be invalidated, but Decentraland price could end up crashing by more than 30% to $XXX.

Fantom price saves itself

Trading at $0.417, the altcoin posted the green candle on Monday after bouncing off the critical support level of $0.386. The altcoin now has to flip the critical barrier at $0.442 into support first to rally toward the year-to-date highs of $0.634.

FTM/USD 1-day chart

However, traders must note that the Relative Strength Index (RSI) is closer to the bearish zone, which could lead to FTM falling through the critical support level of $0.386. This could result in a further decline in price, and the cryptocurrency would end up tagging the monthly lows of $0.294, marking a 28% plunge in value.

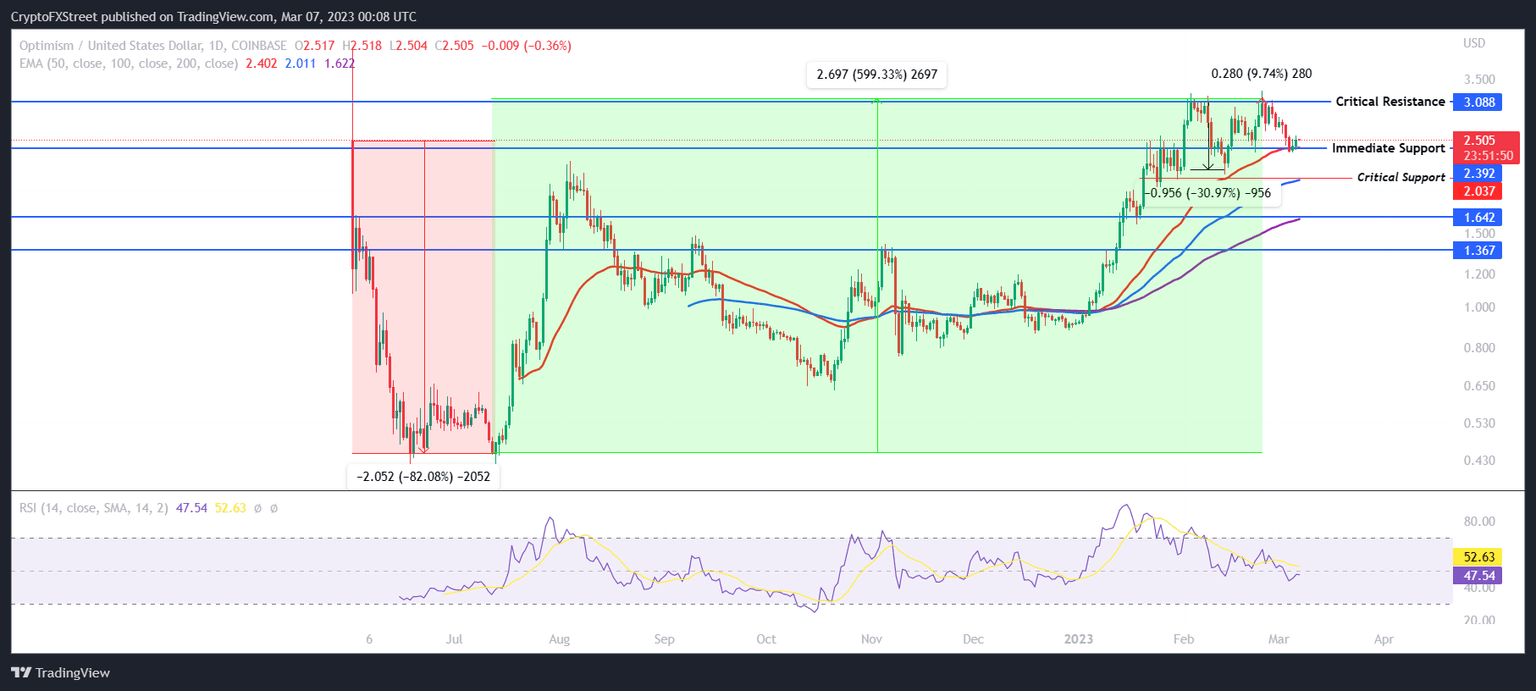

Staying optimistic on Optimism price

Following FTM’s lead, Optimism price also bounced off the immediate support level at $2.39 to trade at $2.50 at the time of writing. A bullish narrative is highly likely for the altcoin as the RSI is close to rising back above the center line at 50.

This would provide some support to the altcoin to chart a 23% rise to test the critical resistance at $3.08. Breaching this level would also place OP at a year-to-date high.

OP/USD 1-day chart

But if bulls lose their conviction and the Optimism price declines below the immediate support level at $2.39, it could end up testing the critical support at $2.03. Falling through this level would prove to be harmful to the altcoin, as OP could crash by as much as 30% to tag $1.64.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.