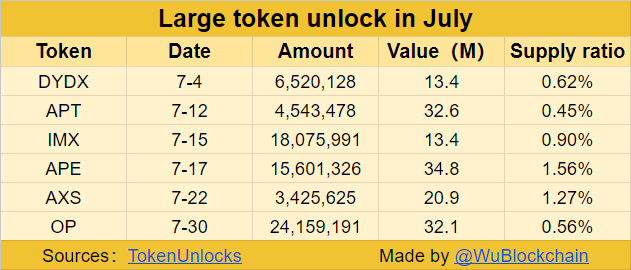

- Crypto tokens worth $147 million are set to unlock in July 2023 according to data from TokenUnlocks.

- DYDX, APT, IMX, APE, AXS and OP rank among the largest unlocks, supply ranging from 0.50% to 1.50%.

- Token unlocks typically increase the circulating supply of crypto across exchanges, resulting in selling pressure on assets.

While Bitcoin and Ethereum prices reel from the intense selling pressure in the crypto market, altcoins are likely to bleed further in July. The Securities and Exchange Commission’s request for more information in spot Bitcoin ETF filings sent Bitcoin and Ethereum prices lower overnight on Friday.

Altcoins on the other hand, are likely to experience higher selling pressure from the upcoming token unlocks scheduled for July. Nearly $147 million in tokens of key projects like DYDX, ApeCoin, Aptos, Axie Infinity and Optimism are set to join the circulating supply within the following weeks.

Token unlocks to watch out for in July

According to data from intelligence tracker TokenUnlocks, a large volume of tokens from different DeFi projects are gearing up for unlock in July. While crypto market participants reel from the selling pressure and pullback in asset prices as a result of SEC crackdown, unlocks could intensify it further.

As seen in the chart below, DYDX, Aptos (APT) and Immutable (IMX) are set to unlock in the first half of July. A total of 29.13 million tokens of these three projects will be unlocked, at a value of $59.4 million.

These token unlocks range between 0.45% and 0.90% of the supply of the assets. Typically less than 1% unlocks have less negative impact on asset prices.

Token Unlocks in July

In the second half of July, ApeCoin (APE), Axie Infinity (AXS) and Optimism (OP) unlocks are lined up. These unlocks range from 0.5% to 1.5% of the asset’s supply, implying a significant impact on asset prices and a likelihood of higher selling pressure.

Crypto market participants need to watch out for sell the news events where prices of these tokens rally in the weeks leading up to the unlock, and a mass sell off takes place on the day of the event. Moreover, APE, AXS and OP are likely to be hit by a double whammy, the SEC’s clampdown and the token unlock event.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Shiba Inu eyes positive returns in April as SHIB price inches towards $0.000015

Shiba Inu's on-chain metrics reveal robust adoption, as addresses with balances surge to 1.4 million. Shiba Inu's returns stand at a solid 14.4% so far in April, poised to snap a three-month bearish trend from earlier this year.

AI tokens TAO, FET, AI16Z surge despite NVIDIA excluding crypto-related projects from its Inception program

AI tokens, including Bittensor and Artificial Superintelligence Alliance, climbed this week, with ai16z still extending gains at the time of writing on Friday. The uptick in prices of AI tokens reflects a broader bullish sentiment across the cryptocurrency market.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

XRP price could renew 25% breakout bid on surging institutional and retail adoption

Ripple price consolidates, trading at $2.18 at the time of writing on Friday, following mid-week gains to $2.30. The rejection from this weekly high led to the price of XRP dropping to the previous day’s low at $2.11, followed by a minor reversal.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.