- Dogecoin, Shiba Inu, Pepe, Dogwifhat, and Bonk extend losses following Bitcoin's drop to around $58,000.

- Meme coins have observed a decline in on-chain activity.

- Meme coin market capitalization shrinks to $40 billion on Monday.

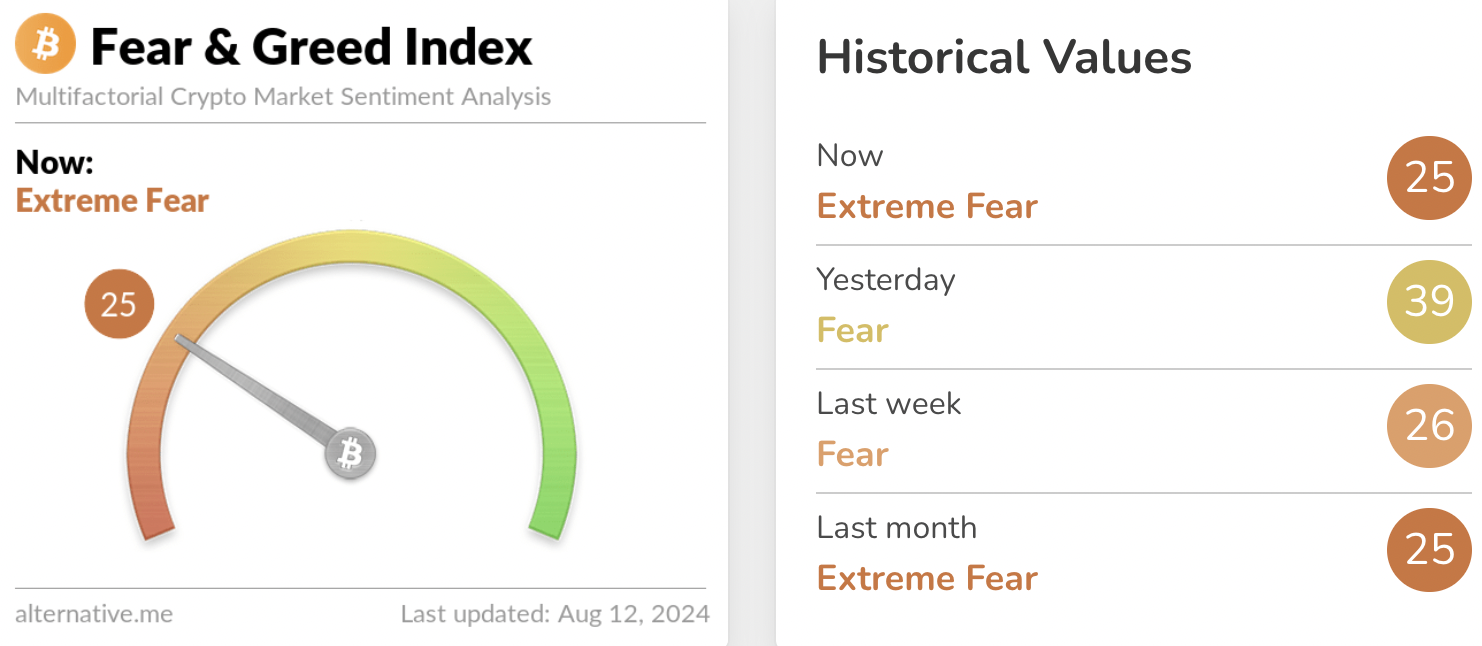

Meme coins erased 6% of their market capitalization in the last 24 hours, down to $40 billion per CoinGecko data. The shrinking market capitalization reflects the “fear” among crypto traders.

Alternative.me’s Crypto fear and greed index reads 25 on Monday, signaling “extreme fear” among traders. Two market movers are likely driving the changing sentiment, alongside macro factors this week.

Crypto fear and greed index

Meme coins extend losses on Monday

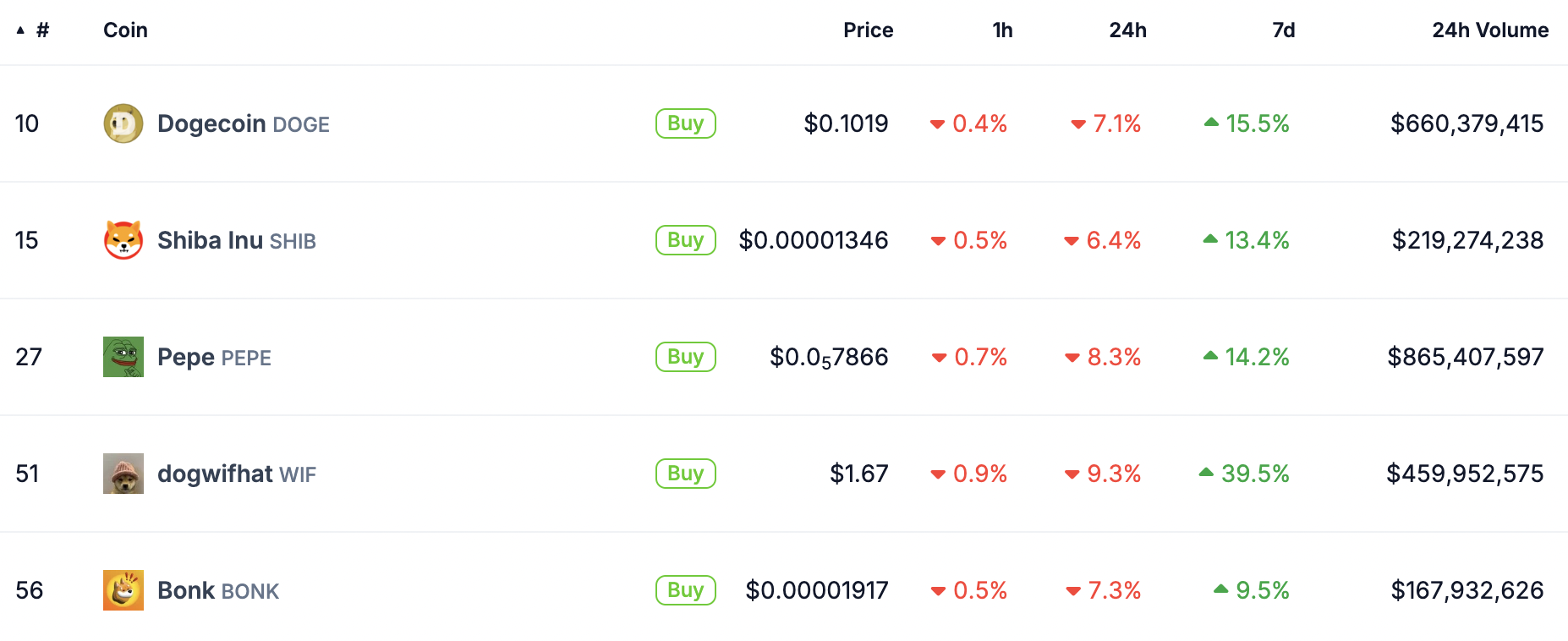

The top five meme coins ranked by market capitalization include Dogecoin (DOGE), Shiba Inu (SHIB), Pepe (PEPE), Dogwifhat (WIF) and Bonk (BONK). These five tokens erased between 6% and 9% of their value in the last 24 hours, per CoinGecko data.

Meme coin price change

Meme coins are the leading narrative in the ongoing market cycle, which has been termed as the “meme coin supercycle. The sector outperformed others consecutively in the first two quarters of 2024.

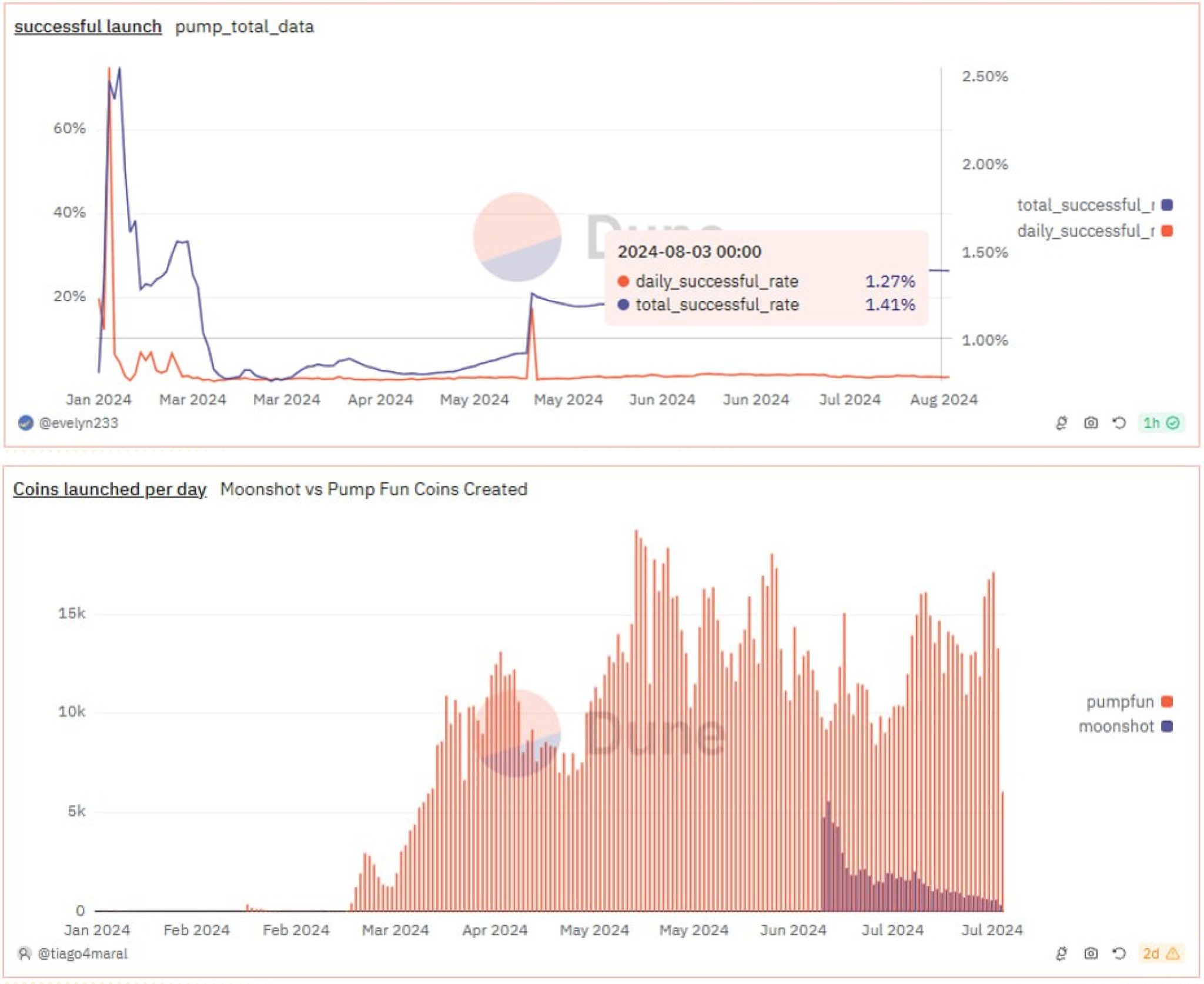

Meme coin launchpads like Pump.fun and Moonshot have recorded a large number of launches as the asset category gains popularity.

Data from Dune Analytics shows only 0.12% of the meme coin launches on Pump.fun made it past $60,000 in market capitalization (in the last 24 hours) and a listing to the decentralized exchange Raydium. The alarming numbers show the state of meme coins and investments in the category.

1.4% of Pump.fun’s 1.58 million meme coins that have been listed on the DEX since its inception were listed on a DEX. Nearly 99% of the projects failed or ended up in a “pump and dump” scheme. The chart below shows the number of projects launched and the successful ones (that were listed on an exchange.)

Successful launch and coins launched per day

Declining on-chain activity signals traders’ loss of interest

Santiment data shows that active addresses in the 24 hour timeframe declined in top meme coins. A drop in on-chain activity is a sign of a loss of interest from market participants. This can be attributed to last week’s crypto crash, the drop in Bitcoin’s price under $60,000, and an overall decline in capital inflow to the meme coin category.

Active addresses 24-hour for SHIB, DOGE, and PEPE

At the time of writing, the sentiment among crypto traders is that of “extreme fear”, and Bitcoin ranges below $60,000. On Monday, BTC trades at $58,883, DOGE trades at $0.1038, SHIB at $0.00001376, PEPE at $0.00000817, WIF at $1.730 and BONK at $0.00001967.

Cryptocurrency prices FAQs

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

%20[13.53.33,%2012%20Aug,%202024]-638590503913055620.png)