Top 3 Price Prediction Ethereum, Bitcoin, XRP: Pullback complete, first crypto bull run for 2022 begins

- Bitcoin price develops a powerful bullish reversal candlestick on its weekly chart.

- Ethereum price finds support against intense Fibonacci and Ichimoku price levels.

- XRP price hits time and price zone that could push Ripple back to $1.00

Bitcoin price action shows clear signs that the bottom is in and a new run higher is imminent. Ethereum price has so far rejected any further selling pressure by remaining above the bottom of the Cloud. XRP price is inside one of the most essential Gann Cycles of the Inner Year, pointing to a new bull run soon.

Bitcoin price ready to bounce and retest $45,000 as resistance

Bitcoin price is developing one of the most sought-after bullish reversal candlesticks in Japanese candlestick analysis: the Dragonfly Doji. The Dragonfly Doji is a candlestick with little to no body, a small wick above and a long wick below. The single candlestick pattern alone is not sufficient to identify the likelihood of a bottom, but the combination of the Dragonfly Doji and the current oscillator conditions support that theory.

The Relative Strength Index remains in bear market conditions, yet despite the significant drop over the past two weeks, it is relatively unchanged and remains in neutral territory. On the other hand, the Composite Index has slowly increased while price has decreased, creating regular bullish divergence – a warning that the current downswing is likely to weaken or terminate. Finally, the most glaring example of how oversold Bitcoin price currently is best represented by the Optex Bands oscillator, which is in extreme oversold conditions for the first time since July 2021.

BTC/USD Weekly Ichimoku Kinko Hyo Chart

Upside potential for Bitcoin is likely limited to the $45,000 to $47,000 in the near -term. Downside risks remain but are likely limited where Bitcoin price found immediate support near the 88.2% Fibonacci retracement at $33,000.

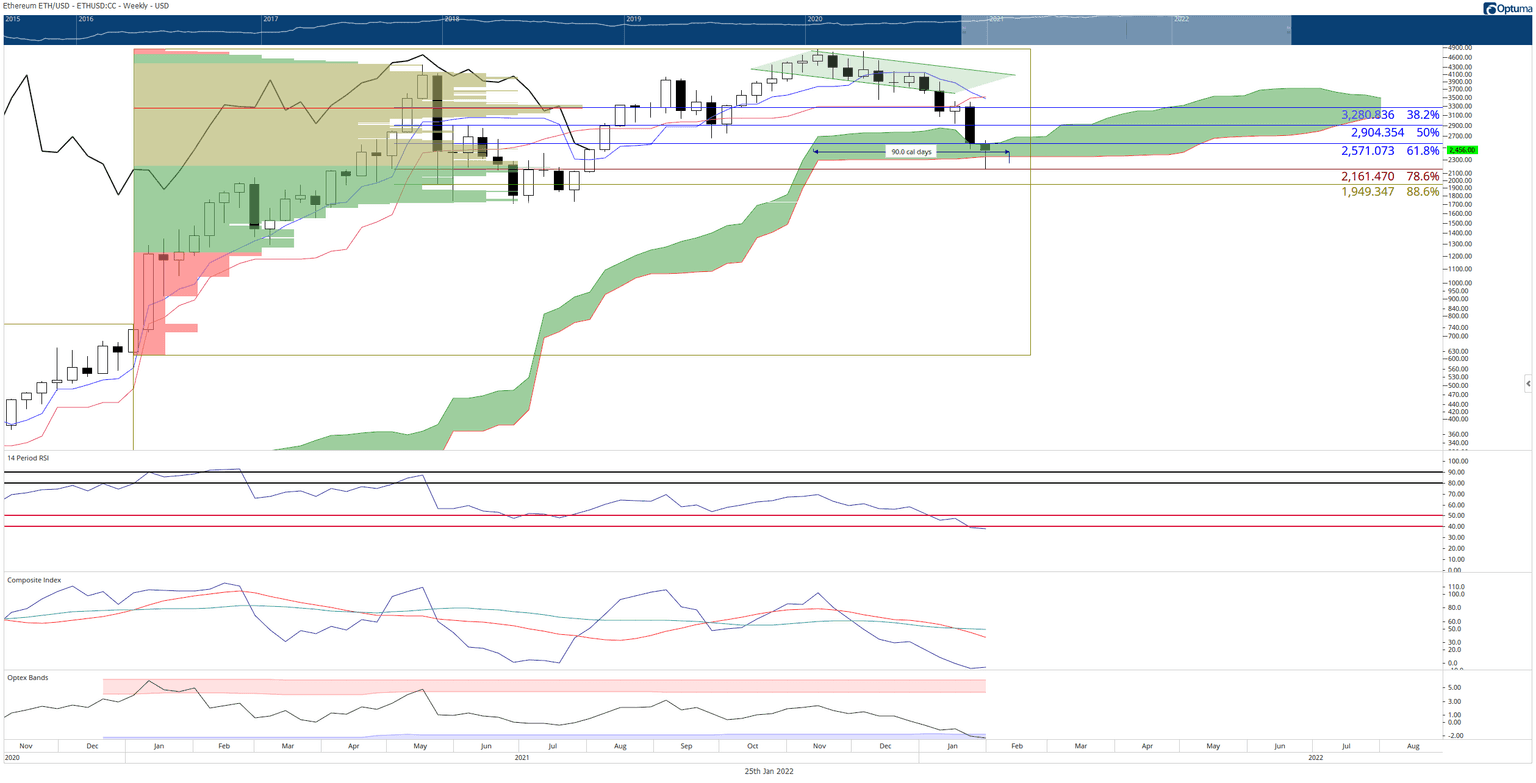

Ethereum price finds substantial buying support between $2,150 and $2,350

Ethereum price has had a nice bounce since bottoming around the $2.150 value area. While downside risks indeed remain, the present price action appears to have eliminated much of that concerns – for now. Substantial buying occurred at the 78.6% Fibonacci retracement and the bottom of the Cloud ($2,160 and $2,350, respectively).

Ethereum must close the current weekly candlestick where the Chikou Span will not move below the bodies of the candlesticks. To occur, Ethereum price must close at or above $2,450. Failure to do so would position Ethereum in a condition where another sell-off could occur.

ETH/USD Weekly Ichimoku Kinko Hyo Chart

If Ethereum price remains above the bottom of the Cloud (Senkou Span B at $2,160), then it could quickly push towards a return to $4,000. The Relative Strength Index, Composite Index, and Optex Bands oscillator show extreme oversold conditions. Combined with the current support zone for Ethereum price, there is an extremely high probability that Ethereum will experience a strong uptrend soon. Downside risks are likely limited to the $2,000 value area.

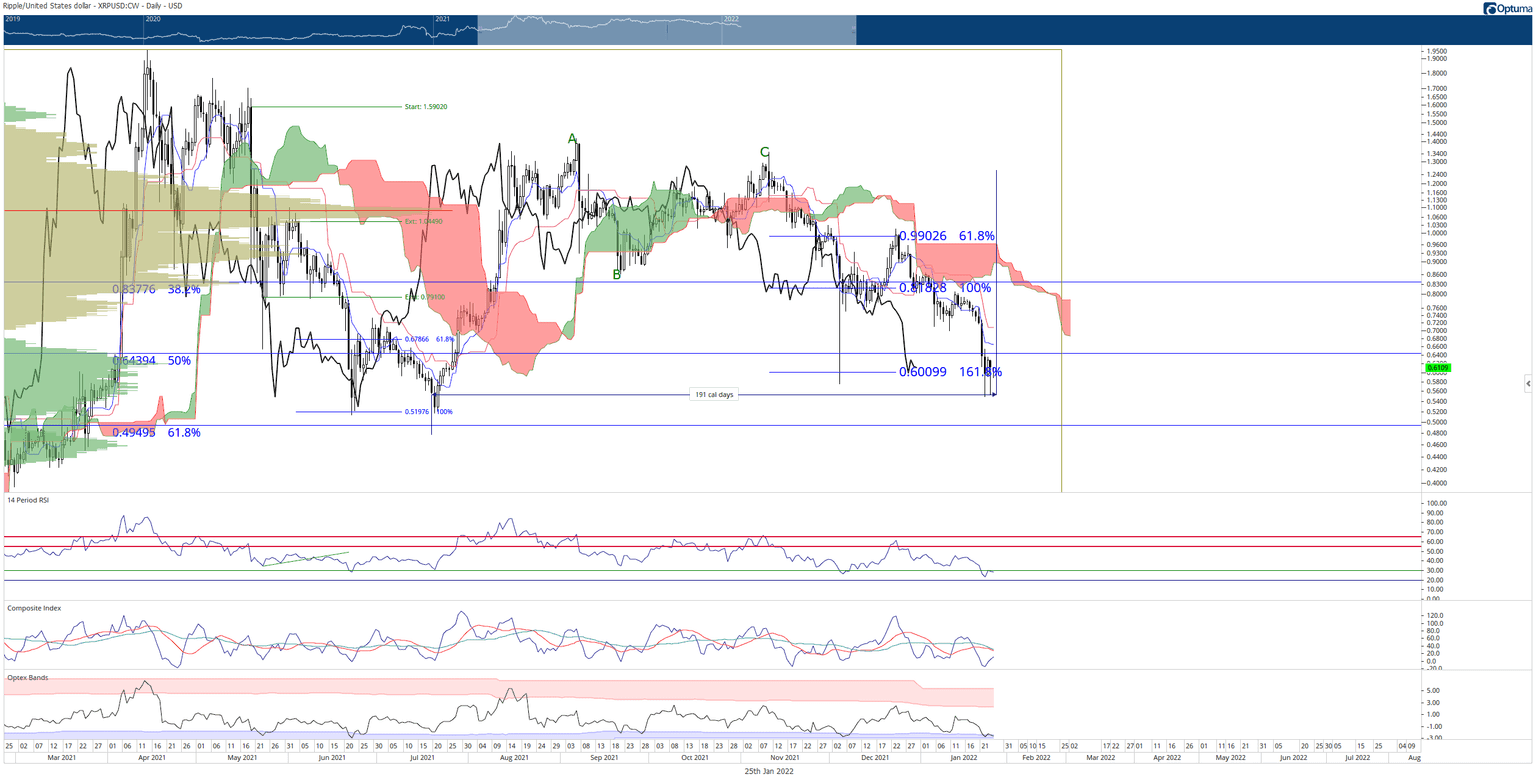

XRP price and time confluence suggests a giant price spike very soon

XRP price action has found a strong support near the 50% Fibonacci retracement at $0.64 and the 161.8% Fibonacci retracement at $0.60. This support comes in as XRP has developed highly oversold conditions in the Relative Strength Index, Composite Index, and Optex Bands oscillators.

Perhaps the most critical warning signal that a new bull run could be imminent is the 180-day (180 to 198 days) Gann Cycle of the Inner Year. The 180-day is the second most powerful Inner Year Cycle. Gann wrote that the 180-day cycle has a high probability of establishing important support or resistance levels. Additionally, he also warned that reversals often happen at this time cycle.

XRP/USD Weekly Ichimoku Kinko Hyo Chart

Bulls should look for a return to test the $1.00 value area if XRP price can close above the 50% Fibonacci retracement at $0.64. Downside pressure remains but is likely limited to the 61.8% Fibonacci retracement and psychological price level at $0.50.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.