- Cryptocurrencies see fresh dips after a weekend recovery.

- Digital coins' paths of least resistance are to the downside but some are doing better than others.

- Here are the levels to watch according to our proprietary technical tool, the Confluence Detector.

NASDAQ continues to proceed with the plans to provide Bitcoin futures in the first quarter of 2019. The upbeat news for cryptos helped them stabilize over the weekend.

However, digital coins turned down in the wake of the new week. Some suspect that this is a necessary correction. After all, cryptocurrencies have not hit new lows. Others suspect that this is just a dead cat bounce before another fall.

According to one theory, crypto whales, or the big boys, are dumping digital coins to cause panic and a sell-off, only to begin re-accumulating. Some thought this moment of buying has already begun. However, even if the whales are not dumping further cryptos, they are not buying either and seem to be on the sidelines.

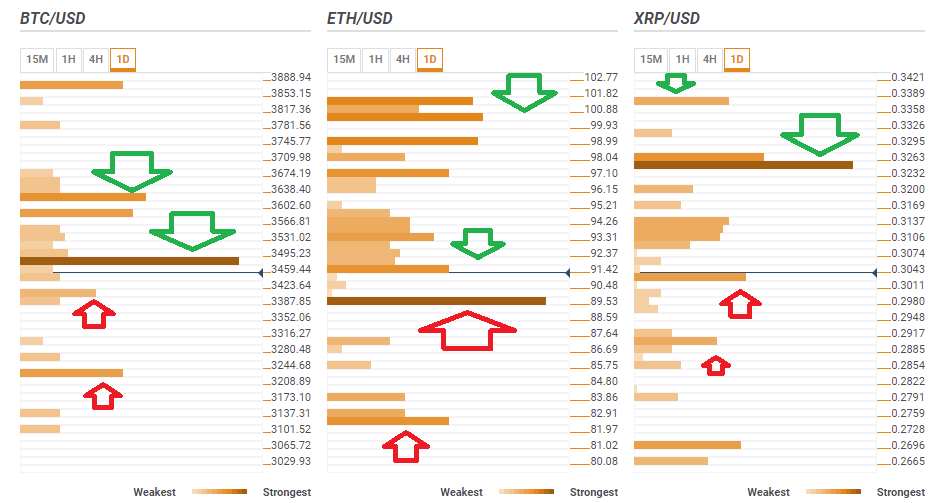

The technical levels do not bode well for any of the top 3 cryptos. Here are the levels to watch on Bitcoin, Ethereum, and Ripple.

BTC/USD faces a hurdle at $3,480

Bitcoin sees a significant hurdle at around $3,480 where we see a dense cluster including the Bollinger Band 15-minute Middle, the Fibonacci 23.6% one-week, the Simple Moving Average 5 one-hour, the previous month low, the SMA 10-1h, and the Fibonacci 61.8% one-day.

The next substantial cap is around $3,585 where we see the convergence of the SMA 5 one-day, the Fibonacci 23.6% one-day, the Bollinger Band 4h-Upper, and the BB 1h-Upper.

Looking down, weak support awaits at $3,403 which is the meeting point of the 4h-low, the Pivot Point one-day Support 1, and the BB 15m-Lower.

$3,223 is the last noteworthy support line, including last week's low and the Fibonacci 161.% one-day.

ETH/USD stands out with support at $89.53

Ethereum stands out from the crowd by enjoying significant support, but the upside is not that easy.

At $89.53 we see the meeting point of the PP one-day Support 1, the previous daily and four-hour low. Further down, at $82.50 we see the previous weekly low, the Fibonacci 161.8% one-day, and the Pivot Point one-day Support 2.

Some resistance to ETH/USD awaits at $91.42 where we see the Fibonacci 23.6% one-week, the previous 1h-high, the BB 15-minute Middle, the SMA 100-1h, and the SMA 5-1h.

The road to the upside is packed with resistance lines and the most significant one is at the very round number of $100 which is the Pivot Point one-day Resistance 1, the previous daily high, the SMA 50-4h, and the SMA 200-1h.

The prospects for Vitalik Buterin's brainchild has somewhat improved.

XRP/USD continues facing the $0.3250 hurdle

Ripple has some support at $0.3025 where we see the confluence of the SMA 5-15m, the previous daily low, the PP one-day Support 1, and the Bollinger Band 1h-Lower.

At $0.3250 we continue seeing a cluster of critical levels: the Fibonacci 38.2% one-week, the PP one-day R1, and the previous monthly and daily lows.

$0.3374 we see the meeting point of the PP one-day R2 and the SMA 10-one-day.

Low support is at $0.3030 which is the convergence of the previous weekly low, the Fibonacci 161.8% one-day, and the PP one-day S2.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin consolidates ahead of MicroStrategy Q1 earnings, strategic Bitcoin reserve deadline

Bitcoin price is extending its consolidation streak, trading around $95,000 on Wednesday, as traders await a decisive breakout. MicroStrategy’s Q1 earnings release and the approaching deadline for the Strategic Bitcoin Reserve have the potential to move BTC price.

Chainlink price offers mixed signals as supply outside of exchanges soars but network activity declines

Chainlink's supply outside exchanges has surged to 803.38 million from 778.87 million in under two months. LINK network activity declines, with new and active addresses falling from a recent peak.

Ripple Price Prediction: XRP price uptrend toward $3 looks steady

Ripple (XRP) price hovers at $2.24 at the time of writing on Wednesday as bulls try to prevent the pullback from its April peak of $2.36 from extending further. If XRP holds above the immediate support at $2.21, a reversal could soon ensue.

THORChain announces integration of XRP stagenet ahead of the mainnet network launch

THORChain announced on Tuesday that its stagenet development of its Ripple (XRP) integration is nearing the final step, with mainnet activation imminent. This integration enhances THORChain’s economic model by increasing swap activity and protocol fees.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.