- The market is technically bullish but only by a few dollars without anything conclusive.

- Ethereum has made its second attempt to jump to $290.

- XRP plays another game but does not lose sight of the King.

In the article published yesterday, I have highlighted a potential window of opportunity to an upward movement that would take the three main protagonists of the Crypto market to higher prices.

The bullish escape attempt has begun late in the European session and remains prevalent now. The stakes could not be higher – the end of the crypto winter is at play.

After more than 18 months of substantial falls – typical to this market – and of some increases that have taken prices to 50% of the historical maximums, the future can be decided today.

It is not the first attempt of the bulls to send the bears to the cave. The first has occurred between May 26 and June 3 and miserably failed. The bears defended themselves well – prolonging the winter and burying any signs of spring.

The second attempt to enter the warm season has kicked off on Wednesday – and for now – has succeeded, but only just. BTC/USD tops the upper trend line of the long term downward channel by a mere $3 – a considerably fragile and unstable situation.

Bitcoin’s rise above this line is the first condition for declaring an end of Cryptowinter. The second condition – a better relative behavior of Ethereum against Bitcoin – is still in the works. The following analysis of ETH/BTC will provide more clues.

ETH/BTC 4-Hours Chart

The ETH/BTC crypto cross is currently trading at 0.032 and is conquering the upper parallel trendline at the lower end. The move is in play and is unconfirmed at the time of writing.

A break above 0.0347 is essential to ending the cold season in cryptos.

Above the current price, the first resistance level is at 0.0332 (price congestion resistance), the second one is at 0.0338 (first upper parallel trend line) and the third one is at 0.0346 (relative highs).

Below the current price, initial support level awaits at 0.0319 (lower parallel bullish trend line), the second is at 0.0316 (price congestion support) and the third for ETH/BTC is at 0.031 (EMA50, SMA100, and SMA200), significant support.

The MACD on the 4-hour chart has fully entered the positive zone of the indicator. The profile is bullish, and the opening between the lines is essential. However, the structure is very fragile and can change quickly.

The DMI on the 4-hour chart shows how bulls dominate the market against bears that assume – without hesitation – that the end of winter is near.

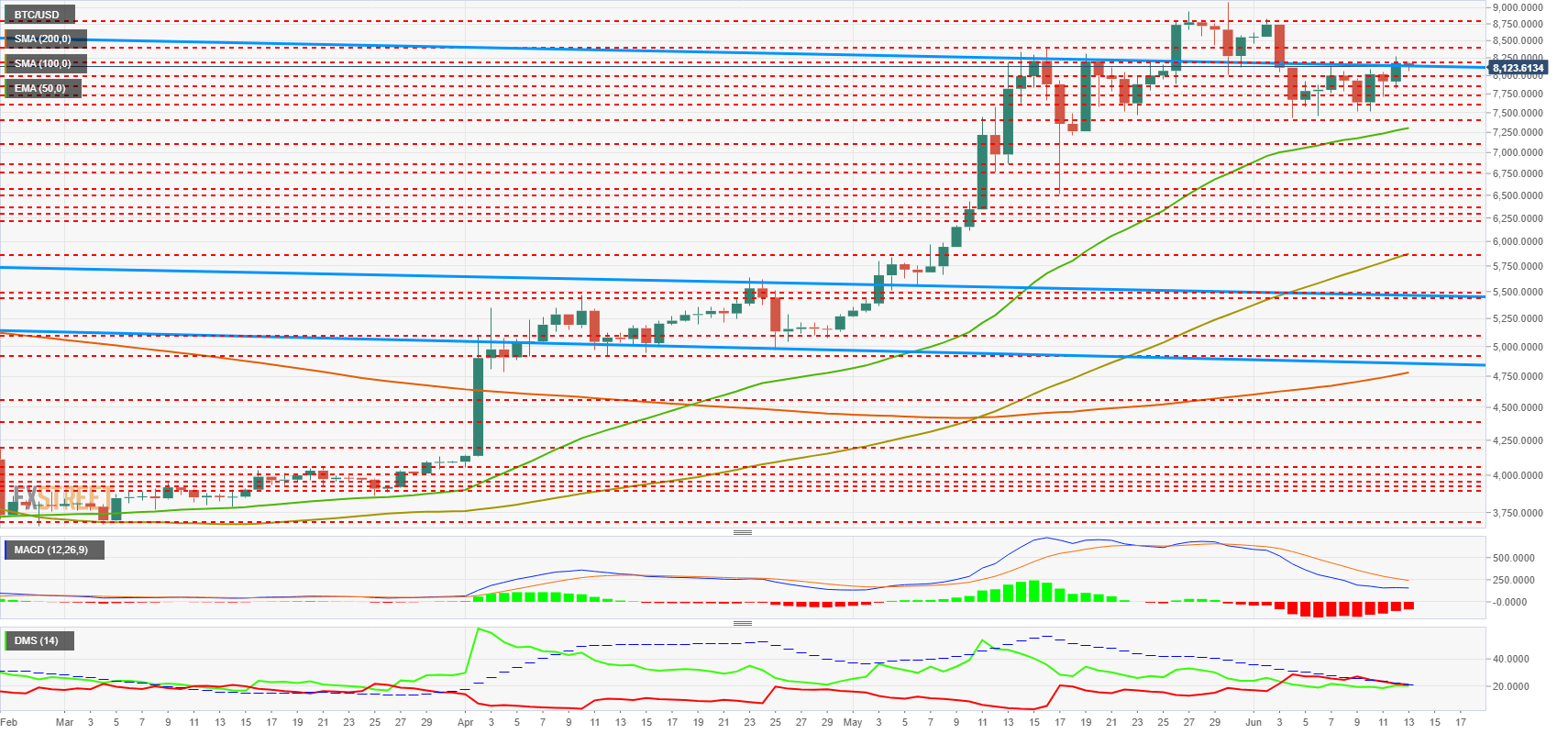

BTC/USD Daily Chart

BTC/USD is currently trading at $8,128 and remains just above the long term bearish channel. However, it is still too early to declare victory.

Above the current price, the first resistance level is at $8,200 (price congestion resistance), followed by $8,450 (price congestion resistance) and finally by $8,770 (price congestion resistance and relative maximum).

Below the current price, the first support level is $8,120 (long term down channel ceiling trend line), then the second support level is at $8,000 (price congestion support). The third level of support for awaits at $7,800 (price congestion support).

The MACD on the daily chart shows how the rally of the last few days has caused the bearish profile to decline. It is not common for the current structure to initiate a significant bullish movement.

The DMI on the daily chart shows a total tie between the two sides of the market. To increase the uncertainty of the moment, the ADX indicator moves at the same point as the D+ and D-.

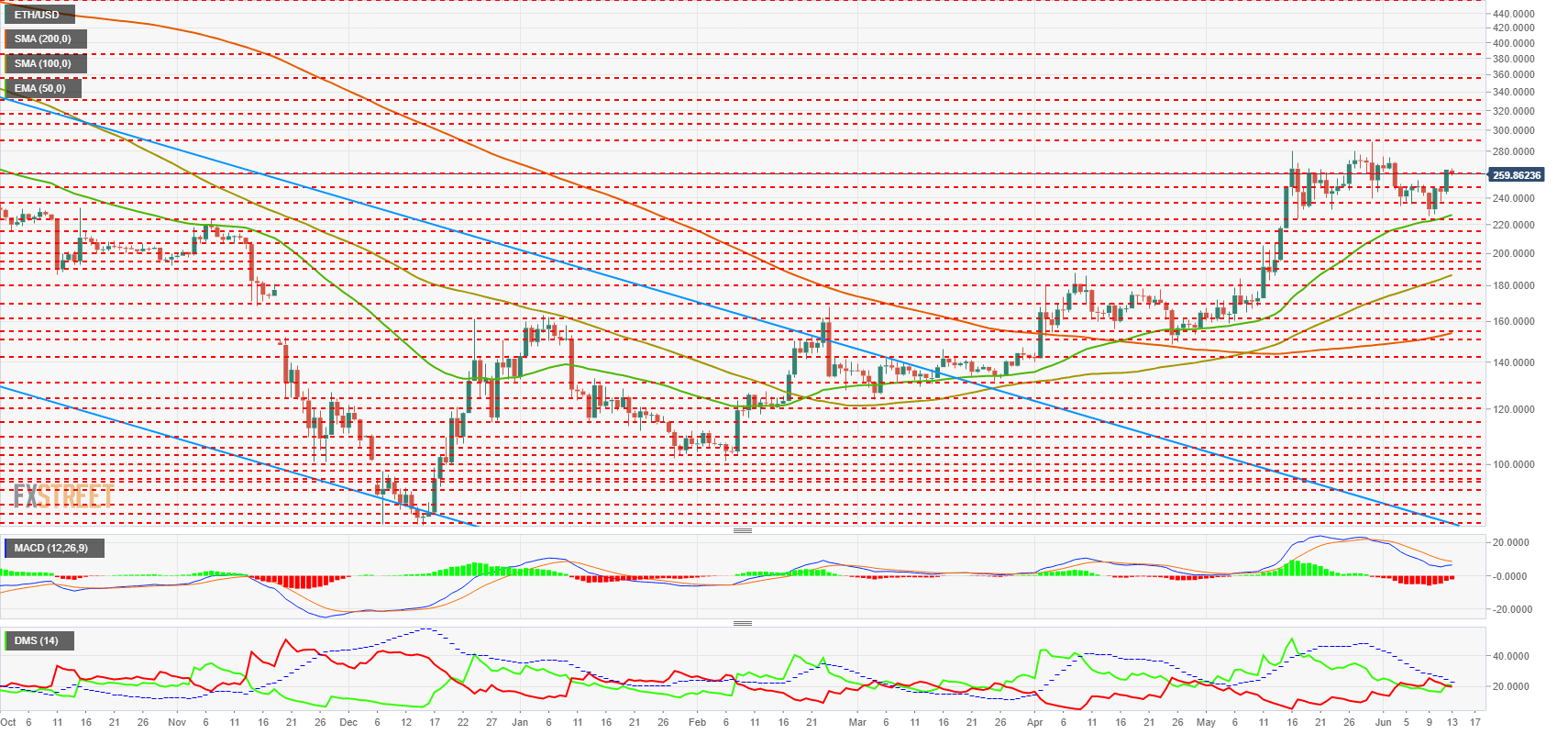

ETH/USD Daily Chart

Vitalik Buterin’s creation trades at $259.4. From this point, resistance is far away at $290, a big jump and one that will require significant inflows of funds.

Above the current price, the second resistance level is at $310 (price congestion resistance). The final line is $320 (price congestion resistance).

Below the current price, the first support level is at $245 (price congestion support), the second one is $238 (price congestion support). The third level of support for Ethereum is at $222 (price congestion support and EMA50).

The MACD on the daily chart shows a profile that invites us to think about a possible bullish cross. From a more conservative position, it is more likely to turn down again – before heading for new relative highs.

The DMI on the daily chart shows a very similar situation between both sides of the market, although bulls have a small advantage. Both sides of the mark are below the ADX line, which will provide an extra signal as soon as one of them achieves the bullish break.

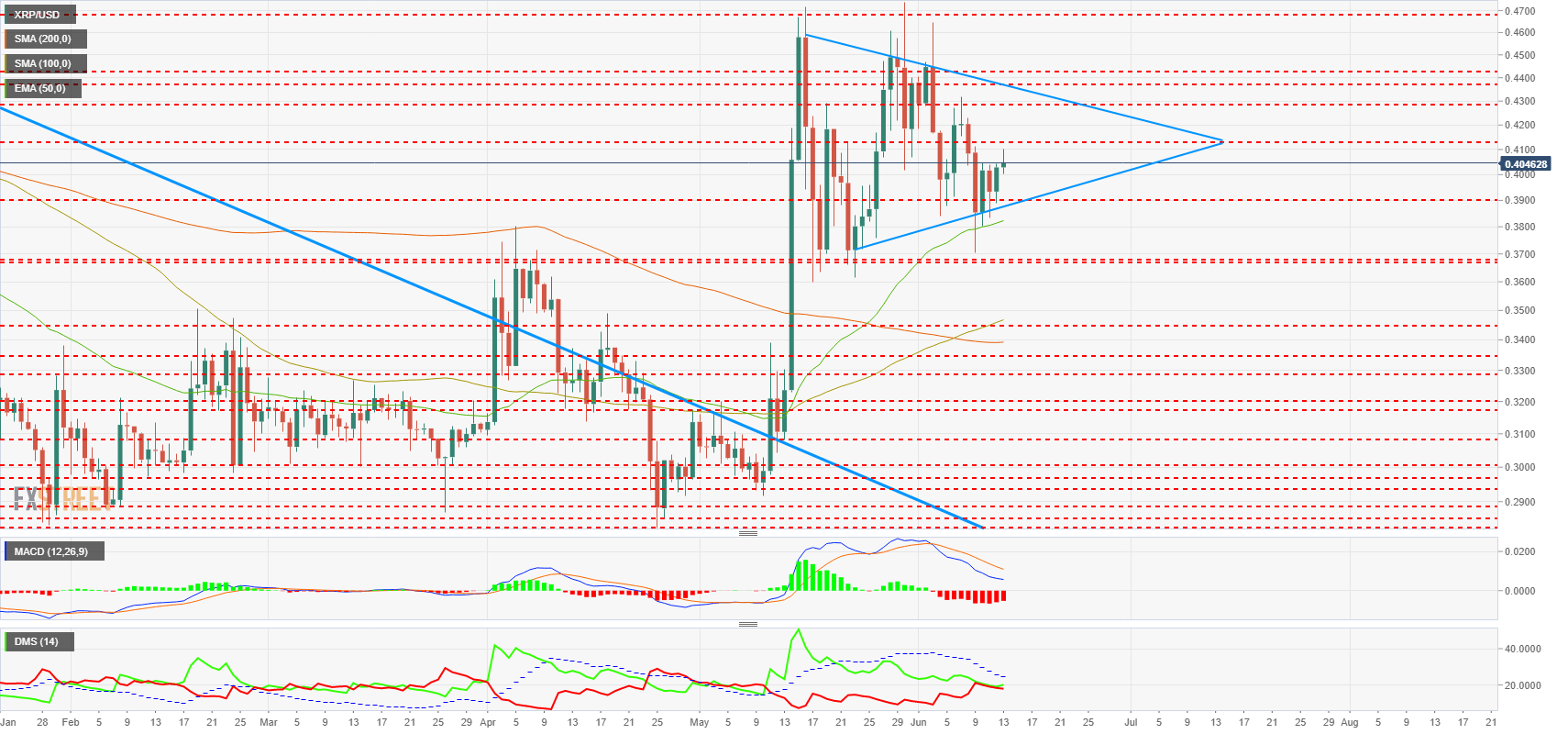

XRP/USD Daily Chart

XRP/USD is currently trading at the $0.4040 price level and continues within the flag structure.

Above the current price, the first resistance level is $0.413 (price congestion resistance), followed by $0.43 (price congestion resistance) and finally by $0.438 (price congestion resistance) – and that would mean the break up of the flag figure.

Below the current price, the first support level is $0.39 (price congestion support) and the second one is $0.382 (EMA50). The third support level for the XRP/USD pair is $0.368 (double price congestion support).

The MACD on the daily chart shows a bearish structure – both for inclination and for the opening between lines. It is surprising that with this setup, XRP/USD is not ceding any ground.

The DMI on the daily chart shows how after Wednesday’s tie between bulls and bears, the bullish side gets a small advantage over the bears today. The ADX continues to decline, typical of flag-like structures that compress the price.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Johann Kerbrat, Robinhood Crypto GM: “US regulation to be late compared to EU and Asia”

Johann Kerbrat is the Crypto General Manager at Robinhood, the trading app used by many US retail investors during the 2020 meme stock mania. FXStreet interviewed him at the European Blockchain Convention held in Barcelona, where he explained the plans for the company’s worldwide expansion.

1INCH price faces downturn after rejection at key resistance, negative on-chain metrics

1inch (1INCH) extends losses on Monday after being rejected from its key resistance level on Saturday. On-chain data further support the bearish outlook, as 1INCH’s Exchange Flow Balance is positive, and dormant wallets are in motion, suggesting a decline in the upcoming days.

Top dog-theme meme coins WIF, BONK, FLOKI: Double-digit gains on the horizon

The prices of top trending dog-theme-based meme coins, Dogwifhat, Bonk and FLOKI, hold gains on Monday after prices increased more than 20% last week. The technical outlook suggests that the bulls still have steam to push these three meme coins for extra double-digit gains.

Binance users earn Dogecoin and Bellscoin rewards through mining Litecoin

Binance Pool users can earn rewards in Bellscoin and Dogecoin, in addition to Litecoin rewards through merge mining. In Merge mining, miners contribute their computational resources to multiple blockchain networks simultaneously, this increases the earned rewards and benefits for users.

Bitcoin Weekly Forecast: $70,000 mark on sight as bulls remain strong

Bitcoin has risen around 3% so far this week, breaking above its range upper limit of $64,700. This gain was supported by increased institutional demand for ETFs, which recorded inflows of more than $612 million this week.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.

-636960156410892787.png)