- Bitcoin may attempt to hit new highs cannot be ruled out before a consolidation.

- ETH/BTC positions show a growing possibility for an upward rebound.

- XRP/USD Stays bullish and consolidates its technical levels.

Not since late 2017 have actors in the crypto market felt so great. The spectacular climb of digital coins was led by the remarkable rise of King Bitcoin.

The top representative of this disruptive technology enjoyed a considerable rise from $5,800 on Friday afternoon to touch $7,500 on Sunday. The coin is back to its natural, authentic behavior.

The primary victim of the movement has been Ethereum, which despite exceeding $200 in the euphoric peak, was unable to keep up with Bitcoin.

What does that mean?

The data has two different readings.

First, as I have said on several occasions, the crypto market has not experienced any bull market in which Altcoins, and Ethereum in particular, have not behaved better than Bitcoin.

So, if this pattern continues, the current rises are not yet attributable to the beginning of a bull market, only to repositioning for the start of one.

If the pattern is not repeated this time, those with high exposure to Altcoins may find themselves in a complicated situation. Even as they will see the value of their positions rise, the respective value in Bitcoin will decrease in parallel.

ETH/BTC Daily Chart

The ETH/BTC pair is trading at levels similar to those it was trading at the end of last week. Early on Saturday, ETH lost substantial value against BTC and hit a low at 0.0255.

Now, the ETH/BTC crypto cross is trading at the price level of 0.0267. Above the current price, the first resistance level is at 0.0275 (price congestion resistance), then the second resistance level is at 0.0292 (price congestion resistance). The third resistance level is at 0.0301 (price congestion resistance).

Below the current price, the first support level is at 0.026 (price congestion support), then the second support level is at 0.0246 (price congestion support and December lows). The third support level is at 0.024 (price congestion support).

The MACD on the four-hour chart shows crossed lines rising but with little inclination to grow and a tiny opening between them. In general, the structure has diverged from the relative lows. According to this structure, bearish shocks are likely to continue, but in the short term, Ethereum can do better than Bitcoin.

The DMI on the four-hour chart shows bears dominating the pair but decreasing in strength in recent hours. The bulls are also retreating and are about to break down the ADX line, which would lengthen the bearish moment.

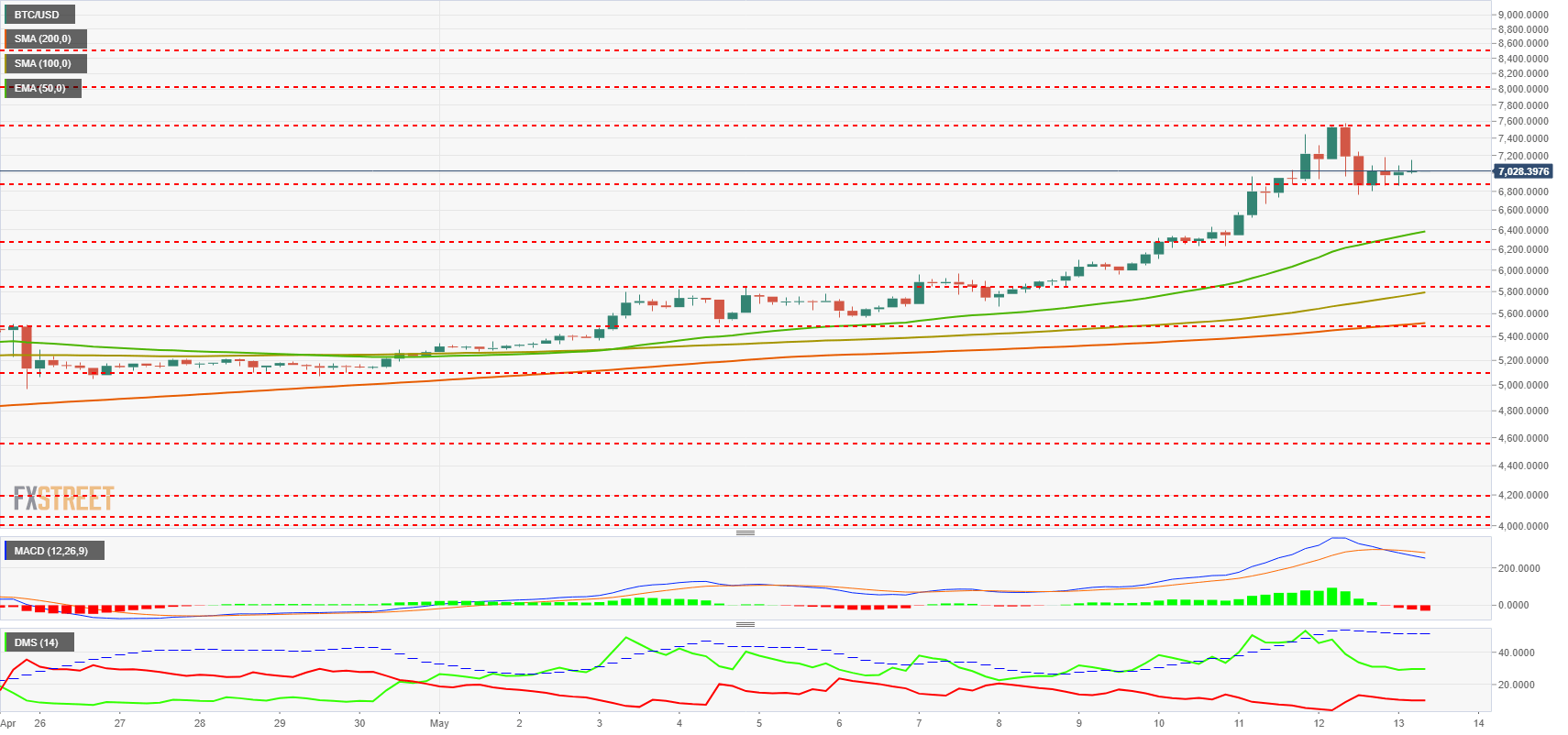

BTC/USD Daily Chart

The BTC/USD pair is currently trading at the $7.028 price level, after leaving a relative high of $7.500. After the substantial gains of these hours, it is expected that the BTC will consolidate its gains against the Dollar.

Below the current price, the first support level is $6,375 (EMA50 and price congestion support), then the second support level is at $5,800 (SMA100 and price congestion support). The third level of support for BTC/USD is at $5,500 (SMA20 and price congestion support).

Above the current price, the first resistance level is at the weekend highs of $7,550 (price congestion resistance), then the second resistance level is at $8,000 (price congestion resistance). The third resistance level is at $8,500 (price congestion resistance).

As we can see, technical supports appear stronger than resistances.

The MACD on the 4-hour chart shows the cross lines down after the extreme levels reached. The cross does not have an excessive bearish slope, so it is possible that some attempt to reach new relative highs can still be seen.

The DMI on the 4-hour chart shows bulls dominating but showing exhaustion from the $7,000 bullish breakout. The bears increase their positions from a similar price level. The pattern indicates high possibilities of a new optimistic attempt, but that would have little development in time.

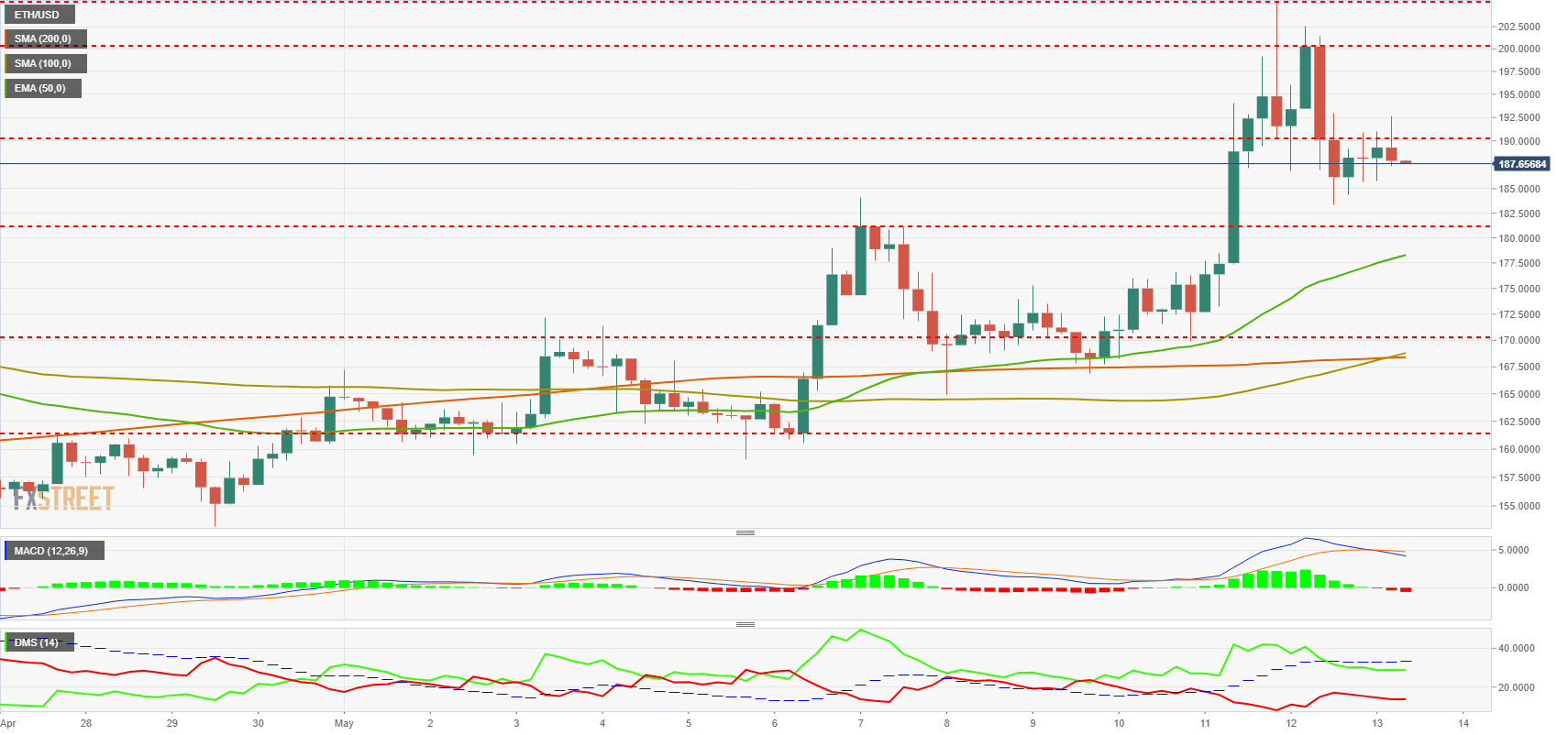

ETH/USD Daily Chart

The ETH/USD is currently trading at the $187 price level, after hitting a relative high of $205.

Below the current price, the first support level is at $181 (price congestion support and EMA50), then the second support level is at $170 (price congestion support, SMA200, and SMA100). The third level of support for the ETH/USD pair is at $161 (price congestion support).

Above the current price, the first resistance level is at $190 (price congestion resistance), then the second resistance level is at $200 (price congestion resistance). The third resistance level for the ETH/USD pair is at $205 (relative maximum).

The MACD on the 4-hour chart shows a bearish cross initiated today during the Asian session. The lines have little downward inclination, and the price may still try new highs within a short term downturn environment.

The DMI on the 4-hour chart shows bulls with many advantages over bears, although after reaching the $200 level they began to show weakness. The bears, on the other hand, have increased their strength from the same price levels, but have relaxed in recent hours.

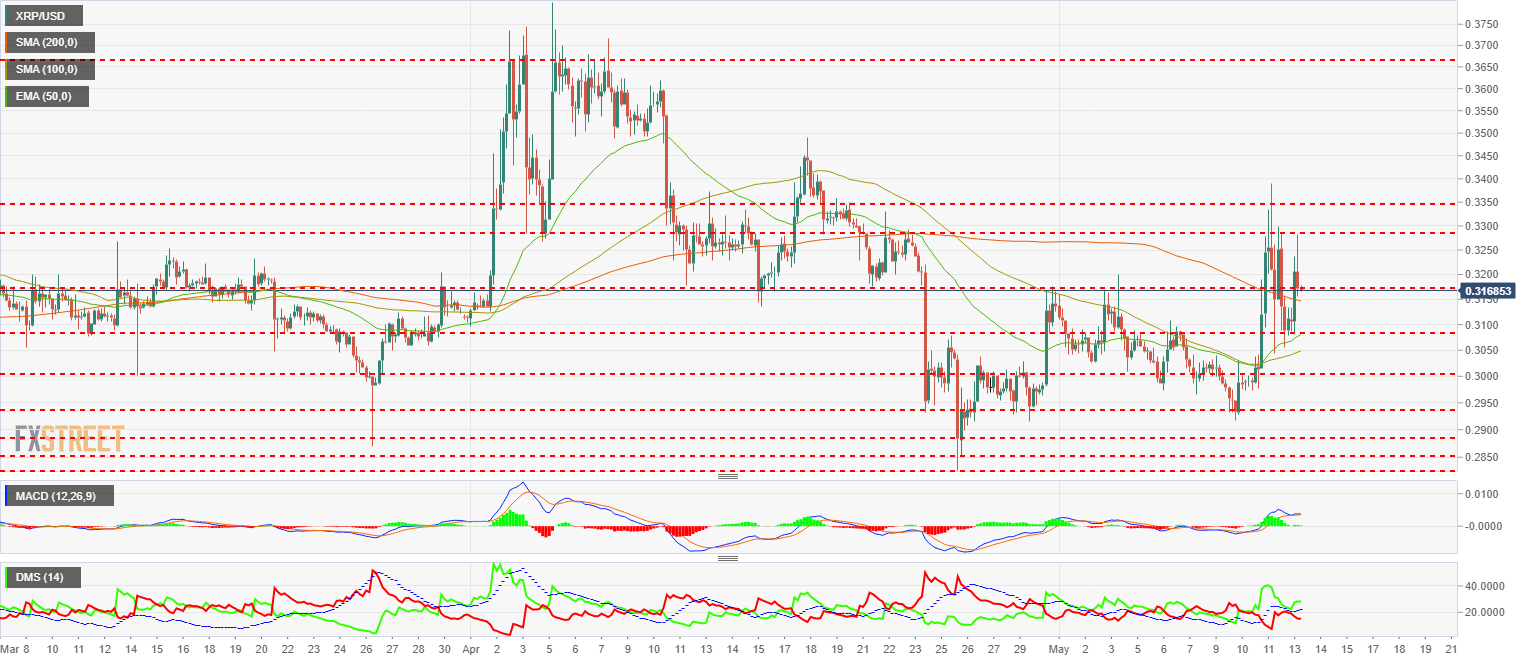

XRP/USD Daily Chart

XRP/USD is currently trading at $0.316, breaking all moving averages in the last 48 hours, something that hasn't happened since April.

Below the current price, the first level of support is $0.315 (price congestion support and SMA200). The second support level is $0.308 (price congestion support, EMA50, and SMA100). The third level of support for the XRP/USD pair is $0.30 (price congestion support).

Above the current price, the first resistance level is $0.325 (price congestion resistance), then the second resistance level is $0.328 (price congestion resistance). The third resistance level is at $0.335 (price congestion resistance).

The MACD on the four-hour chart shows a bearish cross structure but has not yet occurred. If it coincides in time with the last attempt at a Bitcoin rally, the result can be potent.

The DMI on the four-hour chart shows bulls dominating the market but without an undue advantage. It is positive that bulls stay above the ADX line, which favors bullish continuity. Bears bounce from lows but cannot get above the 20 levels of the indicator.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ripple update: XRP shows resilience in recent crypto market sell-off

Ripple's XRP is up 6% on Tuesday following a series of on-chain metrics, which reveals investors in the remittance-based token held onto their assets despite the wider crypto market sell-off last week.

Floki DAO floats liquidity provisioning for a Floki ETP in Europe

Floki DAO — the organization that manages the memecoin Floki — has proposed allocating a portion of its treasury to an asset manager in a bid to launch an exchange-traded product (ETP) in Europe, allowing institutional investors to gain exposure to the memecoin.

Six Bitcoin mutual funds to debut in Israel next week: Report

Six mutual funds tracking the price of bitcoin (BTC) will debut in Israel next week after the Israel Securities Authority (ISA) granted permission for the products, Calcalist reported on Wednesday.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

-636933345191841575.png)