- Cryptocurrencies are recovering after a lost weekend that saw new lows.

- Ohio's approval of Bitcoin for some taxes is a central driver of the recovery.

- The charts still show the trend is down with digital coins out of oversold territory.

The "lost week" saw a Bitcoin hitting $3,456, Ethereum dip below $100, and Ripple not looking resilient. The downfall was an extension of the November 14th sell-off that sent BTC/USD below $6,000, and the November 19th plunge that sent it below $5,000. The Black Friday weekend was quite dark for cryptos.

However, all digital currencies are enjoying a recovery. Ohio will accept Bitcoin as a payment for no less than 23 types of business taxes from today, November 26th, also known as Cyber Monday. Ohio is the first US states to do so and one of the first local governments in the world to move forward.

Critics of cryptos state that the inability to pay taxes, enforceable by governments, undermines their prices. The step by the Mid-Western state is a significant step forward. Ohio's Treasury explains the choice of the granddaddy of cryptocurrencies:

Cryptocurrencies cannot be transferred to third parties without user initiation, thereby practically eliminating fraud; Anyone can view all transactions on the blockchain network; Payments on the blockchain can be tracked on a second-by-second basis; a minimal fee is charged to confirm transactions on the blockchain network

However, looking at the technical charts, the picture remains quite gloomy and perhaps provides an opportunity to take profits, go short, or just sell before prices plunge to lower levels.

BTC/USD Technical Analysis - just another dead cat bounce?

Examing the Relative Strength Index (RSI) on the four-hour chart, we see the that bounced above 30. The drop below that level indicated oversold conditions, from where the bounce came. Yet after this bounce, the current level of around 37 indicates BTC/USD could resume its falls. Momentum remains to the downside, despite the recovery.

Support awaits at $3,647 which was a stepping stone to the recovery. The fresh 14-month low at $3,456 is critical. A loss the weekend trough opens the door to $3,000.

Looking up, $4,000 is a significant psychological level but real resistance is at $4,124 which capped the digital coin in its recovery attempt. The pre-crash peak of $4,595 is next.

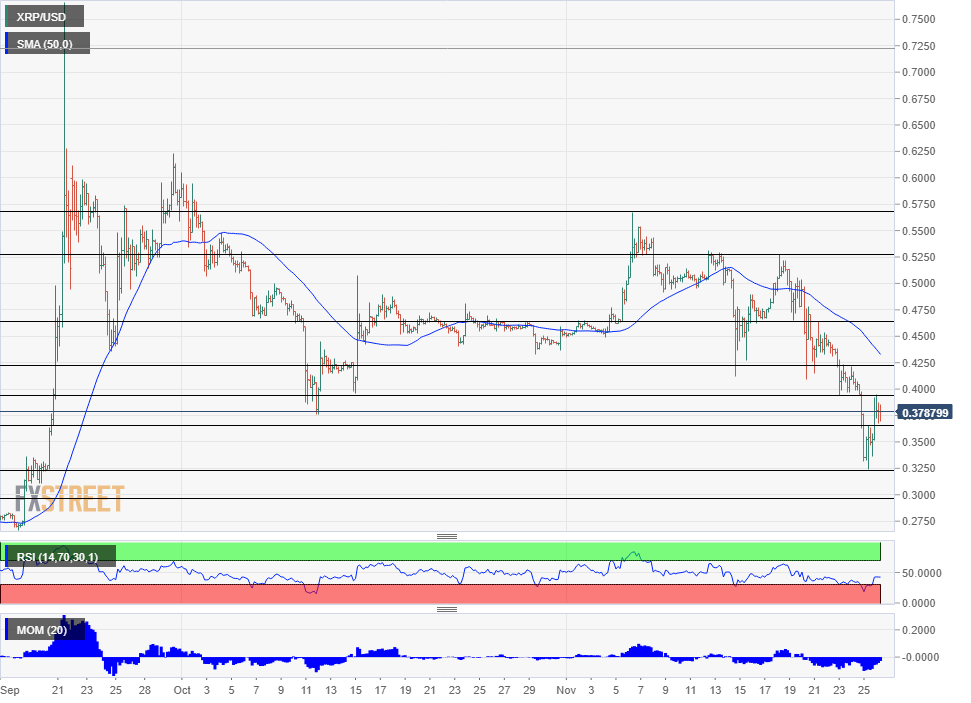

XRP/USD Technical Analysis - Looking better, but not by much

The current crypto-crisis sent Ripple to second place, this time leaving Ethereum far behind. During most of the time, the digital coin used for transactions stood out in its resilience, but not for too long. It also suffered and fell. The technical picture looks better than Bitcoin's and it is only at a two-month low. However, it does not stand out.

Also here, the RSI is out of oversold conditions and stands at around 43 at the time of writing, somewhat better than Bitcoin. Yet also with Ripple, Momentum remains to the downside.

Ripple has a bit more hope if it surges back above 43, topping the 50 Simple Moving average (SMA). However, it first needs to overcome $0.3944 which served as support before the fall and then turned into resistance. Further above, the former support line of $0.4240 awaits. Above $0.43, we note $0.4660 as another line of resistance after preventing a recovery attempt last week.

Looking down, $0.3650 is immediate support, followed by the cycle low of $0.3250. Below $0.30, we see $0.2690.

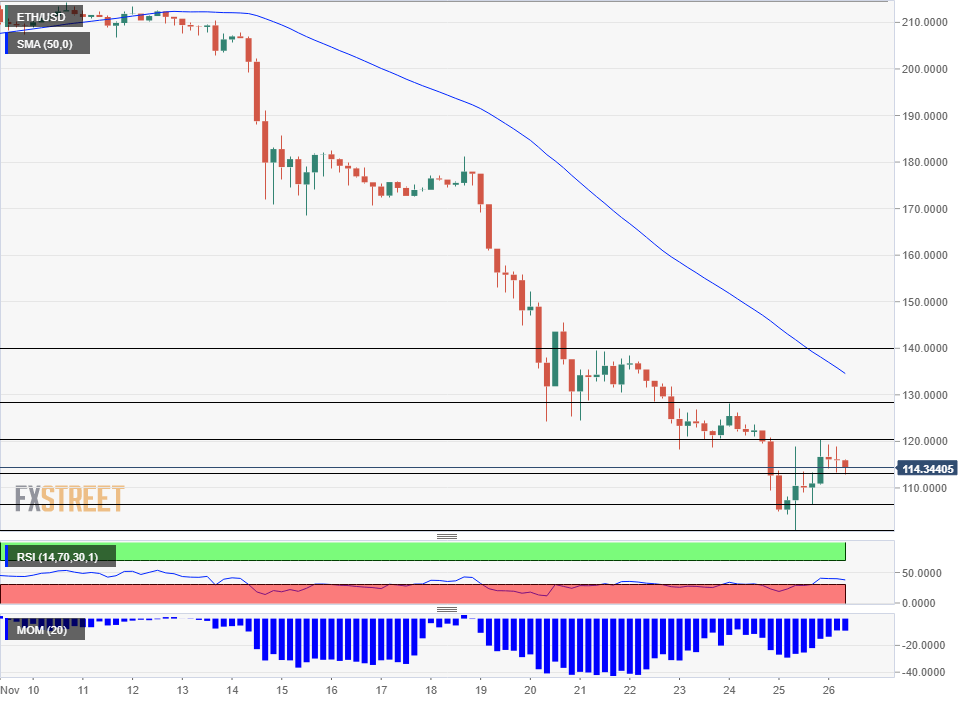

ETH/USD Technical Analysis

Ethereum, used in so many Initial Coin Offerings (ICO's) is on the back foot. Also here, there are some signs of life, but it is probably the weakest of them all. The Relative Strength Index is at 38 and Momentum is still significantly to the downside.

$113 is the first level on the downside after supporting ETH/USD in recent hours. Further down, $106.50 was a swing low and is a weak line of support. $100.97 was the trough over the weekend.

Looking up, the round number of $120 capped Ethereum earlier in the day and is immediate resistance. $128.25 served as resistance on Saturday, after the leg down earlier. $140 was the top level on Friday.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

-636788228798780452.png)