- Cryptocurrencies have been enjoying a weekend rally with Bitcoin rising to yearly highs.

- Critical caps have been broken, unleashing the upside, and Facebook's reported launch of Libra and Testnet may be partially behind the move.

- Here are the next levels to watch according to the Confluence Detector.

Cryptocurrencies have been active over the weekend – and not for the first time. And this time, price action in digital coins has sent Bitcoin – the king – to above $9,200 and the highest in a year. Cryptos have already been on the move on Thursday and on Friday, making their ways to higher ground. However, the more substantial moves have come deep in the weekend – regardless of timezones.

Fresh reports about Facebook's launch have added fuel to the fire. The social media behemoth will reportedly unveil the "Libra Association" as early as Tuesday, June 18th. Mark Zuckerberg's company will run the entity from Geneva, Switzerland – a world-renowned financial hub. Facebook will announce its dedicated Libra Blockchain which will be back by the Libra Reserve – used to store assets – and grant low inflation, global acceptance, and fungibility – similar to central banks.

The entrance of one of the world's largest companies – which has over two billion users – into the world of cryptocurrencies – helps legitimize the industry. Nevertheless, it is important to note that news of FB's crypto launch have been floating around for some time – and the recent rally may be based on some Fear Of Missing Out (FOMO).

Some deny it is only FOMO and that Bitcoin will go as high as $400,00 based on real use.

Before we aim for another solar system, let us examine the current technical alignment. We can observe that cryptocurrencies have broken above considerable resistance lines which now turn into support – now turning into launching pads for the next bullish moves.

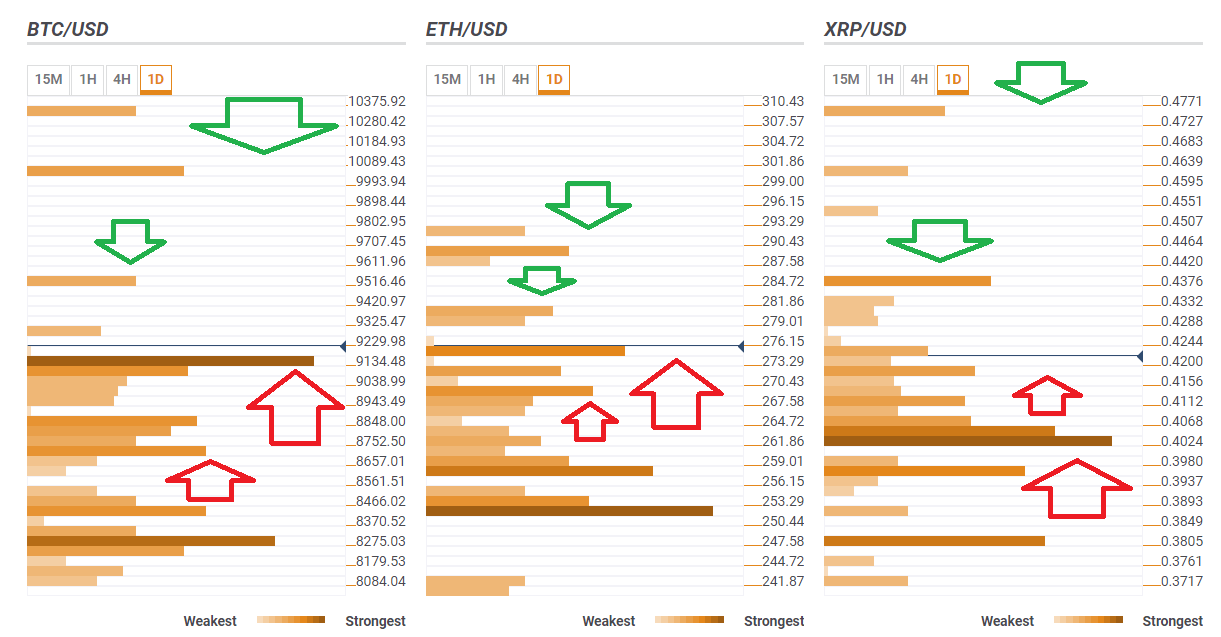

This is what the Crypto Confluence Detector shows in its latest update:

BTC/USD sits above strong support and eyes $10,050

Bitcoin has overcome a dense cluster of resistance lines that capped it at $9,134. This resistance-turned-support consists of the previous monthly high, the Pivot Point one-week Resistance 1, the previous 1h-high, the Bollinger Band one-day Upper, the BB 1h-Upper, the Simple Moving Average 5-15m, and the Pivot Point one-day Resistance 2.

The first noteworthy target is $9,516 which is the Pivot Point one-week Resistance 2.

The next upside target is also a lone level – $10,050 which is where the Pivot Point one-month Resistance 1 hits the price.

BTC/USD has further support at $8,840 which is the convergence of the previous 4h-low, the BB 1h-Middle, the SMA 5-4h, and the Fibonacci 23.6% one-day.

The next cushion is at $8,700 where the Pivot Point one-day Support 1 and the previous weekly high converge.

ETH/USD aims for $289

Ethereum has also broken above significant resistance at $274 which is the confluence of the previous daily high, the previous 4h-high, the PP 1d-R1, and the BB 1h-Upper.

It has some resistance at $280 which is the meeting point of the BB 1d-Upper and the PP 1d-R2.

ETH/USD eyes $289 as the next target. This is the convergence of the PP 1d-R3 and the previous monthly high.

Looking down, Vitalik Buterin's brainchild enjoys further support at $269 which is the convergence of the BB 1h-Middle, the SMA 5-4h, and the Fibonacci 38.2% one-day.

XRP/USD eyes $0.4750

Ripple has been in a different situation, already overcoming fierce resistance at $0.4040 earlier. XRP/USD has is eyeing $0.4376 as an initial target. The line is the convergence of the PP 1w-R2 and the Fibonacci 161.8% one-week.

Further up, it targets $0.4750 which is last month's high.

Initial support awaits at $0.4180 which is a juncture of lines including the PP 1d-R1, the BB 1d-Middle, the BB 4h-Middle, the BB 4h-Upper, the BB 15min-Middle, and the SMA 5-1h.

And as mentioned earlier, robust support awaits at $0.40 where we see the BB 1h-Lower, the SMA 2001-h, the SMA 50-4h, the SMA 100-1h, the SMA5-1d, and the previous daily low converge.

See all the cryptocurrency technical levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP eyes recovery but derivatives market stalls progress

Ripple's XRP is up 2% in the early Asian session on Thursday following rising accumulation among investors and a potential bottom signal in the MVRV Ratio.

Ethereum could see a boost as Cboe files for 21Shares to begin staking within its ETH ETF

Ethereum (ETH) could be set for increased demand in the coming months following Cboe BZX 19b-4 filing with the Securities & Exchange Commission (SEC) to enable staking for the 21Shares Core Ethereum exchange-traded fund (ETF).

Bitcoin and crypto recovers from CPI data as Trump pushes Russia–Ukraine diplomacy

Bitcoin (BTC) and the crypto market saw slight gains on Wednesday after President Donald Trump's resolution calls with Russian President Vladimir Putin and Ukraine's President Volodymyr Zelenskyy.

Ethereum Price Forecast: ETH eyes $3,000 as Trump and Putin agrees to begin negotiations on ending Ukraine war

Ethereum (ETH) saw a 3% gain on Wednesday following United States (US) President Donald Trump's agreement with Russian President Vladimir Putin to begin negotiations to end the Russian-Ukraine war.

Bitcoin: BTC shows weakness, bears aiming for $90,000 mark

Bitcoin price hovers around $97,000 on Friday after losing nearly 5% in the last three days. CryptoQuant weekly report shows that activity on the Bitcoin network has declined to its lowest level in a year.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.