- ETH/BTC shows a considerable robust bullish configuration.

- BTC/USD looks resilient and refuses falls.

- XRP/USD remains lethargic awaiting a catalyst.

Good morning from old Europe where we are suffering an ultra-warm summer day. Fatigue takes hold of the body in the same way that the doubts are shot to waves before the days of relative passivity in the price of Bitcoin.

The great headlines of the past that persist in the collective mind speak of double-digit increases on a daily basis, and before much less radical gains seem to somewhat fail.

But nothing fails – the Crypto market has not reached the maximums of 2017 with a trajectory of a space rocket. Then – and now – we are witnessing a gradual climb over many months and a vertical climb only in the terminal phase.

The current bullish process has many months ahead of it, and the phases will be consumed at the precise moment until it is completed with another terminally euphoric step accompanied by headlines in the broad media.

My number one scenario is that we will Altcoins outperforming Bitcoin in the coming weeks, while the King continues with its current consolidation.

In my opinion, the ETH/BTC graph supports this scenario. After many months developing a bearish structure, the chart now invites optimism regarding Ethereum and with it the vast majority of Altcoins.

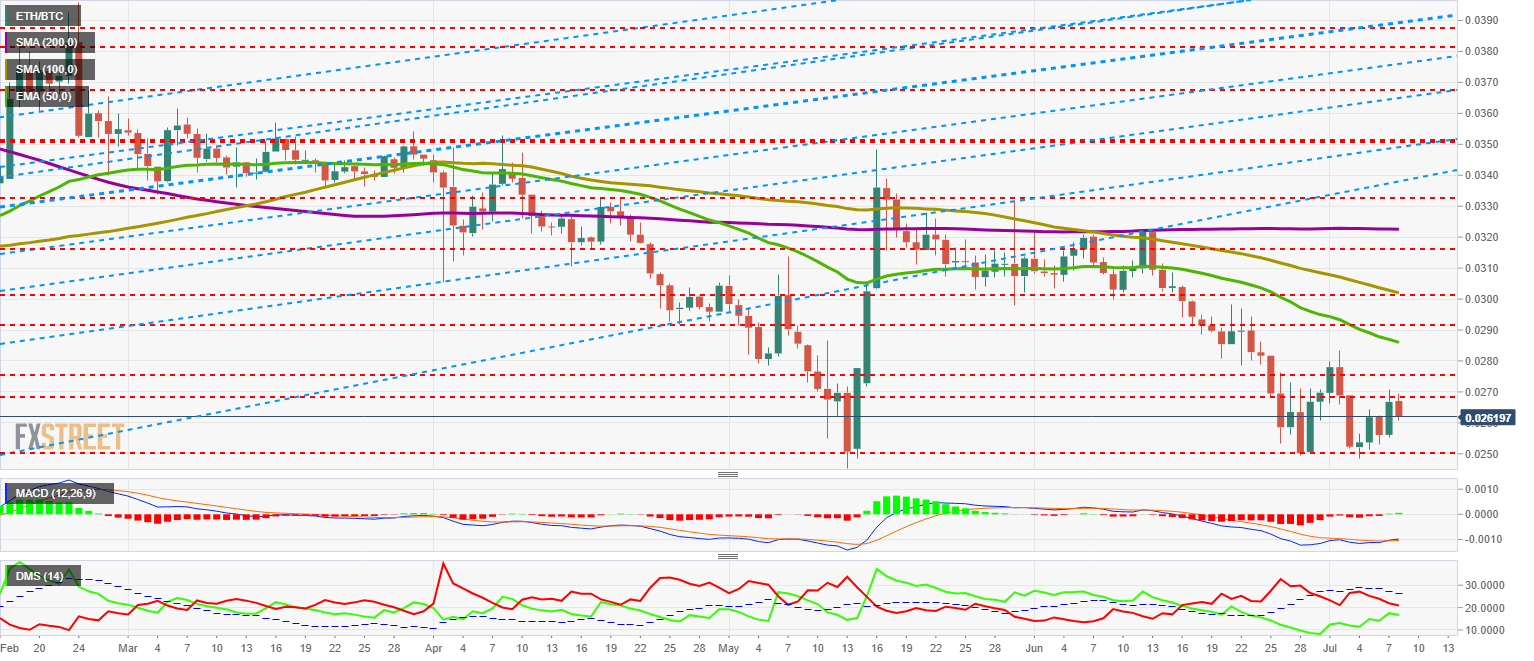

ETH/BTC Daily Chart

The ETH/BTC cross is currently trading at 0.0261 and is trying to beat the price congestion resistance of 0.02685. The target to reach is above 0.032, but for that, it must overcome resistance at 0.0275 (price congestion resistance) first, then the second at 0.029 (EMA50 and price congestion resistance) and the third one at 0.030 (SMA100 and price congestion resistance).

If the bullish attempt fails, the first support level is at 0.025 (price congestion support), then the second awaits at 0.023 (price congestion support) and the third one is at 0.020 (price congestion support).

The MACD on the daily chart brings exciting news. The indicator crossed yesterday's bullish trend and showed that the development is going to be optimistic in the background. How fast will it move up? That depends on the structure it builds in the next few days.

The DMI on the daily chart is less bullish. It shows bulls increasing activity during double bottom formation, but bears do not give up. The moment of encounter between these two sides of the market can be the clash of the year.

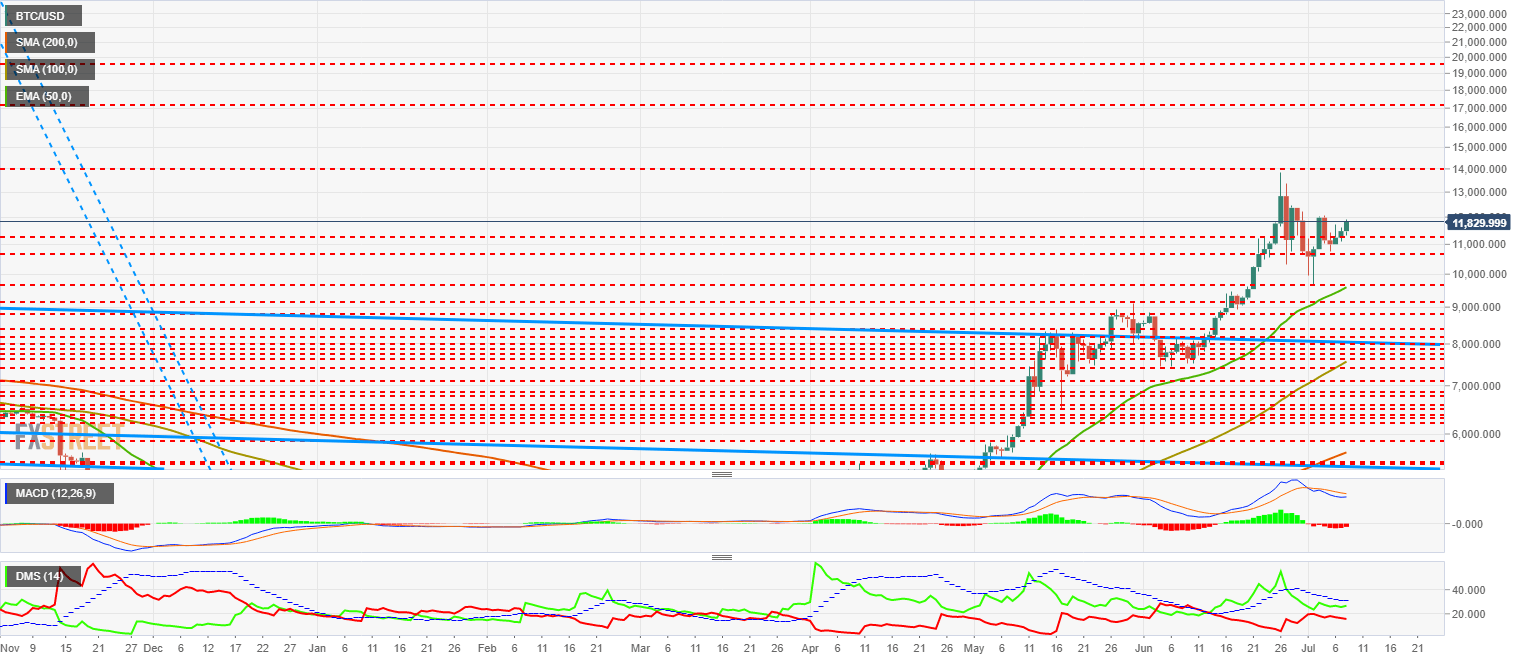

BTC/USD Daily Chart

BTC/USD is trading at $11,825 and remains in the same range as it ended last week. The granddaddy of cryptos is developing a second wave of consolidation – and it is likely to visit at least the $9,600 EMA50 level when it forms the third wave.

Above the current price, Bitcoin has three key resistances at $14,000, $17,000 and $19,690, the three price congestion resistances adding the honor of being the historical maximum to the third.

Looking down, the structure is not that simple. The first level of support is at $11,250 (price congestion support), then the second at $10,700 (price congestion support) and the third one at $9,600 (EMA50 and price congestion support).

The MACD on the daily chart continues to cross down, and the most likely scenario is that of bearish continuity but without ruling out a new upward stretch dragged by a better-toned Ethereum.

The DMI on the daily chart shows bulls leading despite the consolidation phase. They do it while keeping themselves at high levels, while the bears are unable to overcome the 20 levels and it seems that they weaken in the last days.

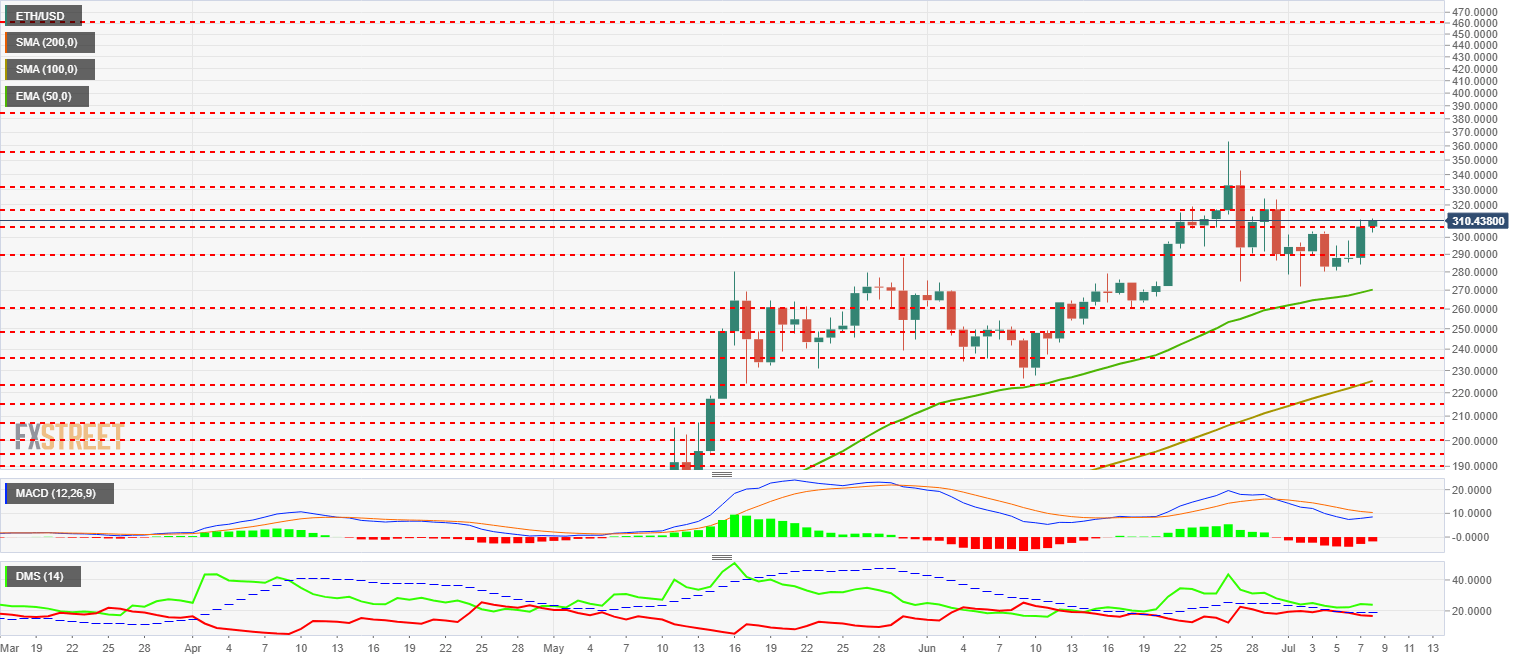

ETH/USD Daily Chart

The ETH/USD pair is showing a desire to move higher today. It is currently trading at the $310.4 price level after setting the day's high of $311.5.

Above the current price, the first resistance level is at $318 (price congestion resistance), then the second at $330 (price congestion resistance) and the third one at $355 (price congestion resistance).

Below the current price, the first level of support is at $305 (price congestion support), then the second at $290 (price congestion support) and the third one at $270 (EMA50).

The MACD on the daily chart shows a profile close to a new bullish cross but which should be confirmed by the end of the week.

The DMI on the daily chart shows us how the bulls regain strength after hesitating at the end of the previous week. The bears fail in their attempt to breach the ADX line and move lower.

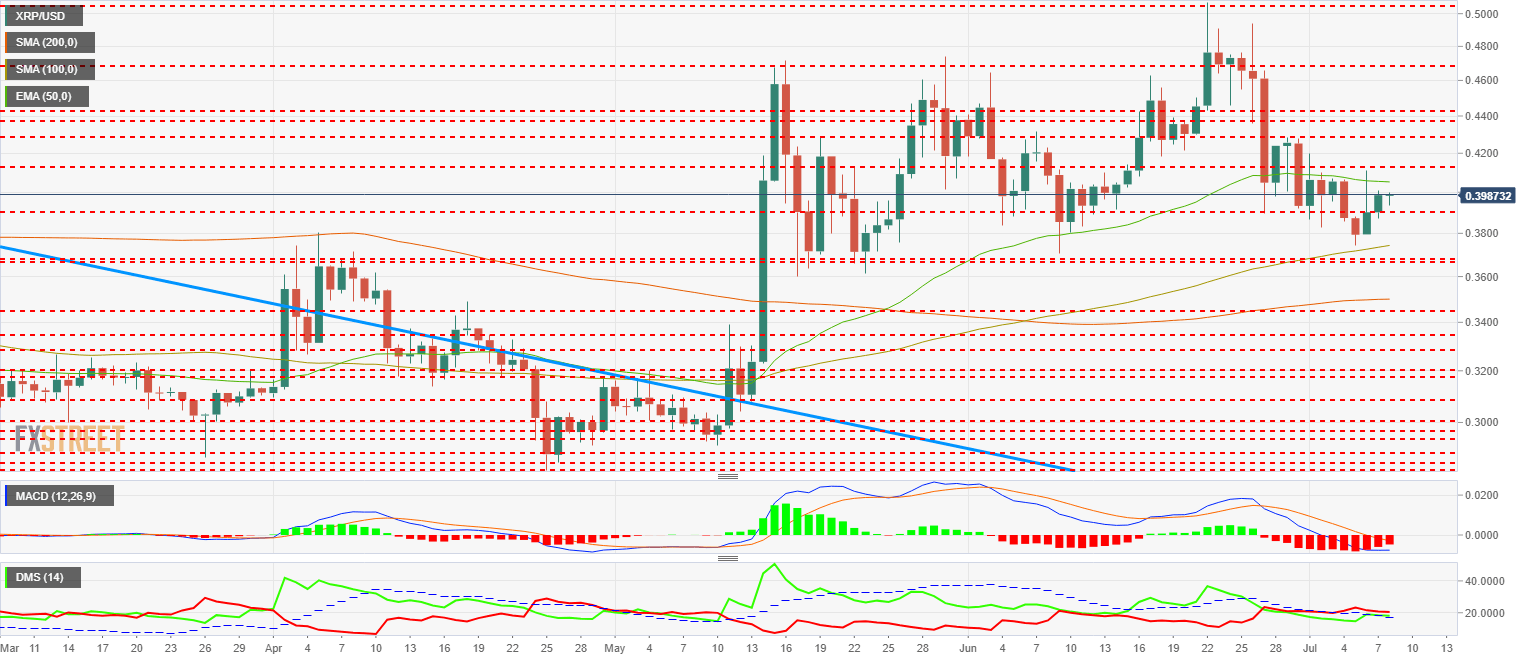

XRP/USD Daily Chart

XRP/USD remains in its bubble – an unexciting one. The cryptocurrency that has always been the instigator of the upsurge parties is now the guest who doesn't seem to want to have fun at the party.

Above the current price, the first resistance level is at $0.405 (EMA50), then the second at $0.412 (price congestion resistance) and the third one at $0.429 (price congestion resistance).

Below the current price, the first level of support is at $0.39 (price congestion support), then the second at $0.37 (SMA100 and double price congestion support) and the third one at $0.346 (SMA200 and price congestion support).

The MACD on the daily chart shows how the bearish force has decreased but is clearly moving on the negative side of the indicator. Weakness may persist for days.

The DMI on the daily chart shows bears leading but with minimal advantage over bears. The positive, as far as volatility is concerned, is that both sides of the market are above the ADX line, which would facilitate an unexpected move.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP sustains bullish momentum despite SEC's appeal against Ripple

XRP continued trading above the $3 mark on Thursday as investors stepped on the accumulation gear following rumors of Donald Trump considering its addition to a US digital asset reserve.

Upbit crypto exchange faces suspension in South Korea over alleged KYC violations

Cryptocurrencies aggregate market capitalization consolidated at $3.5 trillion on Thursday rising by $152 billion within the last 24 hours. Altcoin markets rose by 9%.

Binance bulls target $750 as Trump drives crypto trading volumes to a record high

BNB price crossed the $715 on Thursday as traders continued to take strategic speculative positions ahead of the US Presidential inauguration slated for January 20.

Ethereum Price Forecast: Staking could spark ETH rally in 2025 as PostFinance launch stirs bullish sentiment

Ethereum experienced a 3% decline on Thursday despite growing excitement over the launch of ETH staking services by PostFinance AG. Investors are optimistic that this development may lead to the approval of staking in Ethereum ETFs.

Bitcoin: BTC rallies above $102,000 ahead of Trump’s inauguration

Bitcoin’s (BTC) price continues to trade in the green, trading above $102,000 at the time of writing on Friday after rallying more than 7% this week. Recent US macroeconomic data released this week supported the rise of risky assets like BTC.

Trusted Broker Reviews for Smarter Trading

VERIFIED Discover in-depth reviews of reliable brokers. Compare features like spreads, leverage, and platforms. Find the perfect fit for your trading style, from CFDs to Forex pairs like EUR/USD and Gold.