- Cryptocurrencies continue consolidating as the next moves are awaited.

- All three have clear caps they must cross in order to move higher.

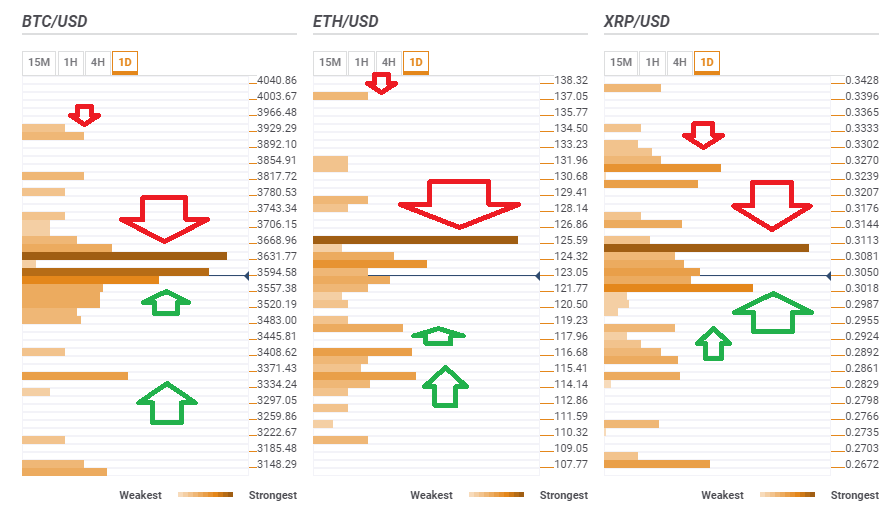

- Here are the levels to watch according to the Confluence Detector, our proprietary tool.

Not much has changed in the world of cryptocurrencies in the past 24 hours. Prices have been stable and no major breaking news came out. However, technical levels have realigned and things look clearer now.

Bitcoin, Ethereum, and Ripple all have clear barriers to climb over. Breaking above these levels may unleash a bullish run.

This is what the Crypto Confluence Detector shows.

BTC/USD must break above $3,631

Bitcoin faces fierce resistance at $3,631 which is the convergence of the Simple Moving average 5-1d, yesterday's high, the Pivot Point one-day Resistance 1, the Fibonacci 23.6% one-week, and the Bollinger Band 4h-Upper.

Breaking above that level may send it to around $3,910 where the Pivot Point one-month Resistance 1 awaits BTC/USD.

Looking down, there is some support around $3,557 which is yesterday's low, the PP 1d-S1, the BB 4h-Lower, the Fibonacci 23.6% one-day, the Fibonacci 38.2% one-week, and a few other lines.

The downside target is $3,350 where last week's low meets last month's low.

ETH/USD has to move above $125.59

Ethereum, which led the surge, is currently leading the fall. It must surpass $125.59 which is the confluence of the SMA 50-1d, the PP 1d-R1, the BB 1d-Upper, the BB 4h-Upper, and the Fibonacci 38.2% one-month.

The upside potential is $137.05 where we see the PP one-week R2.

Support is at $118.50 where we note the juncture of the Fibonacci 23.6% one-week and yesterday's low.

Further down, ETH/USD is supported at $116.68 is where the Fibonacci 23.6% one-month and the BB 4h-Lower converge.

XRP/USD rise is dependent on breaking $0.3113

Ripple has its hard cap at $0.3113 which is the confluence of the BB 4h-Upper, the previous day's high, the Fibonacci 38.2% one-week, the Fibonacci 23.6% one-month, and more.

The upside here is somewhat more limited: At $0.3250, XRP/USD faces the convergence of the Fibonacci 38.2% one-month and the BB 1d-Upper.

Support for XRP/USD awaits at $0.3018 which is a dense cluster including the Fibonacci 61.8% one-week, the SMA 200-1h, the SMA 50-4h, the BB 1h-Lower, and the Fibonacci 61.8% one-day.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Lukas Enzersdorfer-Konrad, Bitpanda deputy CEO: “Crypto needs Gary Gensler gone”

Lukas Enzersdorfer-Konrad is the deputy CEO at Bitpanda, a broker based in Europe with more than five million users. At the European Blockchain Convention held in Barcelona, the executive shared with FXStreet his views on the current state of the crypto industry and its regulation.

Bitcoin still consolidates despite positive spot ETFs demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

Why is ONDO’s price outlook bullish?

DefiLlama data shows that Ondo TVL reached a new ATH of $613.75 million. Ondo’s Supply Distribution metric shows whale accumulation. On-chain data shows that ONDO’s daily trading volume is rising, and the supply of exchanges is decreasing.

Maker price eyes a rally on technicals and on-chain metrics

Maker trades above $1,500 on Thursday, suggesting a potential rally as technical indicators show bullish divergence. This positive outlook is reinforced by MKR’s Exchange Flow Balance, which shows a negative spike, indicating growing investor confidence in the platform.

Bitcoin: Fed-led rally could have legs towards $65,000

Bitcoin is poised for a second consecutive week of gains, supported by the recent 50-basis-point cut in interest rates by the Federal Reserve. Bitcoin broke above several key technical resistances this week, signaling a rally continuation.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.