- Major cryptocurrencies suffered heavy losses on Saturday, Bitcoin dropped below $10,000.

- IRS has reportedly started sending out letters to more than 10,000 crypto investors.

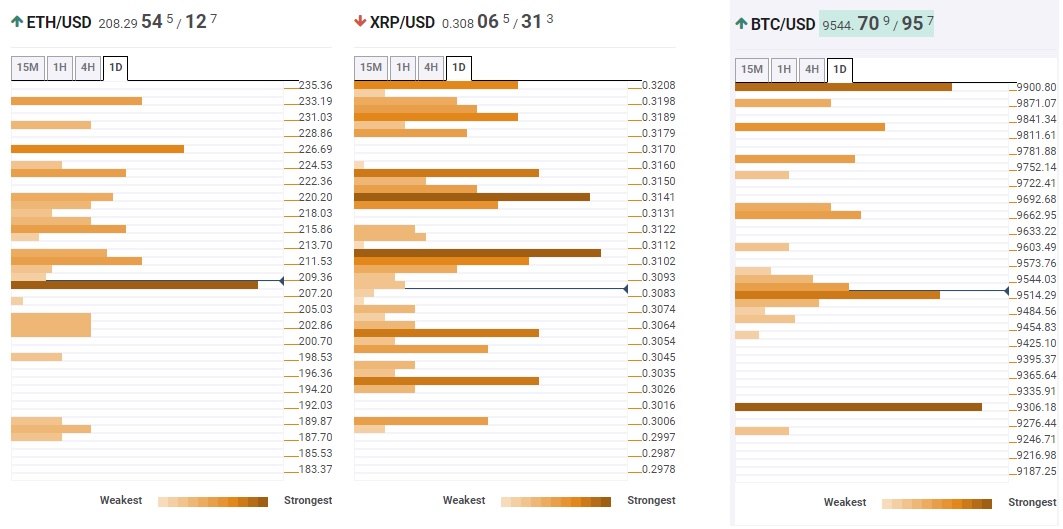

- Both Ethereum and Bitcoin are trading near key levels according to Confluence Detector.

Following the news of the US Internal Revenue Services (IRS) having started to send out letters to more than 10,000 cryptocurrency investors to potentially penalise them over failure to properly report income forced the crypto market sentiment to turn sour this weekend.

Top-20 cryptocurrencies with regard to total market capitalization suffered heavy losses on Saturday and stayed relatively quiet on Monday as investors have taken a back seat while waiting for the next catalyst. In the meantime, this weekend saw more than $15 billion erased from the total market capitalization, which now stands at $264 billion according to the latest available data on CoinMarketCap.

Earlier this week, during an interview with CNBC, the United States Treasury Secretary, Steven Mnuchin, said that they were looking at all of the crypto assets and added that they will make sure to have a unified approach among regulators when introducing new rules and guidelines with an aim to mitigate the potential negative impact on the financial system. Commenting on Bitcoin as an investment tool, "I won’t be talking about Bitcoin in ten years, I can assure you that,” Mnuchin said. “I can assure will not be personally loaded up on Bitcoin.”

Now let's take a look at the technical picture and identify the key technical levels revealed by the Confluence Detector for the top 3 cryptocurrencies.

BTC/USD seems to have found support near $9,500

After breaking below the key $9,900 area, Bitcoin extended its slide but seems to have found support at the $9,500 area, where the previous weekly low, middle-line of the 15-minute Bollinger Band and the previous 1-h low is located.

Below that level, the BTC/USD pair doesn't seem to have any interim support levels until the strong $9,300 region that is reinforced by the 1-week Pivot Point (S1) and the previous daily low.

On the upside, the Fibonacci 61.8% retracement of the monthly price action seems to have formed a key resistance at $9,900. Ahead of that, the Fibonacci 23.6% retracement of the weekly price action at $9,820 could be seen as a hurdle.

ETH/USD trades near critical $208 support

Ethereum trades a tad above the critical $208 support, which is formed by the Fibonacci 23.6% retracement level of both the weekly and daily price action, previous lows on both the H4 and H1 charts as well as the middle line of the hourly Bollinger Band, and could come under a renewed bearish pressure if it makes a daily close below that level. The next target on the south is located at $187 - 200-day moving average.

On the flip side, monthly pivot point (S1) at $223 is a key resistance ahead of $227, where the 100 period SMA on the H4 chart and the previous monthly low is located.

XRP/USD sits in between strong support and resistance levels

Ripple has pierced through a couple of key resistances and could test $0.3054 - the 1-week Pivot Point (S1), next. Below that level, next strong support aligns at $0.3026 - previous weekly low.

The XRP/USD pair's upside seems more crowded, suggesting that a recovery attempt is likely to encounter strong obstacles. The Fibonacci 23.6% retracement of the weekly price action is located at $0.3110, guarding the Fibonacci 38.2% retracement of the same move at $0.3150. The 100 period SMA on the H4 chart at $0.3190 could be the next hurdle.

See all the cryptocurrency technical levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Bitcoin Weekly Forecast: Will the “Uptober” rally reach a fresh all-time high?

Bitcoin continues to climb this week after breaking its resistance barrier, aiming for a new all-time high. US spot Bitcoin ETFs posted $1.86 billion in inflows until Thursday, the largest streak of inflows since mid-July.

Crypto Today: Main tokens gain as Bitcoin is less than 10% away from all-time high

Bitcoin climbs above $68,000 and pulls back as market participants turn greedy, according to the indicator that checks trader sentiment. Ethereum holds gains above $2,600 and XRP hovers around $0.55 on Friday.

Solana Price Forecast: SOL gains 2% as community discusses Firedancer validator for better performance

Solana gains 2% as its community discusses performance improvements through its new validator, Firedancer. Bitcoin’s Layer 2 project Solv Protocol launched BTC staking token on the Solana blockchain.

Bitcoin: Will the “Uptober” rally reach a fresh all-time high?

Bitcoin (BTC) rallied nearly 8% so far this week until Friday after breaking its resistance barrier, aiming for a fresh all-time high (ATH). This rise in Bitcoin’s price is supported by an increase in institutional demand, which showcased a $1.86 billion inflows this week, the largest streak of inflows since mid-July. Rising apparent demand and institutional reports suggest that the current BTC cycle resembles the third halving, when prices increased sharply.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.