- The upside potential for BTC is still impressive, impossible to set goals.

- Bitcoin eclipses Ethereum, which waits for its moment to attract the spotlight.

- XRP claims faith in the lack of harmony with the bull market.

A new crypto trading day dawns in Europe with a great headline once Bitcoin has just left the relative high at $13,000.

It starts to be usual to wake up with positive news about the Crypto industry. A few days ago the story was Libra; today is the concession of an exchange license and clearing of derivatives on Bitcoin futures to LedgerX Ltc.

When a market re-attains a high so quickly, one could argue the prior high was not a bubble after all.

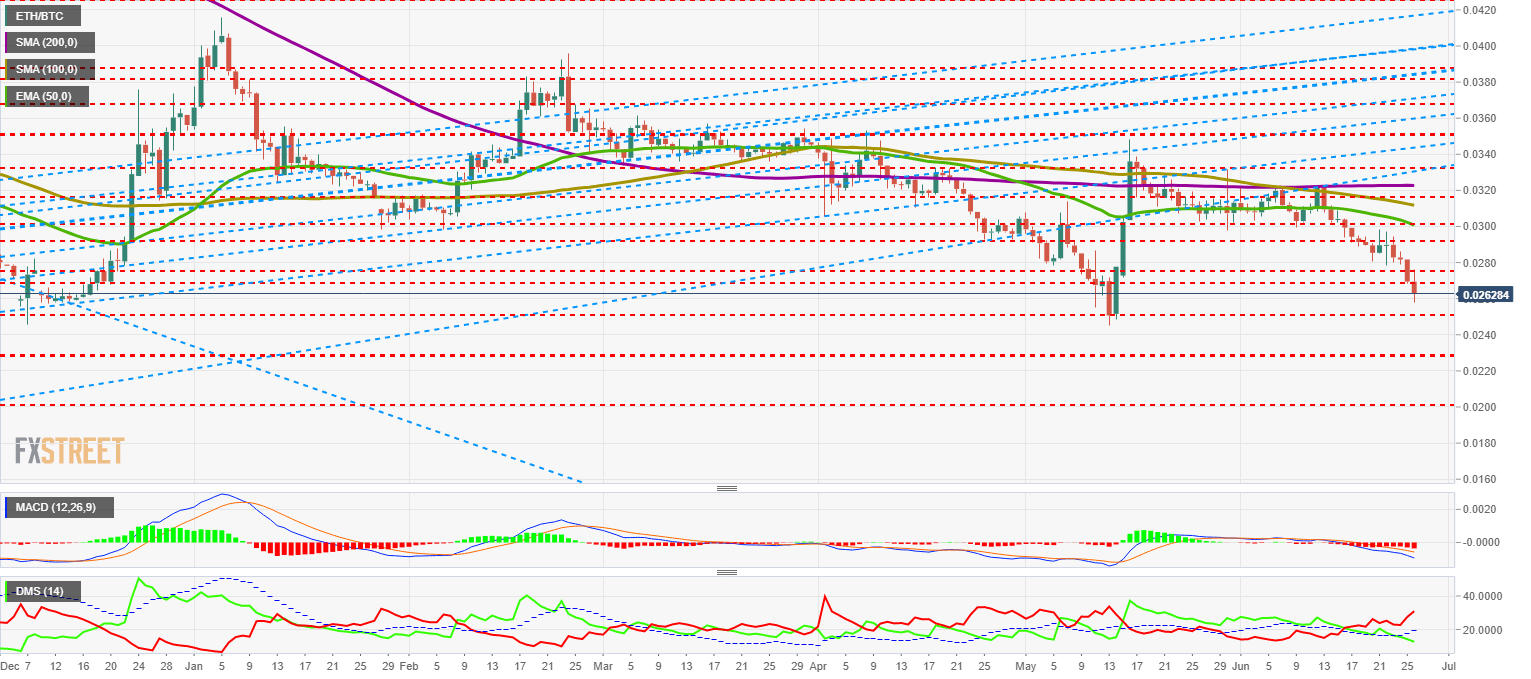

ETH/BTC Daily Chart

ETH/BTC, the pair that most reliably reports the health status of the Alt segment is approaching unseen levels since early 2017. Last May the minimum was 0.025, from where it shot up in a move that helped launch Bitcoin into space.

Technically it is remarkable the possible formation of a triple floor in the current price zone. The confirmation of this technical event would be significant as it would indicate an accumulation zone where portfolios could rotate massively towards the most backward assets in the current bull market.

Above the current price, the first resistance level is at 0.0268 (price congestion resistance), then the second at 0.0275 (price congestion resistance) and the third one at 0.0291 (price congestion resistance).

Below the current price, the first support level is at 0.025 (price congestion support and relative minimum), then the second is at 0.0229 (price congestion support) and the third one at 0.022 (price congestion support).

The MACD on the daily chart shows a bearish profile but does not reflect the current levels of tension in the exchange between Ethereums and Bitcoins. The bearish trend may continue over time.

The DMI on the daily chart shows a worrying profile, with bears dominating and even increasing dominance. The bulls, on the other hand, sink and complicate their existence by getting clearly under the ADX. The pattern indicates that falls can continue for weeks.

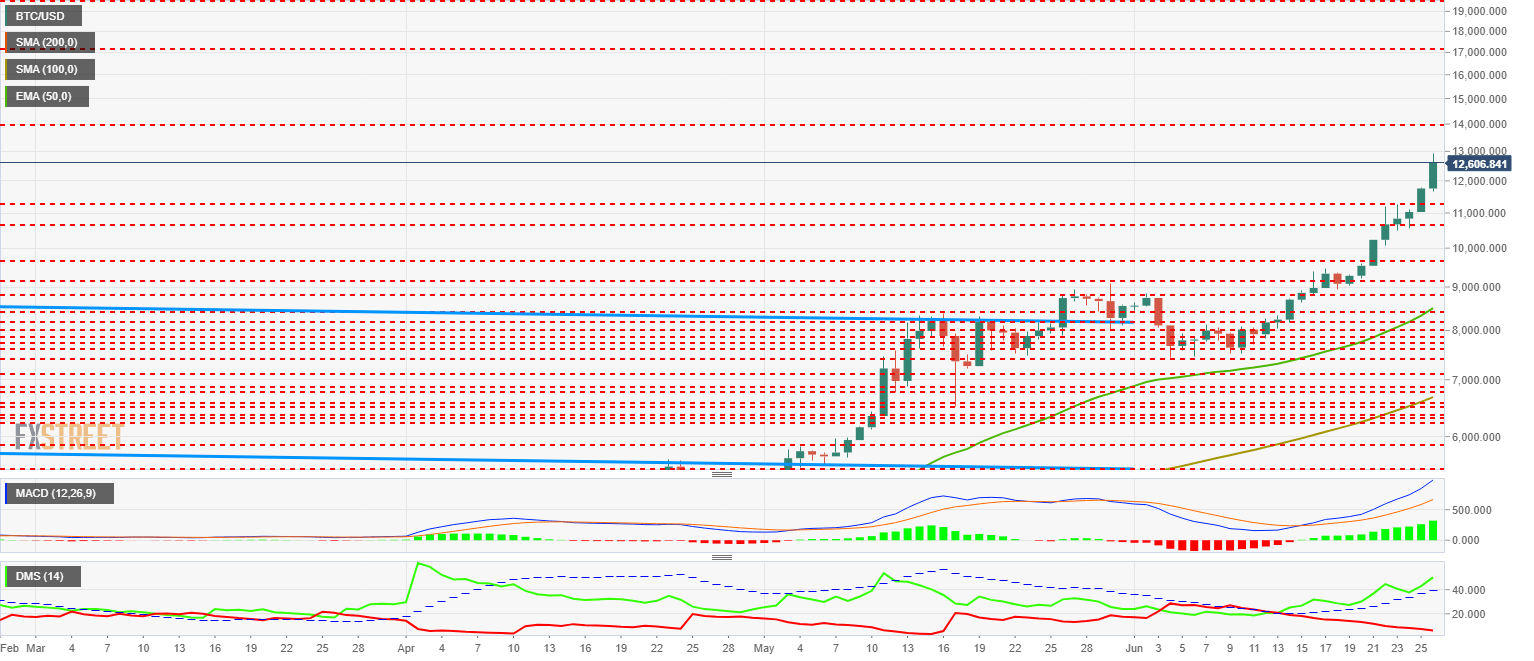

BTC/USD Daily Chart

BTC/USD continues to show the world that what happened at the end of 2017 was not unique and unrepeatable, but is part of the nature of Bitcoin itself and can be improved.

BTC/USD has taken only 14 days to move from $8,000 to $13,000 and no one escapes the fact that historical highs will be surpassed much sooner than anyone could have expected.

Above the current price, the first resistance level is at $14,000 (price congestion resistance), then the second at $17,090 (price congestion resistance) and the third one at $19,800 (historic high close). Above this price level, the BTC/USD pair will go up freely.

Below the current price, the first support level is at $11,280 (price congestion support), then the second at $10,650 (price congestion support) and the third one at $9,600 (price congestion support).

The MACD on the daily chart shows a spectacular profile that not even the most enthusiastic analyst would expect after the increases of these months. Both for inclination and opening between lines, the potential of improvements in the current swing is still huge. The $20,000 is not presented as something distant and improbable but rather as an inevitable and also very soon.

The DMI in the daily range also supports a scenario of bullish continuity that may suffer a correction given the extreme of the movement, but is irremediably bullish and will remain so for many days.

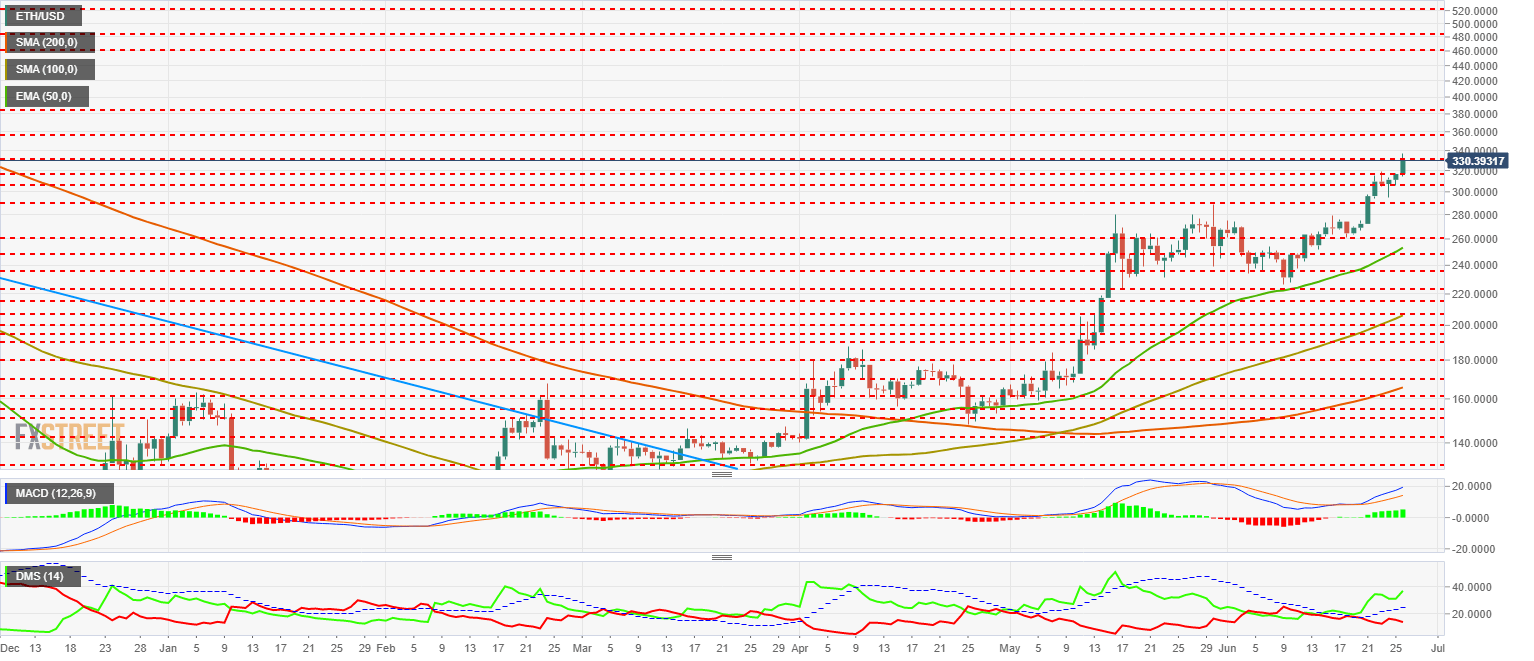

ETH/USD Daily Chart

The ETH/USD is currently trading at $330, an incredible level but one that is overshadowed by the magnitude of the Bitcoin rally. The Ethereum has its critical resistance at $465, which would represent what $9,150 has been for the BTC/USD pair. Above that level, Buterin's creature and friends will fly into the thousand.

Above the current price, the first resistance level is at $355 (price congestion resistance), then the second at $385 (price congestion resistance) and the third one at $465 (price congestion resistance).

Below the current price, the first level of support is at $320 (price congestion support), then the second is at $308 (price congestion support) and the third one at $290 (price congestion support).

The MACD on the daily chart shows a bullish profile still in development, showing weakness in case sales appear but may develop a potential similar to Bitcoin's as the rises accelerate.

The DMI on the daily chart shows, here yes, an excellent bullish profile. Bulls shoot upwards and can continue to expand their dominance to overwhelming levels. Bears begin to give in to evidence but have a long way to go down before reaching extreme levels.

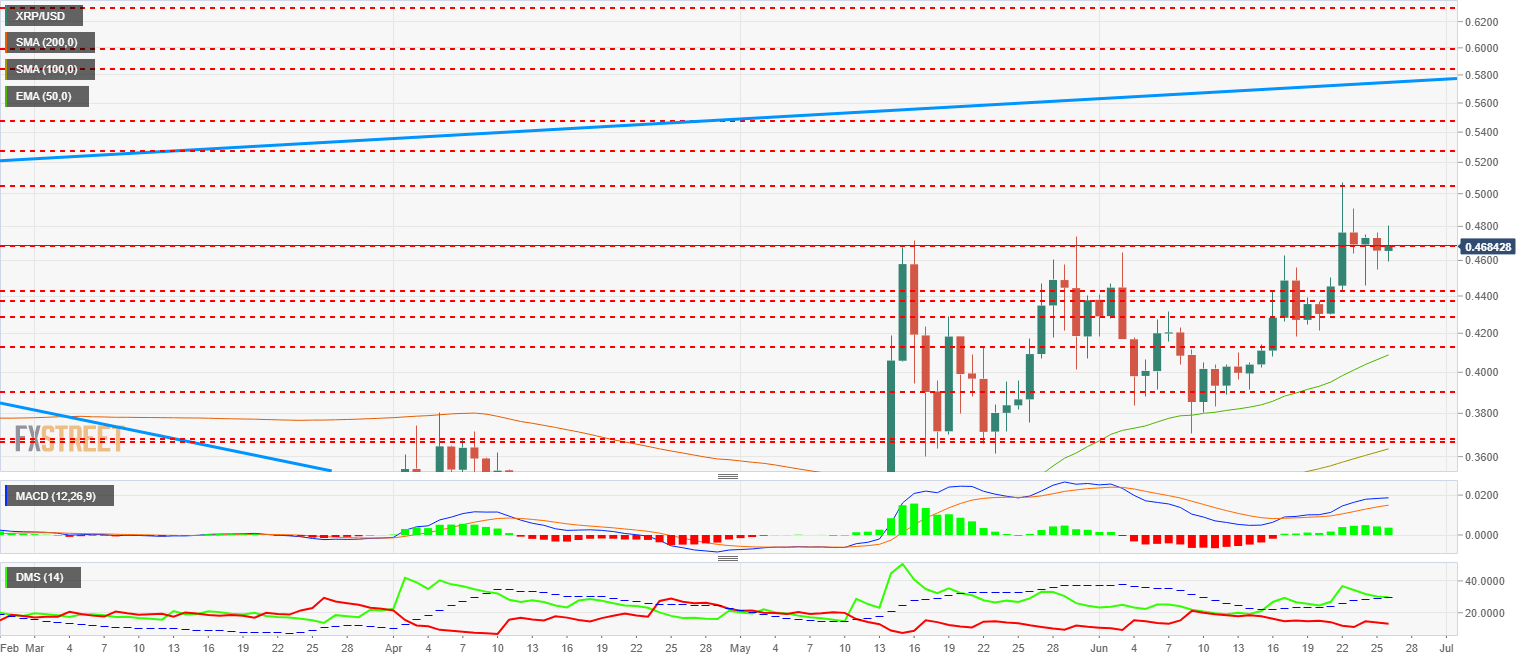

XRP/USD Daily Chart

The XRP/USD pair plays the "ugly duckling" and still doesn't join the bullish party where Ethereum and Bitcoin are. I don't doubt that sooner or later he will jump onto the dance floor, but for now, it's the disappointment of the sector.

Above the current price, the first level of resistance is at $0.504 (price congestion resistance), then the second at $0.527 (price congestion resistance) and the third one at $0.564 (price congestion resistance).

Below the current price, the first support level is $0.44 (double price congestion support), then the second at $0.426 (price congestion support) and the third at $0.413 (price congestion support and EMA50).

The MACD on the 4-hour chart shows a bullish but fragile profile if sales appear. If it evolves like Bitcoin, we can see a very bullish July month in the XRP.

The DMI on the daily chart shows how the bulls are playing in these hours survive above the ADX line. If they fail and lose track, we can see heavy falls. The bears are kept at low but not extreme levels, so they imply that they still have options to attack the leadership in the XRP/USD pair.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Lukas Enzersdorfer-Konrad, Bitpanda deputy CEO: “Crypto needs Gary Gensler gone”

Lukas Enzersdorfer-Konrad is the deputy CEO at Bitpanda, a broker based in Europe with more than five million users. At the European Blockchain Convention held in Barcelona, the executive shared with FXStreet his views on the current state of the crypto industry and its regulation.

Bitcoin still consolidates despite positive spot ETFs demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

Why is ONDO’s price outlook bullish?

DefiLlama data shows that Ondo TVL reached a new ATH of $613.75 million. Ondo’s Supply Distribution metric shows whale accumulation. On-chain data shows that ONDO’s daily trading volume is rising, and the supply of exchanges is decreasing.

Maker price eyes a rally on technicals and on-chain metrics

Maker trades above $1,500 on Thursday, suggesting a potential rally as technical indicators show bullish divergence. This positive outlook is reinforced by MKR’s Exchange Flow Balance, which shows a negative spike, indicating growing investor confidence in the platform.

Bitcoin: Fed-led rally could have legs towards $65,000

Bitcoin is poised for a second consecutive week of gains, supported by the recent 50-basis-point cut in interest rates by the Federal Reserve. Bitcoin broke above several key technical resistances this week, signaling a rally continuation.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.