- Cryptocurrencies are stabilizing over the weekend after the SEC sucked the life out of them earlier.

- Each cryptocurrency is in a different state.

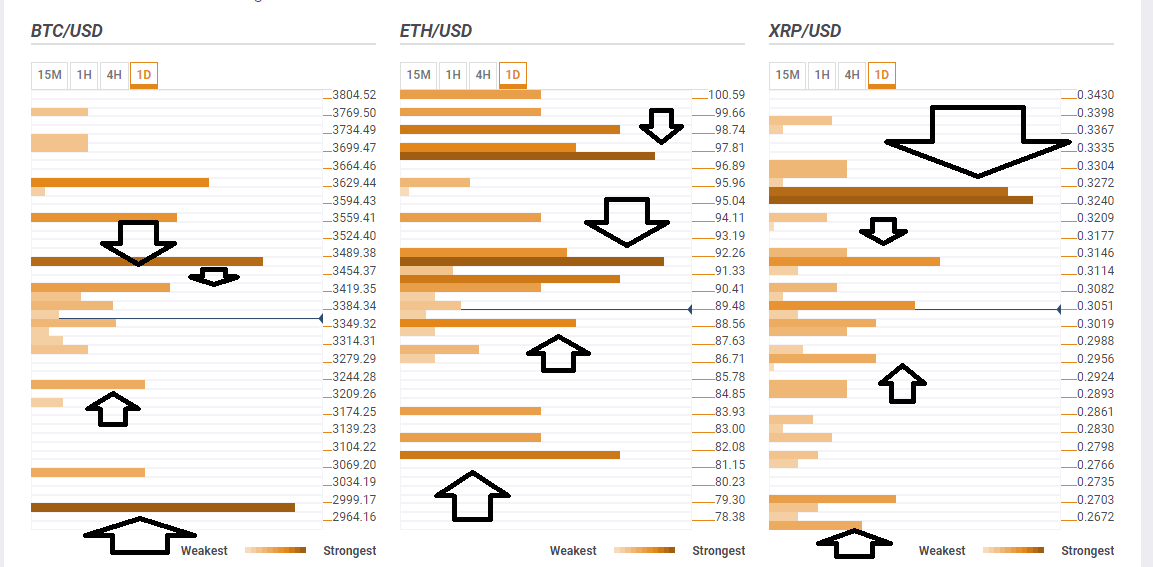

- Here are the levels to watch according to our proprietary technical tool.

After the US Securities and Exchange Commission (SEC) decided to delay its decision on the SolidX / Van Eck Bitcoin ETF decision to February, the granddaddy of digital coins dipped below the previous low of $3,466, Ripple slipped below $0.30, and Ethereum went into double-digit territory.

Yet after the fall on late Thursday / early Friday, we see some stability over the weekend. In the recent month, these periods of stability were only temporary calms before the next storms and cryptos then suffered further crashes.

However, some suspect that whale accumulation is near. After the big players dumped cryptos to lower the price, they will begin buying gradually at lower levels. That is the theory. Is the rout near?

Here are the levels to watch on Bitcoin, Ethereum, and Ripple.

BTC/USD needs to top $3,489 in order to escape $3,000

Bitcoin stabilized at the $3,300 handle and is looking for the next move. Some resistance awaits at $3,419 which is the convergence of the Simple Moving Average 5-4h, the SMA 50-1h, the SMA 200-15m, and the Fibonacci 61.8% one-day.

The more significant hurdle is $3,489 where we see the confluence of the Fibonacci 23.6%, the previous month's low, and the Bollinger Band 1h-Upper.

On the downside, we see support at $3,209 with the meeting point of the Pivot Point one-day Support 1 and yesterday's low.

However, the real cushion for BTC/USD is only below $3,000 at $2,980 which is last year's low and the Pivot Point one-month Support 1, both potent lines.

ETH/USD first needs to climb above $92 before thinking of $100

Ethereum has a more complicated technical picture, with quite a few dense clusters of resistance to the upside.

At around $92 for one Ether, we see the confluence of the Fibonacci 23.6% one-week, the SMA 100-15m, the Bollinger Band 1h-Middle, the Fibonacci 38.2% one-day, and the Simple Moving Average 5-4h.

Further above, $97.50 sees the concentration of the Fibonacci 38.2% one-week, the Bollinger Band 1h-Upper, the previous day's high, and the SMA 100-1h.

Looking down, some support awaits at $88 where we see the Fibonacci 61.8% one-day, the previous hourly low, and the SMA 50-1h converge.

The downside target is $81.50 which is the meeting point of two Bollinger Band levels: the 4h-Lower and the one-day Lower.

The prospects for Vitalik Buterin's brainchild remain bleak.

XRP/USD eyes only one hurdle: $0.3250

Ripple has not reached the yearly lows but is not too far away. Its hope is one specific level.

At $0.3250 we see a dense and explosive cluster including the Fibonacci 38.2% one-week, the Simple Moving Average 100-1h, the Pivot Point one-day R2, and last month's low.

Minor resistance a bit lower awaits at $0.3133 which is the confluence of the Fibonacci 23.6% one-week, the PP one-day R1 and the previous day's high.

Support awaits at $0.2956 with the BB one-hour Lower, the previous 4h low, and the Fibonacci 23.6% one-day.

The downside bearish target is $0.2703 which is the meeting point of the PP one-month S1 and the PP one-month S1.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH plunges 6% following Fed rate decision, eyes a bounce at the $3,550 level

Ethereum is down 6% after the Federal Reserve hinted that it will reduce its rate cut frequency in 2025. The hawkish news has sent ETH's Weighted Sentiment to lows last seen in December 2023.

Crypto Today: Bitcoin holds $104K as XRP, AVAX and Solana traders take profits

The cryptocurrency sector valuation declined 4% on Wednesday, dropping toward $3.8 trillion. While Bitcoin price dipped 2% to consolidate around the $104,600 mark, top altcoins like XRP, AVAX and SOL suffered excess of 5% losses on the day.

Bitcoin, crypto market set for massive dump following Trump's inauguration: Arthur Hayes

Bitcoin and the crypto market could face a massive sell-off as expectations for Donald Trump's administration of pro-crypto policies could be short-lived, according to Arthur Hayes.

Shiba Inu Price Prediction: SHIB whale demand plunges as Solana memes dominate

Shiba Inu price opened trading at $0.000026 on Wednesday, its lowest opening price in 20 days dating back to November 29. On-chain data shows SHIB token struggling to attract whale demand as Solana memes dominate social channels.

Bitcoin: BTC reclaims $100K mark

Bitcoin briefly dipped below $94,000 earlier this week but recovered strongly, stabilizing around the $100,000 mark by Friday. Despite these mixed sentiments this week, institutional demand remained strong, adding $1.72 billion until Thursday.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.