- Cryptocurrencies enjoy the fifth day of rises with Bitcoin breaking the $4K barrier.

- Ethereum also has room to rise but Ripple may lag behind.

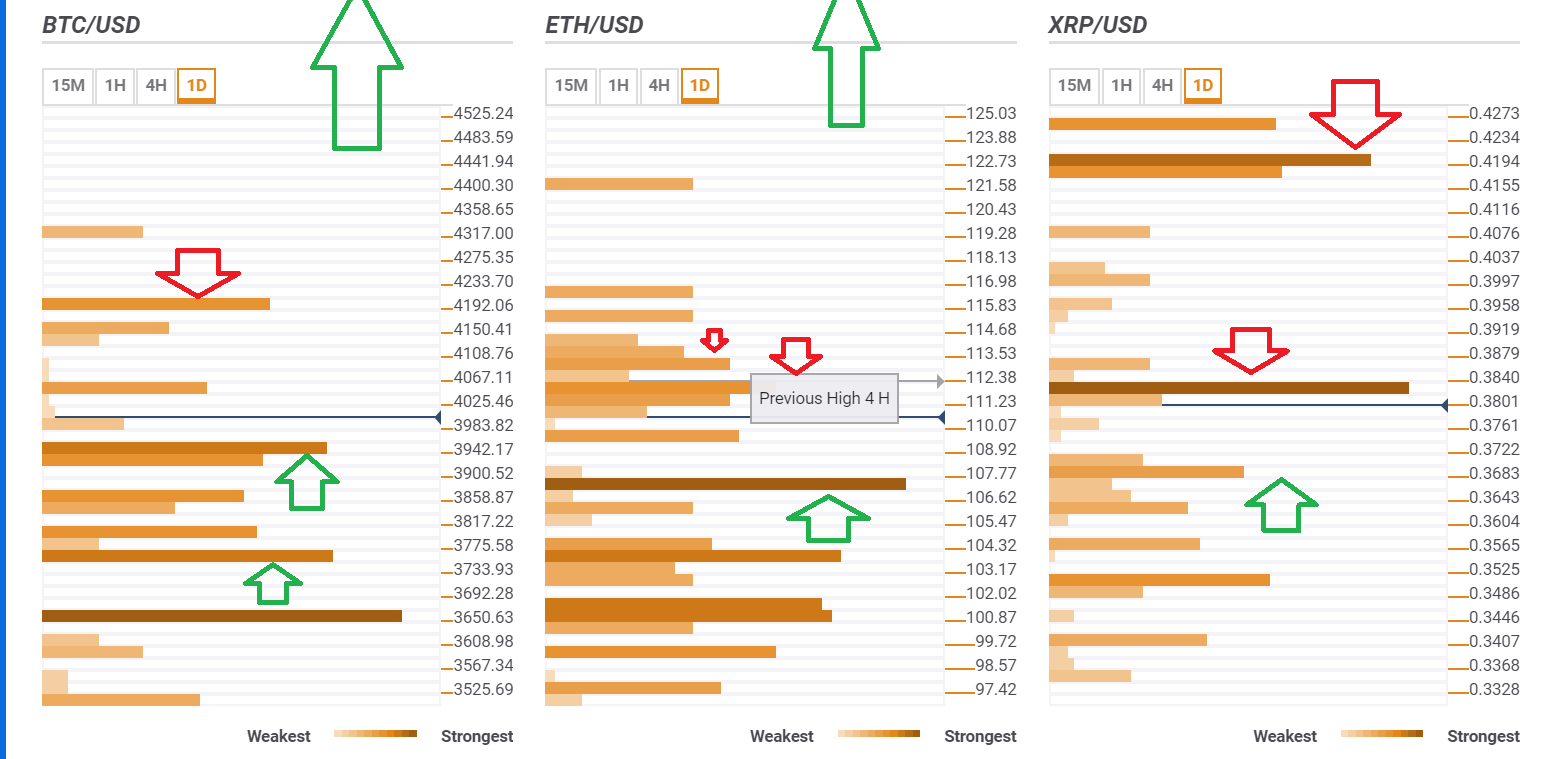

- Here are the levels to watch according to the Confluence Detector, our proprietary tool.

The recovery continues in the world of digital coins. In the past five days, cryptos are climbing two steps forward and consolidate for a while. These are very healthy gains are a mirror image of the unhealthy falls with no real recoveries, only "dead cat bounces".

The move began before the one-year anniversary of Bitcoin's peak near $20K and continue afterward. There are no clear catalysts but the theory of whale accumulation is gaining traction. The theory says that whales operating outside crypto-exchanges dumped coins from November 14th onward only to trigger others to sell and push prices lower. After the crash, they will begin accumulating once again. And in the Q1 2019, when Bakkt and NASDAQ join the crypto-world, prices will continue to higher ground and the whales will widen their wealth.

In any case, it is critical to be aware of the technical levels~

BTC/USD looks beyond $4,500

Bitcoin, the grandaddy of cryptocurrencies, has some resistance at $4,045 which is a convergence of several technical levels including the Simple Moving Average 5-15m, the Pivot Point one-day Resistance 2, the Bollinger Band 15-minute Middle, the previous 1h-high, and the SMA 5-1h.

Further above, $4,192 is the Fibonacci 23.6% one month. However, these are not significant levels and our chart ends at $4,545, indicating there is scope for additional gains beyond that line.

On the other side, support is substantial. At $3,492 we see the previous 1d-high, the PP 1w-R3, and the SMA 10-1h. Another noteworthy line is $3,858 which is where the PP 1d-R1 and the Fibonacci 23.6% one-day converge.

All in all, the path of least resistance for BTC/USD is to the upside.

ETH/USD to beyond $125?

Similar to Bitcoin, Ethereum also enjoys a healthy cushion and few upside levels. The scope of our ETH/USD reaches $125 until where there are no huge hurdles. At around $112 we see the confluence of the Fibonacci 161.8% one-week, the BB 4h-Upper, and the SMA 200-4h.

At $113 we see the PP 1d-R2, the BB 1h-Upper, and the PP 1w-R3.

Vitalik Buterin's brainchild has considerable support at around $107, where we see the PP 1d-R1, the SMA 10-1h, and the PP 1w-R2.

XRP/USD will struggle with $0.3820

Ripple has a different story. It faces a hurdle at $0.3820 which is a dense cluster including the all-important Fibonacci 23.6% one-month, the BB 1d-Upper, the BB 15m-Middle, and quite a few other lines.

If the No. 1 Altcoin does manage to overcome this hurdle, $0.4194 is the clear target It is the meeting point of the Pivot Point one-day R2, and the Fibonacci 38.2% one-month.

Support awaits XRP/USD at $0.3670 which includes the Fibonacci 38.2% one-day, the BB 1h-Middle, and the SMA 5-4h.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 gainers Supra, Cosmos Hub, EOS: Supra leads recovery after Trump’s tariffs announcement

Supra’s 25% surge on Friday calls attention to lesser-known cryptocurrencies as Bitcoin, Ethereum and XRP struggle. Cosmos Hub remains range-bound while bulls focus on a potential inverse head-and-shoulders pattern breakout.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin price remains under selling pressure around $82,000 on Friday after failing to close above key resistance earlier this week. Donald Trump’s tariff announcement on Wednesday swept $200 billion from total crypto market capitalization and triggered a wave of liquidations.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker is back above $1,300 on Friday after extending its lower leg to $1,231 the previous day. MKR’s rebound has erased the drawdown that followed United States President Donald Trump’s ‘Liberaton Day’ tariffs on Wednesday, which targeted 100 countries.

Gold shines in Q1 while Bitcoin stumbles

Gold gains nearly 20%, reaching a peak of $3,167, while Bitcoin nosedives nearly 12%, reaching a low of $76,606, in Q1 2025. In Q1, the World Gold ETF's net inflows totalled 155 tonnes, while the Bitcoin spot ETF showed a net inflow of near $1 billion.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.