- Bitcoin price struggles cross above the Tenkan-Sen, could create profit-taking and a corrective move. ]

- Ethereum price breaks out above a bullish continuation pattern, but momentum is weak.

- XRP price continues to lag Bitcoin and Ethereum but is poised to catch up in relative performance.

Bitcoin price has spent the past five trading days below the daily Tenkan-Sen in the Ichimoku Kinko Hyo system, warning that a deeper corrective move could occur. Ethereum price breaks out above a bullish pennant, but bullish follow-through has been relatively muted. XRP develops a bullish continuation pattern while maintaining bullish Ichimoku levels.

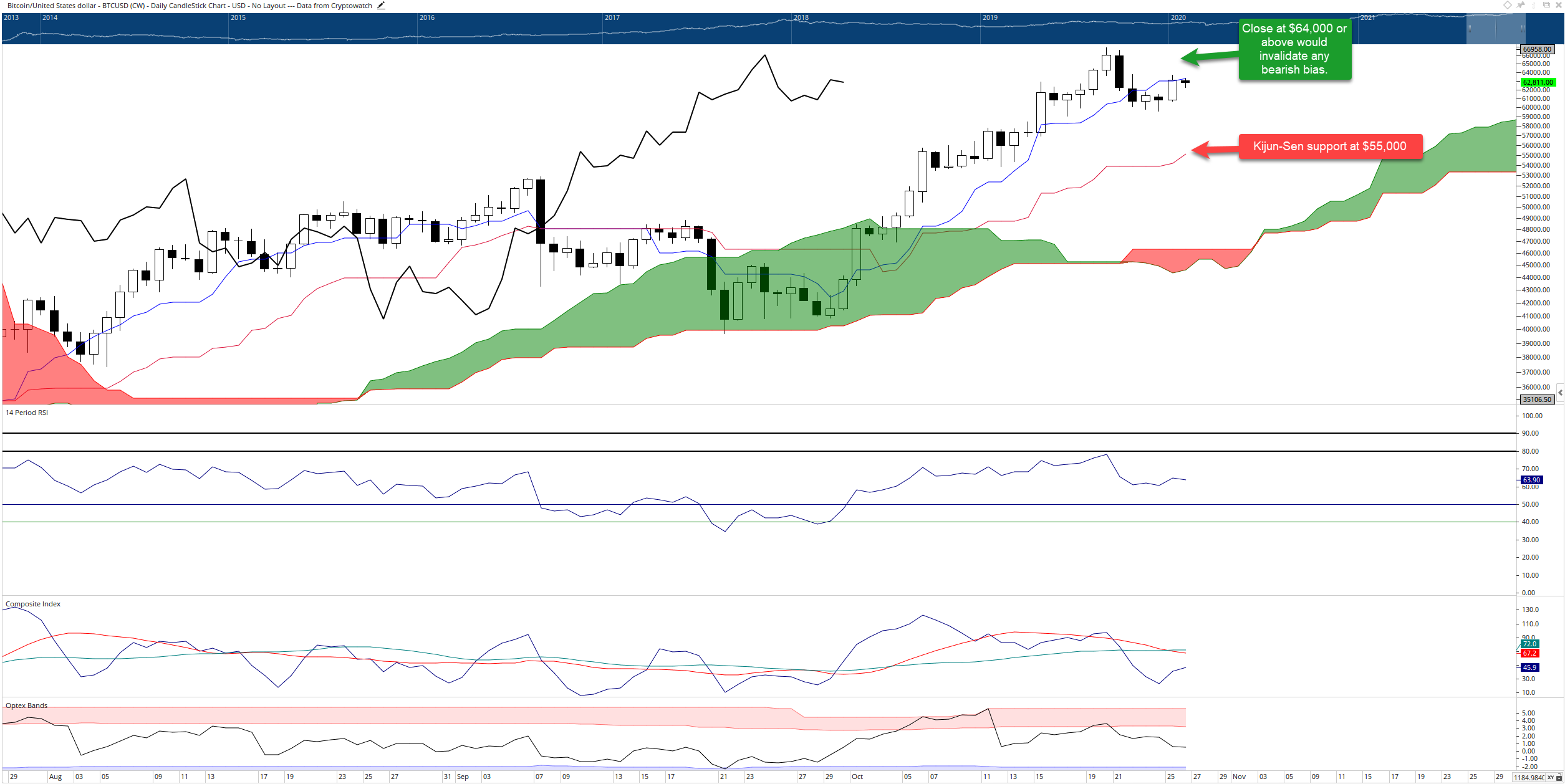

Bitcoin price shows signs of near-term weakness

Bitcoin price could be positioning for a standard corrective move if it fails to return and close above the Tenkan-Sen. The following primary support level within the Ichimoku Kinko Hyo system for Bitcoin is the Kijun-Sen at $55,000. If $55,000 fails to hold as a support zone, then Senkou Span B at $46,500 is next.

BTC/USD Daily Ichimoku Chart

The threat of a corrective move will be invalidated if Bitcoin has a strong close above the Tenkan-Sen, ideally at $64,000 or above. From there, Bitcoin would likely resume its uptrend and push on to new all-time highs.

Ethereum price spikes above the ascending triangle pattern

Ethereum price moves above one of the most sought-after bullish continuation patterns in technical analysis: the ascending triangle. Wherever an ascending triangle develops – at the bottom of a move or the top of a move – it is an overwhelmingly bullish pattern. So it is curious that Ethereum price has not had a strong and decisive bullish response yet. If Ethereum retraces back inside the triangle, a return to test the Tenkan-Sen at $4,000 is likely. Below that, the next Ichimoku support level is the Kijun-Sen at $3,675.

ETH/USD Daily Ichimoku Chart

Of course, any downside pressure will be eliminated if Ethereum price sees a push to new all-time highs. $5,400 is the next target for Ethereum as a level of significant resistance post new all-time highs.

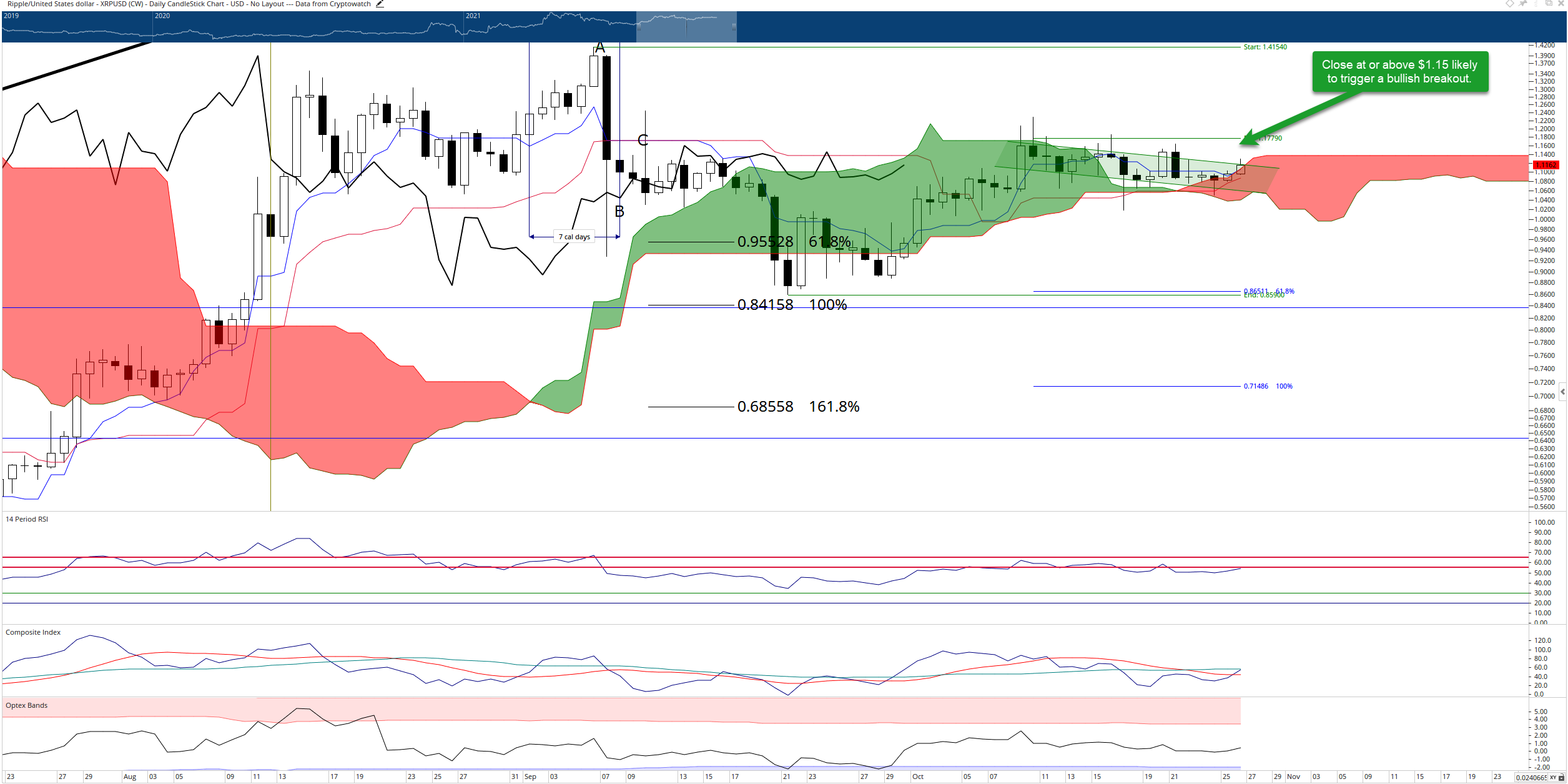

XRP price poised to catch up to Bitcoin and Ethereum, several bullish breakout considerations at play

XRP price has two primary bullish variables on its daily Ichimoku chart that indicate an explosive move higher is imminent. First, XRP has fulfilled all conditions for an Ideal Bullish Ichimoku Breakout. Second, XRP has developed a bull flag. Consequently, a daily close at or above $1.15 would maintain the bullish Ichimoku setup while also confirming an entry after a breakout from the bull flag pattern.

XRP/USD Daily Ichimoku Chart

Downside risks, however, remain. While XRP has a high market cap, it is still correlated to Bitcoin and Ethereums movement. Any intense selling pressure across Bitcoin and Ethereum will weigh heavily on XRP price. If XRP price closes below the Cloud at $1.03, a fast trip to revisit the $0.85 support zone is highly probable.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Crypto Gainers WIF, SPX, HYPE: Meme coins soar with Bitcoin’s recovery to $106K

Crypto market bounces back as Bitcoin (BTC) reclaims the $106,000 level at press time on Tuesday, resulting in a refreshed rally in top meme coins such as Dogwifhat (WIF) and SPX6900 (SPX), and Pepe (PEPE).

Meta shareholders turn down Bitcoin treasury reserve proposal as its stock soar on AI plans

Meta (META) shareholders opposed a proposal to adopt Bitcoin as a treasury asset, with more than 95% voting against the idea, according to a filing with the Securities & Exchange Commission (SEC).

Ripple price forecast: XRP price could hit $1.76 this week amid potential 20% correction

Ripple (XRP) faces legal uncertainty in its battle with the United States Securities and Exchange Commission, and the XRP price continues to slide. At the time of writing, XRP is trading at $2.1540, down 1.20% in the day.

Bitcoin: BTC dips as profit-taking surges, but institutional demand holds strong

Bitcoin (BTC) is stabilizing around $106,000 on Friday, following three consecutive days of correction that have resulted in a near 3% decline so far this week. The correction in BTC prices was further supported by the profit-taking activity of its holders, which has reached a three-month high.