- Bitcoin price is up against a critical resistance zone that will determine the near-term trend.

- Ethereum price extends its two-week rally to a gain of nearly 25%.

- XRP price is stuck at $0.84, bulls unable or unwilling to generate a breakout.

Bitcoin price must cross and close above a critical resistance level to maintain the current uptrend. Ethereum price, unlike Bitcoin, has moved above and is poised to close above the Ichimoku Cloud on the weekly chart, indicating strong sustained upside momentum is ahead. XRP price action, which outperformed BTC and ETH at one point, has been stuck at the $0.84 level since Monday’s close.

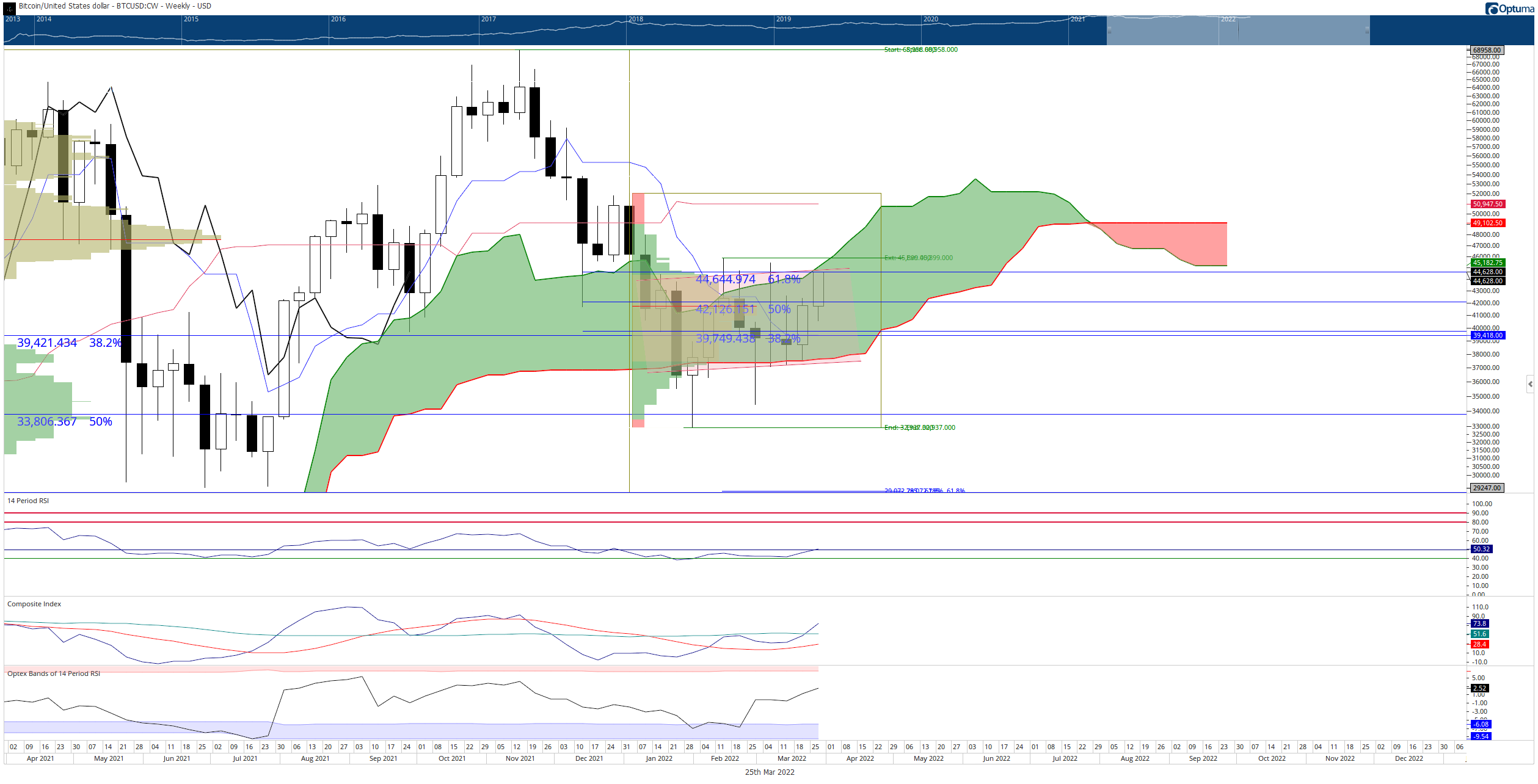

Bitcoin price set for a 25% rally or a 10% pullback

Bitcoin price action has been overwhelmingly bullish this week, gaining nearly 7% at publication, with little selling pressure or bearish price action.

However, Bitcoin is right on top of a critical make-or-break point. Despite the powerful bullish performance thus far, if Bitcoin price fails to close above $45,090, it is at risk of triggering another push towards the bottom of the Ichimoku Cloud.

The $45,090 value area contains the top of the weekly Ichimoku Cloud (Senkou Span A), the 61.8% Fibonacci retracement ($44,655), and the top of the current bear flag ($44,888). If bears halt Bitcoin price and cannot close above that level, bears may see an opportunity to trap bulls and initiate another push towards the bottom of the Ichimoku Cloud near $38,000.

BTC/USD Weekly Ichimoku Kinko Hyo Chart

If buyers successfully close Bitcoin price at or above $45,100, then the next Ichimoku resistance level doesn’t appear until the Kijun-Sen at $50,910, slightly above the 2021 Volume Point Of Control at $47,787. Upside potential is likely limited to the $48,000 to $50,000 over the next week.

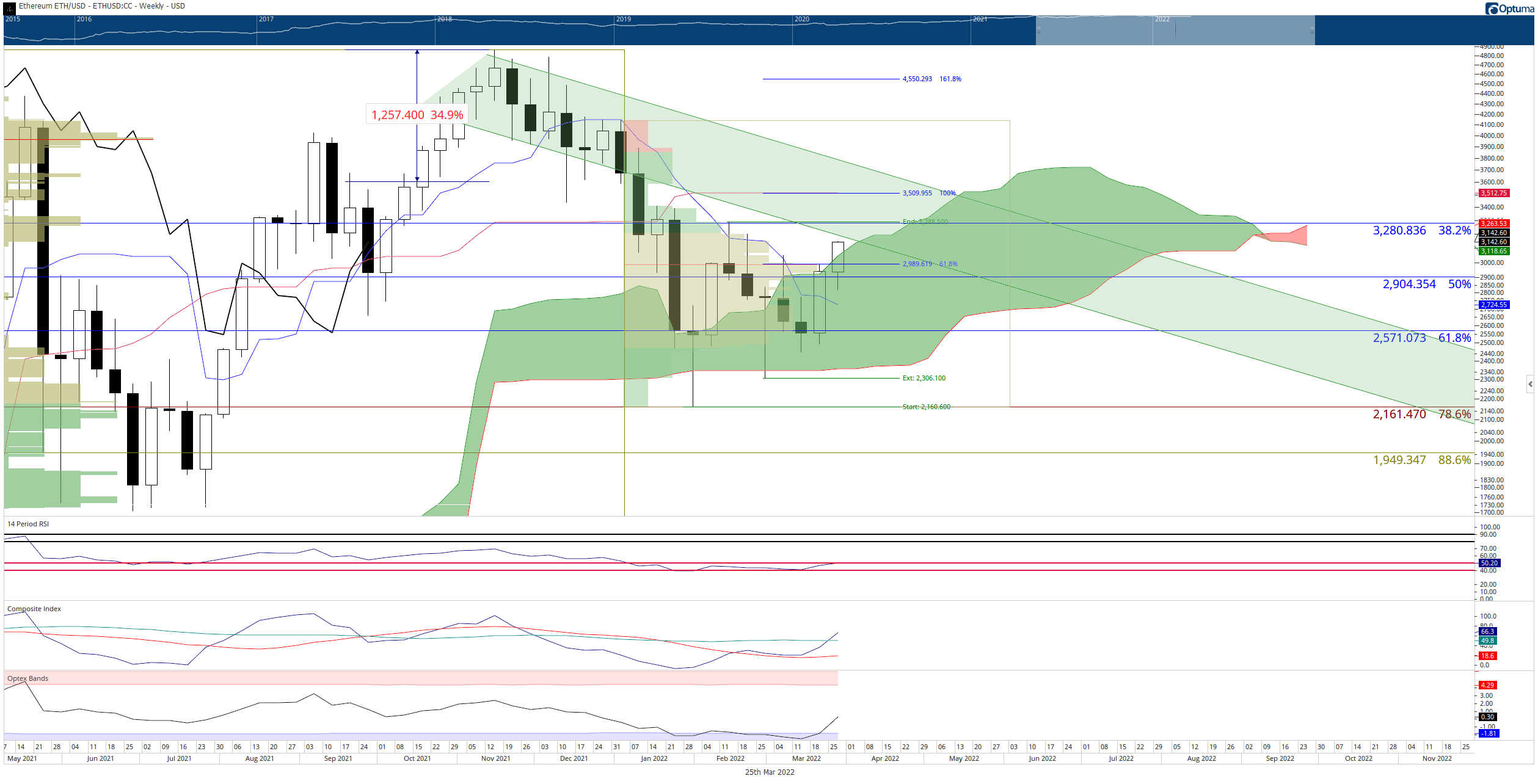

Ethereum price cracks above the Ichimoku Cloud

Ethereum price, at the time of publication, is close to completing a weekly close above the Ichimoku Cloud. There were concerns on Wednesday and Thursday whether this event could or would occur, but unless something drastic changes, ETH is poised to complete a very bullish event.

Upside potential, however, may be limited to the $3,300 value area until next week. In addition, the bottom trendline of a prior bull flag and the 38.2% Fibonacci retracement may halt any upside movement over the weekend. But the weekly oscillators do show that a sustained move higher is very likely.

The Relative Strength Index remains in bull market conditions and has been stuck between the two oversold levels of 40 and 50 ever since the week of January 7, 2022. The angle currently shows a probable breakout above the 50 level. Additionally, the Optex Band oscillator is turning up from the extremely oversold level for the first time in eight weeks.

ETH/USD Weekly Ichimoku Kinko Hyo Chart

For Ethereum price bulls, the most important oscillator measure to watch is November 12, 2021 peak in the Composite Index. If the Composite Index forms a peak above the November 12, 2021 peak – but price has not made a new high above the November 12, 2021 price high, then it would create hidden bearish divergence, pointing to a continuation move south.

XRP price awaits a clear breakout higher, but bulls appear apprehensive

XRP price has been against the 38.2% Fibonacci retracement near $0.84, with very little pressure to move above or below that level. XRP remains in a Bullish Ichimoku Breakout setup – but lacks any follow-through.

If XRP price does find sellers, then a pullback to the daily Tenkan-Sen at $0.82 may be their primary target. A breach of the Tenkan-Sen on the daily Ichimoku chart would mean a test even lower to the Kijun-Sen at$0.78. Upside potential over the weekend and into early next week is likely the $1.00 to $1.05 value area.

XRP/USD Daily Ichimoku Kinko Hyo Chart

However, downside risks remain a concern. XRP price remains inside a bearish continuation pattern. A daily close at or below $0.73 could trigger substantial selling pressure down to the $0.50 value area.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Cardano Price Forecast: ADA bulls target double-digit gains as bullish bets increase among traders

Cardano (ADA) price hovers around $0.74 at the time of writing on Thursday after a recovery of over 4% so far this week. On-chain data hints at a bullish picture as ADA’s stablecoin market cap rises while its bullish bets increase among traders.

GameStop's plan to issue $1.3 billion convertible notes to buy Bitcoin could boost crypto market and meme coins

Video game retailer GameStop announced on Wednesday that it plans to issue senior convertible note offerings worth $1.3 billion. The company aims to use part of the proceeds from the offerings to buy Bitcoin.

Stablecoin mania kicks off as Wyoming and Fidelity join the race

According to Governor Mark Gordon, the state of Wyoming has joined the race for a stablecoin, following plans to launch WYST, a US Dollar-backed token in July.

Toncoin traders target $10B valuation as Elon Musk integrates Grok AI into Telegram

Toncoin price rose 3% on Wednesday despite crypto market inflows subsiding after a two-day rally.

Bitcoin: BTC stabilizes around $84,000 despite US SEC regularity clarity and Fed rate stability

Bitcoin price stabilizes around $84,000 at the time of writing on Friday after recovering nearly 2% so far this week. The recent announcement by the US SEC that Proof-of-Work mining rewards are not securities could boost BTC investors' confidence.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.