- Bitcoin price shows strength as it maintains the $40,000 support zone.

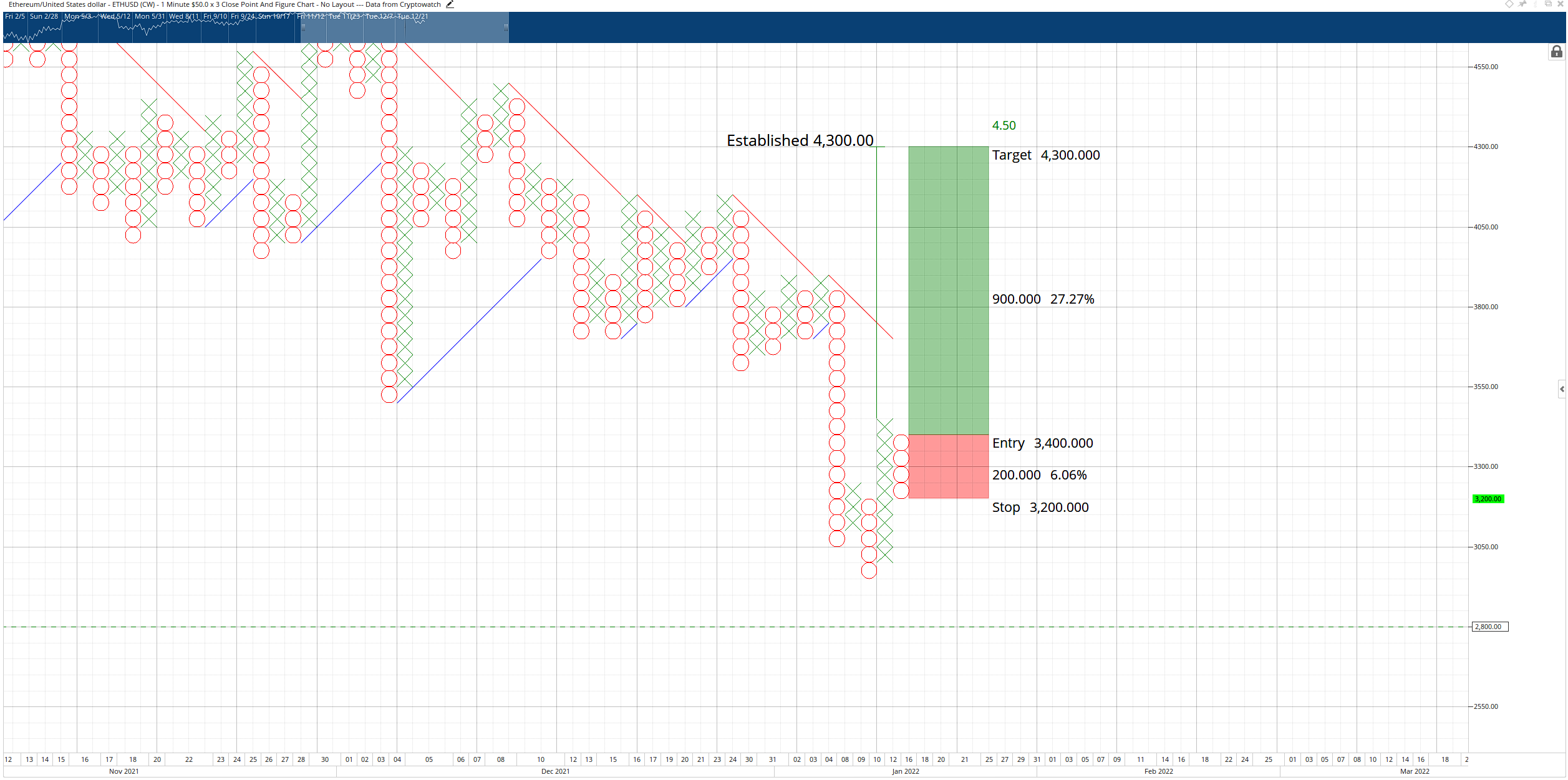

- Ethereum price develops an entry that could yield a 27% gain.

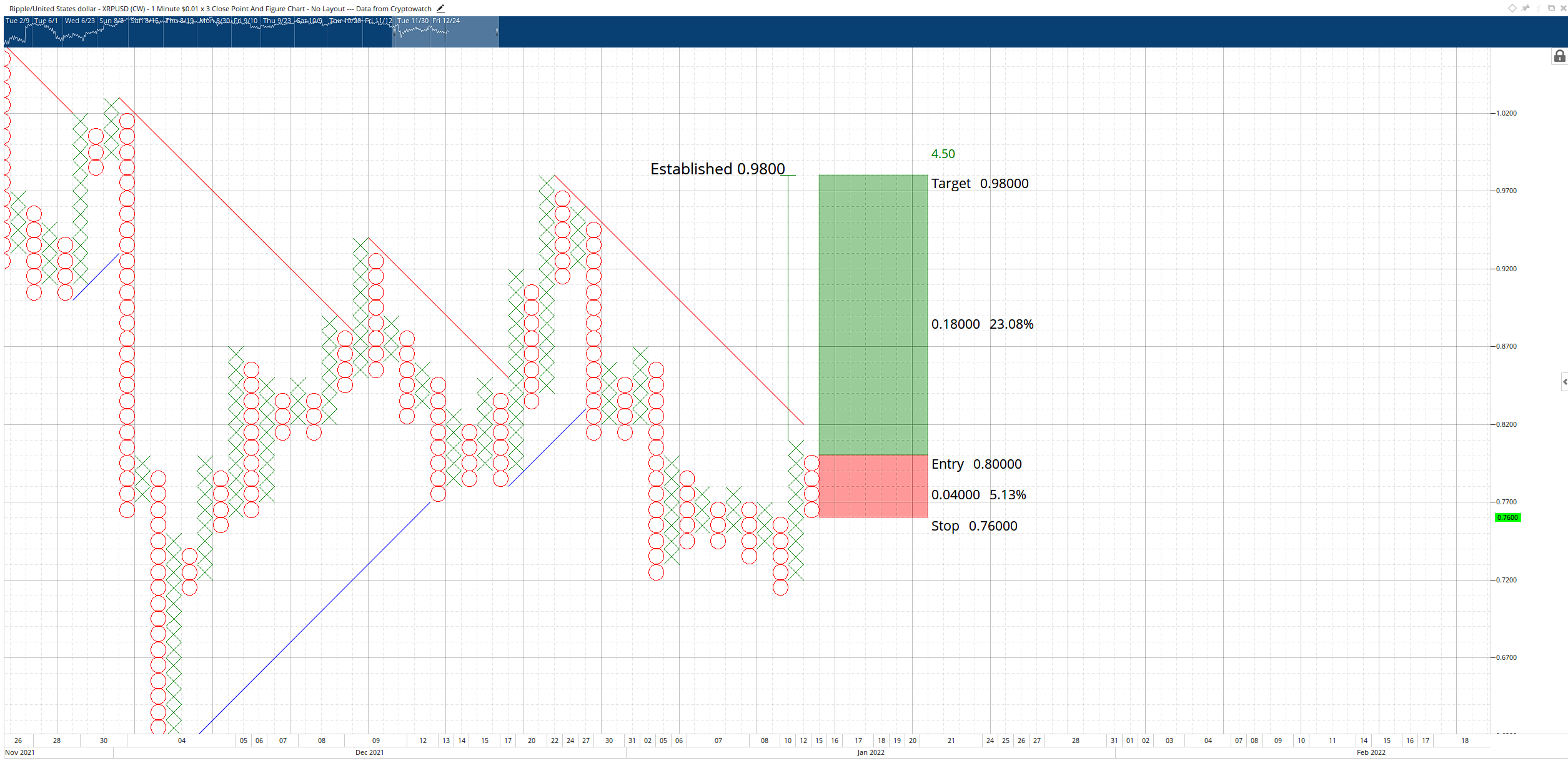

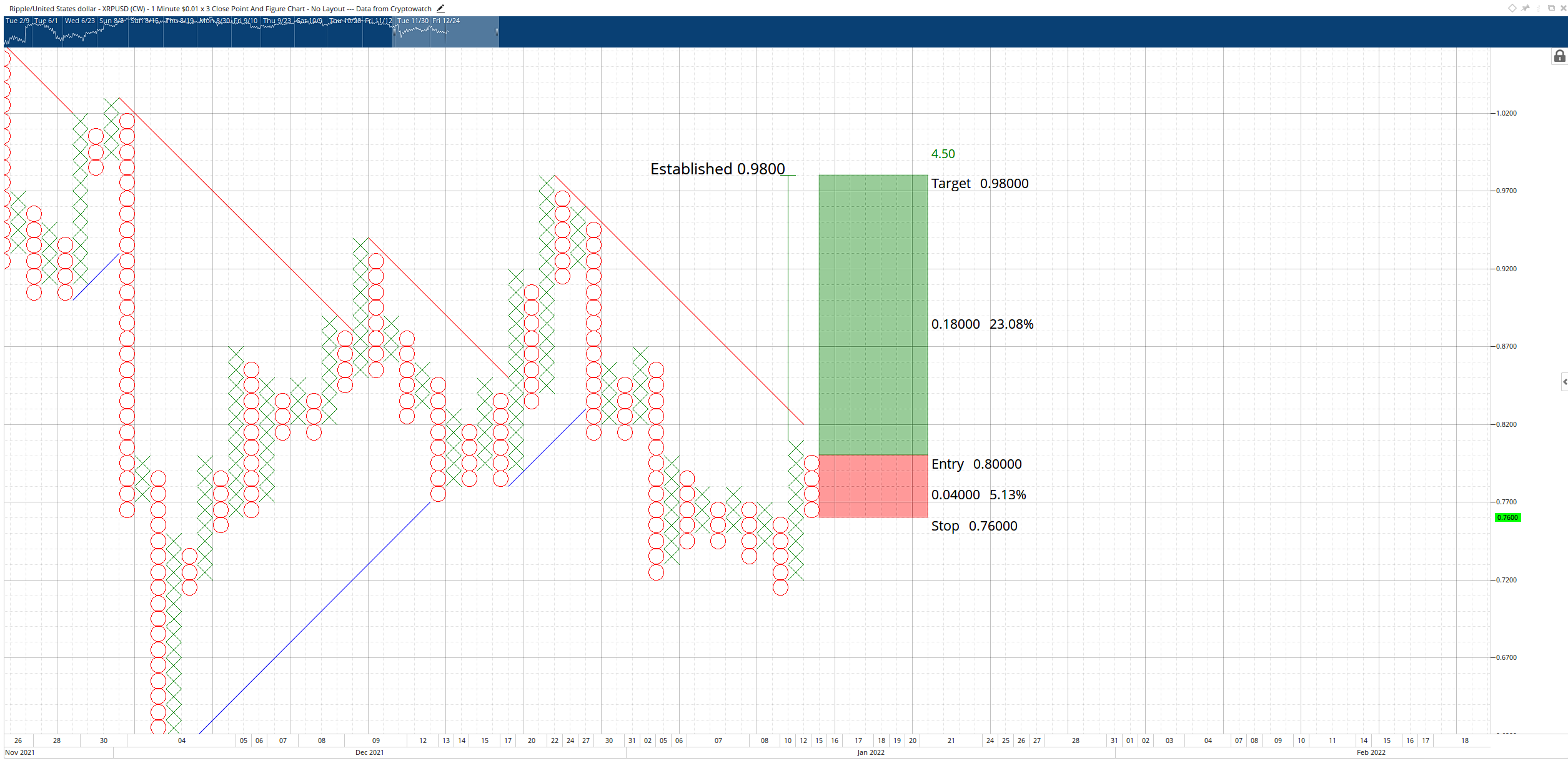

- XRP price is poised to return to the critical $1 value area.

Bitcoin price action has spent the week developing a particularly nasty bear trap off a head-and-shoulders pattern. Ethereum price pulled back from the recent rally, but it has found support and shows signs of buyers returning to continue the push higher. XRP price has developed a near-identical reversal setup to Ethereum as Ripple targets a 20% gain.

Bitcoin price presents buying opportunity before BTC will breakout to $61,000

Bitcoin price action continues to offer an excellent long opportunity before the weekend. The theoretical long entry is a buy stop order at $44,000, a stop loss at $40,000, and a profit target at $61,000. The trade represents a 4.25:1 reward/risk with an implied profit target of over 40% from the entry. A two-box trailing stop would help protect any profit made post entry.

BTC/USD $1,000/3-box Reversal Point and Figure Chart

The theoretical long idea is invalidated if Bitcoin price has a daily or weekly close below the $39,500 value area.

Ethereum price targets a return to $4,000, wiping out short sellers in the process

Ethereum price, like Bitcoin and many other altcoins, has developed several bear traps. However, the most recent bear trap has generated a buying opportunity from a Point and Figure pattern known as a Pole Pattern. Pole Patterns are a more flexible pattern in Point and Figure charting, offering initial entries with inverse reversal setups simultaneously. One of those opportunities now exists for Ethereum.

A theoretical long setup for Ethereum price is a buy stop order at $3,400, a stop loss at $3,200, and a profit target at $4,300. This trade represents a 4.5:1 reward/risk setup with an implied profit target of over 27% from the entry. A two to three-box trailing stop would protect any profit made after triggered entry.

ETH/USD $50/3-box Reversal Point and Figure Chart

The theoretical long entry is invalidated if the current O-column reaches $2,950.

XRP price pulls back and prepares to convert to a bull market

XRP price action has the best-looking bullish breakout compared to Bitcoin or Ethereum. This bullish bias is because the entry off the Pole Pattern breaks the current bear market angle and converts XRP into a bull market.

The possible long entry is a buy stop order at $0.80, a stop loss at $0.76, and a profit target at $0.98. Because this entry is based on a Pole Pattern reversal, XRP can move lower. If XRP does move lower, then the entry and the 4-box stop follow in tandem – but the profit target remains at $0.98.

Like Bitcoin and Ethereum, XRP’s possible long trade setup is a 4.5:1 reward/risk but with a 23% implied gain. As a result, $0.98 may be too conservative, especially given how long XRP has spent wallowing in flat to negative price action compared to Bitcoin and Ethereum.

XRP/USD $0.01/3-box Reversal Point and Figure Chart

This long entry idea is invalidated if XRP price drops to $0.70.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Dogecoin and Bitcoin Cash Price Prediction: Funding rates decrease indicate weakness in DOGE and BCH

Dogecoin and Bitcoin Cash registered 3% and 8% losses on Tuesday following increased selling pressure from the futures market. The decline comes amid large-cap cryptos like Bitcoin, Ether and XRP, holding still with slight gains.

XRP could sustain rally amid growing ETF and SEC vote prospects

Ripple flaunted a bullish outlook, trading at $2.1505 on Tuesday. Investor risk appetite has continued to grow since the middle of last week, propping XRP for a sustainable upward move triggered by the swift decision by US President Donald Trump to suspend reciprocal tariffs for 90 days.

VeChain Price Forecast: VET bulls aim for a double-digit rally

VeChain price hovers around $0.023 on Tuesday after breaking above a falling wedge pattern the previous day; a breakout of this pattern favors the bulls. Bybit announced on Monday that VET would be listed on its exchange. Moreover, the technical outlook suggests rallying ahead, targeting double-digit gains.

Dogecoin, Shiba Inu and Fartcoin price prediction if Bitcoin crosses $100K this week

The meme coin market fell sharply on Monday, shedding 4.8% in market capitalization to settle at $49.25 billion, according to data compiled from CoinGecko. The sell-off coincided with increased volatility across broader crypto markets while investors rotated funds into Bitcoin briefly tested $85,000.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.