- Bitcoin rallies over 20% in a week, fulfills bullish Ichimoku breakout conditions.

- Ethereum grabs 25% gain in a week and pushes on towards $4,000.

- XRP struggles to generate significant momentum despite a 22% move higher.

Bitcoin price fulfills all conditions necessary to complete an Ideal Bullish Ichimoku Breakout setup. Ethereum price, hot on the tail of Bitcoin’s performance, positions for the same Ichimoku breakout as Bitcoin. However, XRP price action is somewhat muted when compared to its peers and shows signs of struggling to catch the same momentum as Bitcoin and Ethereum.

Bitcoin price looks for a clear and sustained break above $50,000 to move towards $70,000

Bitcoin price has fulfilled all the Ideal Bullish Ichimoku Breakout entry requirements within the Ichimoku Kinko Hyo system. The Chikou Span is above the candlesticks; the close is above the Cloud, Future Senkou Span A is sloping up while future Senkou Span B is sloping down and the Tenkan-Sen is above the Kijun-Sen. The only technicals that could derail the sustained move higher are the hidden bearish divergence between the candlestick chart and the Composite Index. Therefore, Bitcoin will need to close above the September 6th high of $52,742 to negate any near-term bearish signals in the oscillators.

BTC/USD Daily Ichimoku Chart

Bulls should be cautious of any return to the inside of the Cloud as it could signal another leg lower towards the $30,000 value area.

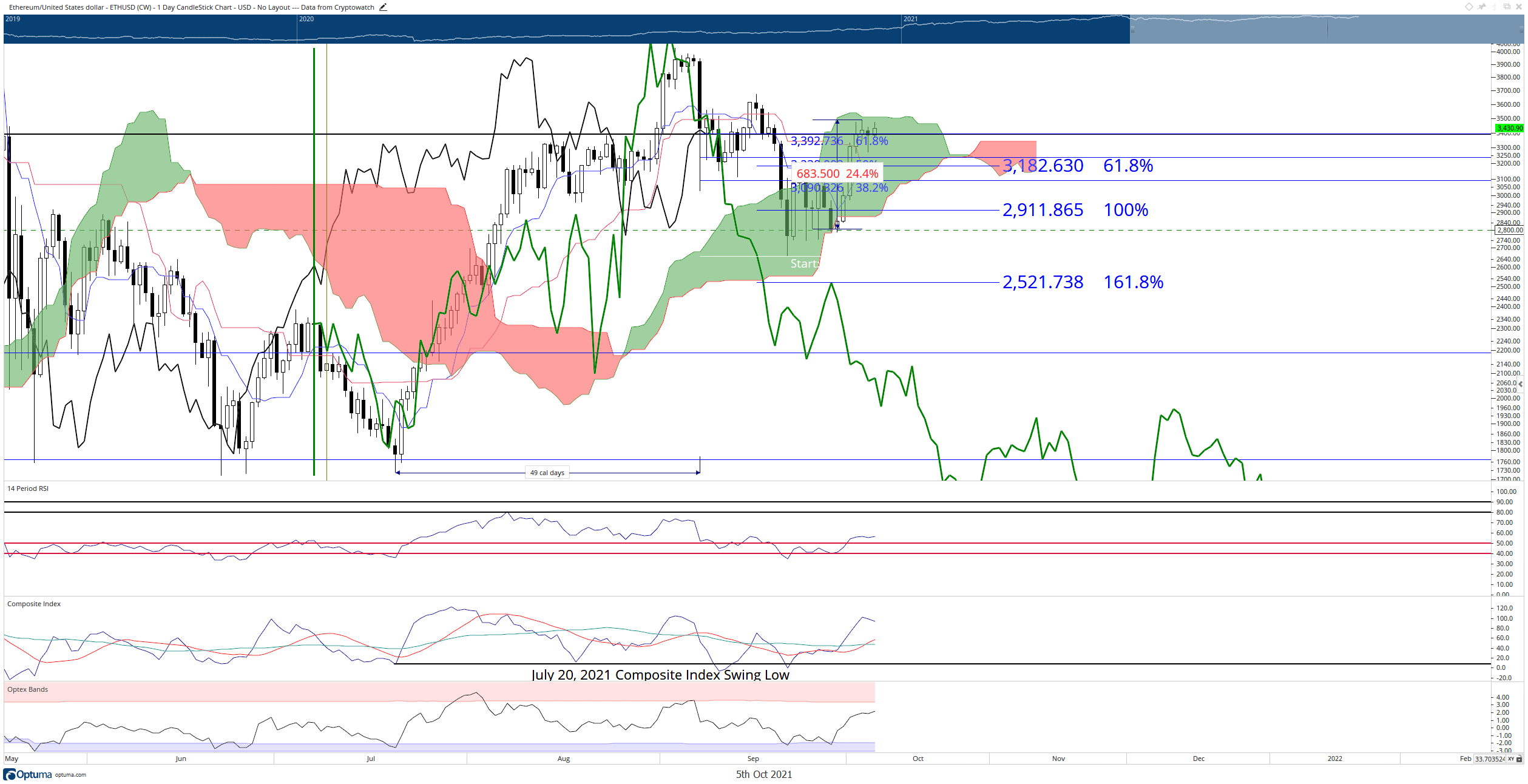

Ethereum price attempts a breakout higher; bulls target $3,600 close to confirm a new bullish expansion

Ethereum price, unlike Bitcoin, remains inside the Cloud has stubbornly been rejected higher from the top of the Cloud (Senkou Span A) at $3,500. For a bullish breakout to be true, the close and the Chikou Span must be above the Cloud, with the Chikou Span also above the candlesticks. This can only occur with a close at or above $3,600. Until then, downside pressure remains a very likely scenario. The same hidden bearish divergence scenario on Bitcoin’s chart exists for Ethereum as well. To negate that bearish divergence and eliminate any downside pressure threat, a close above $4,000 is necessary.

ETH/USD Daily Ichimoku Chart

Ethereum price dropping below $3,000 would be a signal that further downside movement is likely.

XRP struggles to maintain bullish momentum, eyes a return to $0.90

XRP price continues to struggle higher and is now under threat from losing most of its gains over the past week. The Kijun-Sen at $1.05 continues to act as a source of significant resistance. The bearish readings in the oscillators exacerbate the resistance at the Kijun-Sen. The Optex Bands continue to trend higher and are nearing the extreme overbought levels. Hidden bearish divergence between the candlestick chart and the Composite Index also weighs in on further downside momentum. Finally, the Relative Strength Index faces resistance against the first overbought condition in a bear market at 55. A close above $1.20 is necessary to return XRP into a bull market.

XRP/USD Daily Ichimoku Chart

XRP may trigger some substantial price collapses if it fails to hold $1.00.

Like this article? Help us with some feedback by answering this survey:

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.