- Despite appearances, Bitcoin is the asset with the best risk/benefit ratio.

- The current falls are adjusted to the ranges of the previous rise.

- Downward momentum expires in the first half of February.

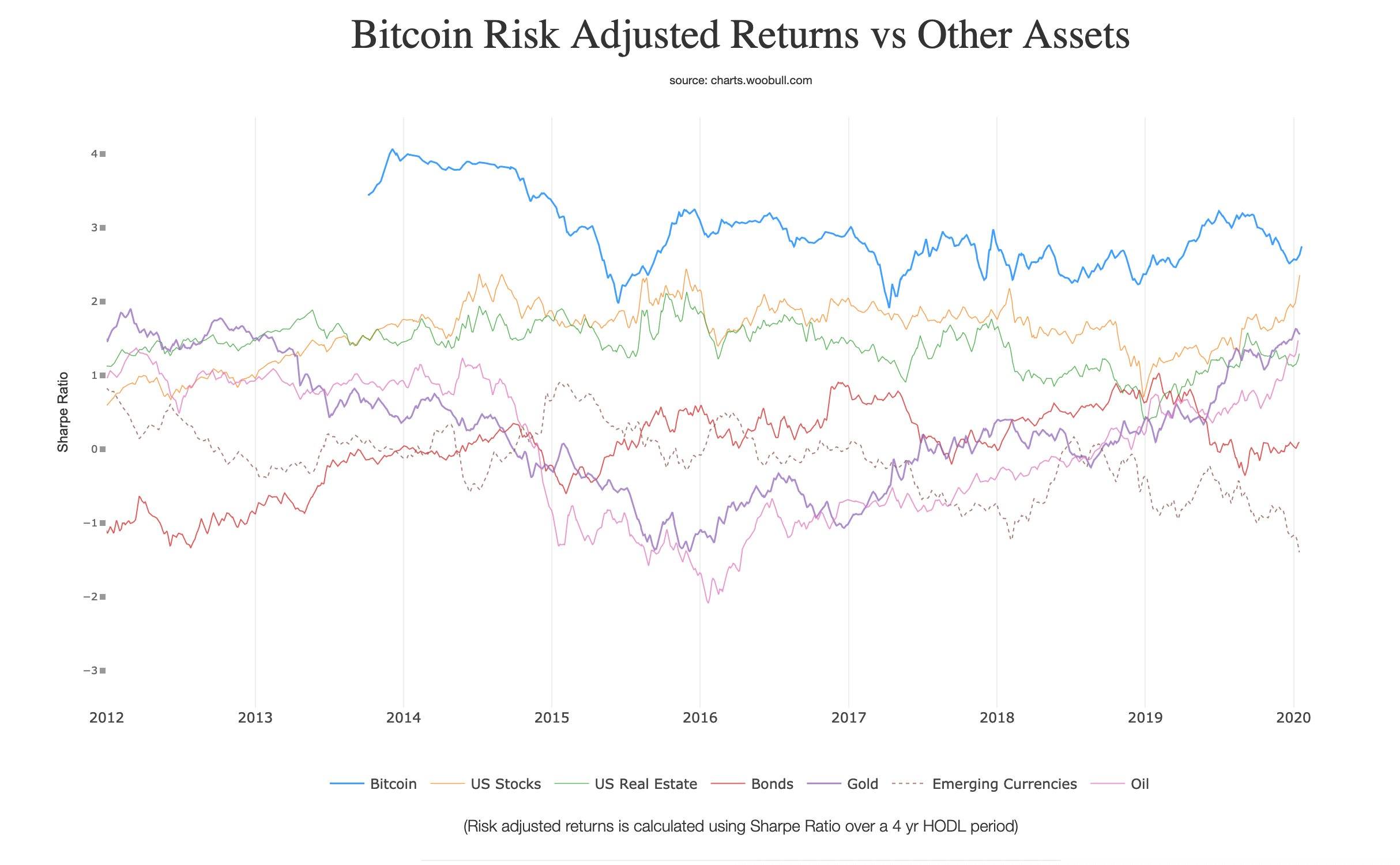

Cryptographer and computer scientist Nick Szabo, has presented in his Twitter account a study on the "risk-benefit" ratio of different assets. The study used a Sharpe Ratio over four years Hodl period.

According to this study, Bitcoin is the best positioned, maintaining an average ratio of 3 in the last four years. Behind them are the US stocks, with an average ratio of 2, and gold, which has gone from the last positions in 2016 to the third in the 2020 ratio.

The worst placed asset category is emerging currencies, which with an average ratio of -2 lags far behind the others.

The crypto board reaches the end of the week with the bears securing the market control they gained yesterday in mid-session.

The structure of the moving averages already indicated that the upward turning process that began on January 10th was going to be quite time-consuming. The magnitude of the downward movements in the second half of 2019 had separated the moving averages a lot.

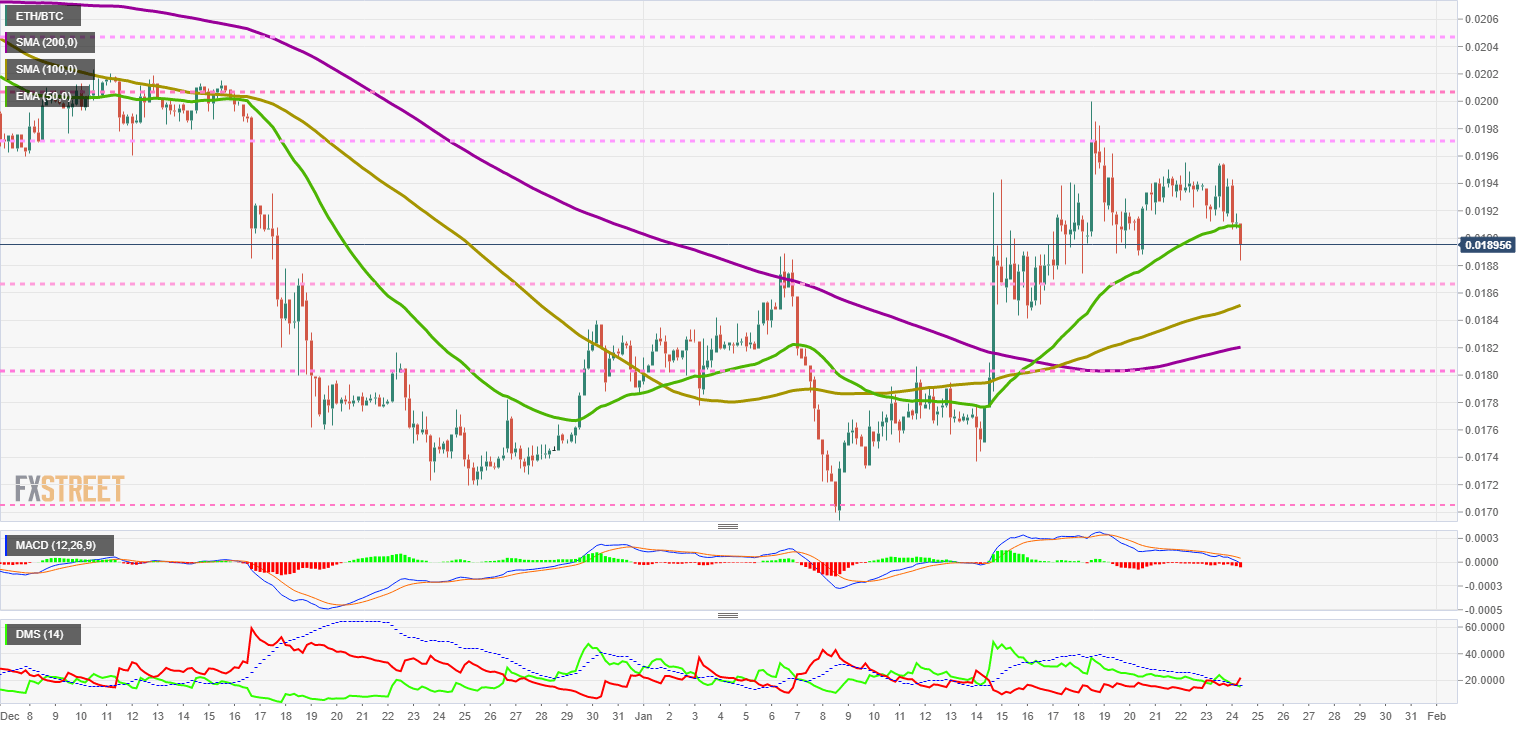

ETH/BTC 4-Hours Chart

ETH/BTC is trading at the price level of 0.01895 and is down by -1.65%. On the 4-hour chart, the spot price is piercing the EMA50. If Ethereum loses this support, the drop will accelerate to the 0.0185 level.

Above the current price, the first resistance level is at 0.0197, then the second at 0.0200 and the third one at 0.0205.

Below the current price, the first support level is at 0.0185, then the second at 0.0185 and the third one at 0.0182.

The MACD on the 4-hour chart is supported directly by the indicator's zero levels. The moving averages are sloping downward and are moving away from it, suggesting an acceleration of the trend.

The DMI on the 4-hour chart shows the bearish-bought pair in equilibrium. Both sides of the market are above the ADX line, a setup that facilitates violent resolutions.

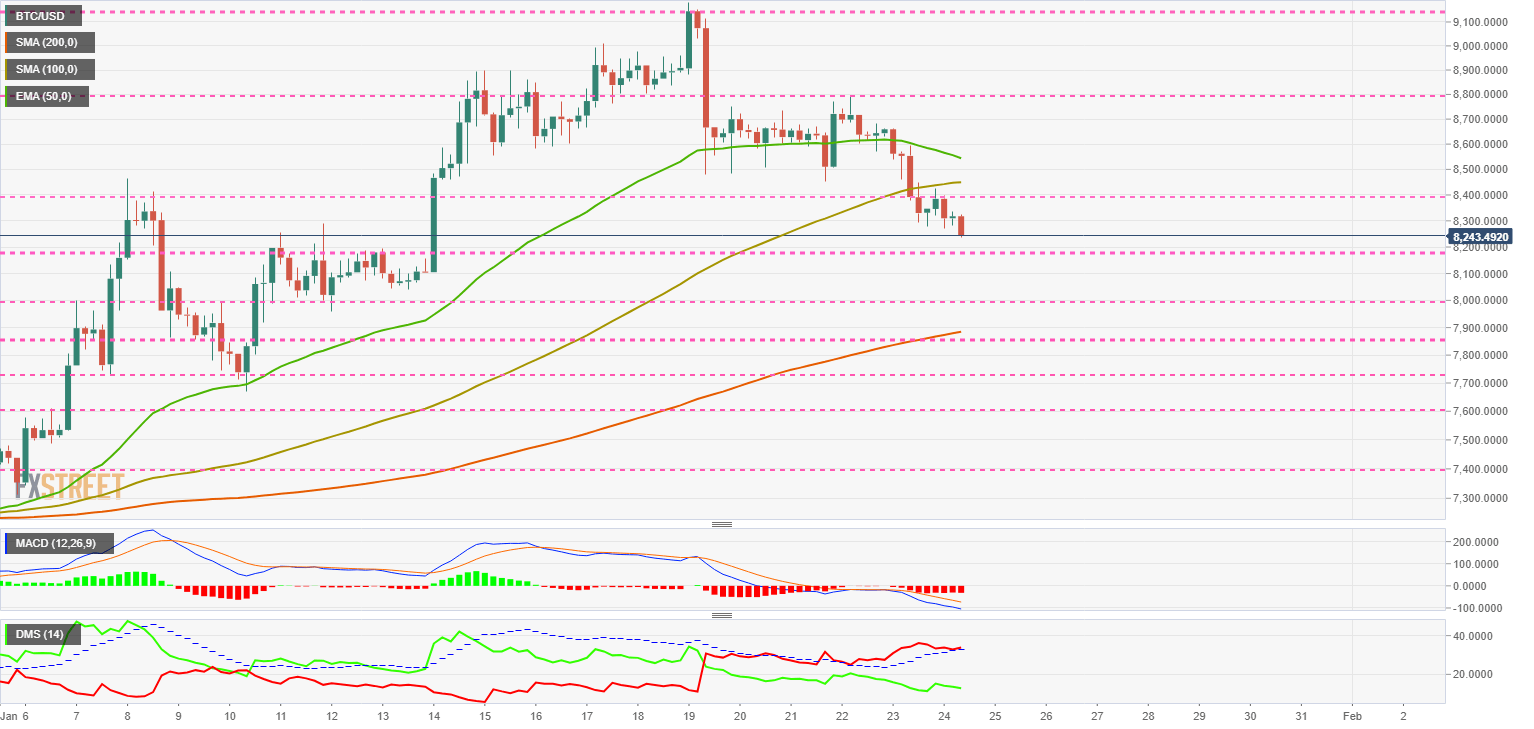

BTC/USD 4-Hours Chart

BTC/USD is currently trading at $8243 and confirms the loss of support at $8400. The EMA50 and SMA100 averages continue to fall and forecast that the end of the downtrend could be on the first week of February.

Above the current price, the first resistance level is at $8400, then the second at $8500 and the third one at $8800.

Below the current price, the first support level is at $8200, then the second at $8000 and the third one at $7900.

The MACD on the 4-hour chart is losing its downward slope, indicating the end of the impulse phase of the movement. The terminal phase can easily take the price below $8000.

The DMI on the 4-hour chart confirms the end of the bearish momentum phase. Bears are preparing to drill down the ADX line. The bulls are very reactive to any upward movement and break the downward trend.

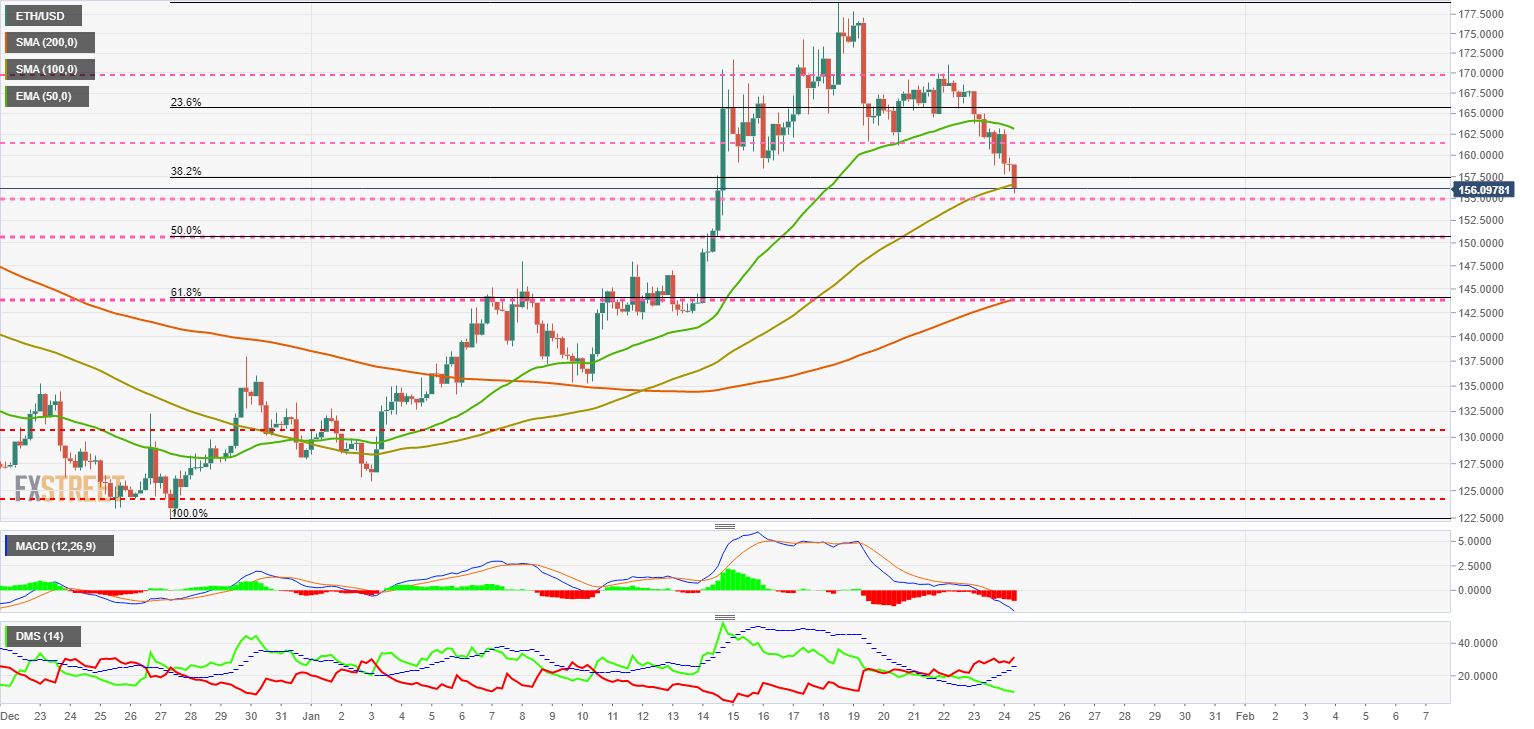

ETH/USD 4-Hours Chart

ETH/USD is currently trading at $156.09 after finding support at the SMA100. The support point coincides with the 38.2% level of the Fibonacci retracement system and the same system indicates that the 50% level at $150 is very likely to be visited.

Above the current price, the first resistance level is at $161, then the second at $165 and the third at $170.

Below the current price, the first support level is at $155, then the second at $150 and the third one at $143 (61.8% level of the Fibonacci retracement system).

The MACD on the 4-hour chart is increasing its openness and is tilting further down, so we can expect an acceleration of the price's decline.

The MACD on the 4-hour chart is increasing its openness and is tilting further down, so we can expect an acceleration of the price's decline.

The DMI on the 4-hour chart shows that the bearish trend is increasing. The bulls are not reacting and continue to lose strength.

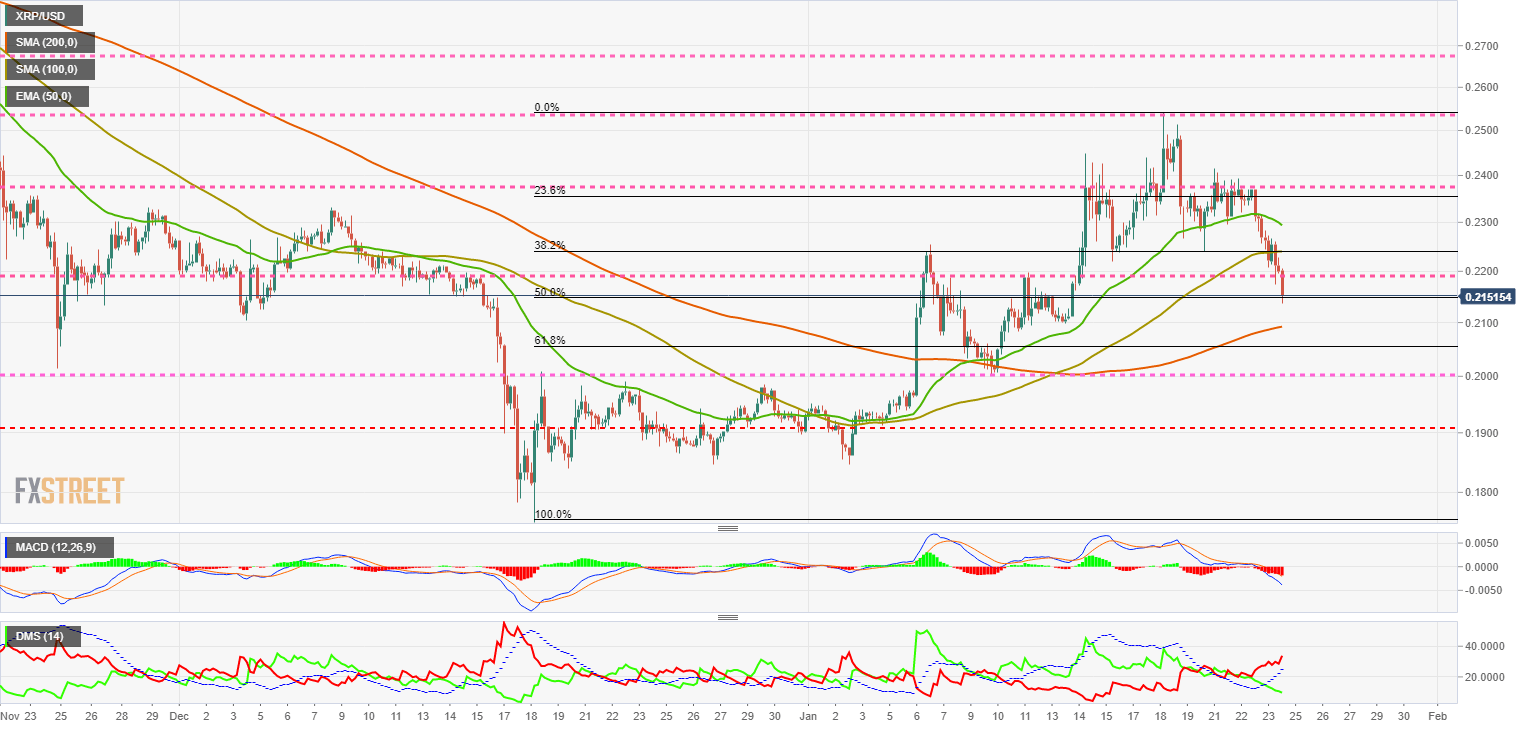

XRP/USD 4-Hours Chart

XRP/USD is currently trading at $0.215 and accelerating the downward movement that began this week. The current price coincides with the 50% level of the Fibonacci retracement system. The next support, according to this tool, is at the 0.205 price level, 61.8% of the Fibonacci retracement system.

Above the current price, the first resistance level is at $0.218, then the second at $0.223 and the third one at $0.235.

Below the current price, the first support level is at $0.205, then the second at $0.20 and the third one at $0.19.

The MACD on the 4-hour chart shows an acceleration of the downward movement. The MACD on the 4-hour chart shows an acceleration of the downward movement.

The DMI on the 4-hour chart shows that the bearish trend is increasing and the bearish momentum is strong. The bulls are not reacting and continue to lose momentum.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP gains as traders gear up for futures ETFs debut this week

XRP climbs over 3% on Monday, hovering around $2.33 at the time of writing. The rally is likely catalyzed by key market movers like XRP futures Exchange Traded Funds (ETFs) approval by the US financial regulator, the Securities and Exchange Commission (SEC), and a bullish outlook.

Bitcoin Price Forecast: BTC eyes $97,000 as institutional inflow surges $3.06 billion in a week

Bitcoin (BTC) price is stabilizing above $94,000 at the time of writing on Monday, following a 10% rally the previous week. The institutional demand supports a bullish thesis, as US spot Exchange Traded Funds (ETFs) recorded a total inflow of $3.06 billion last week, the highest weekly figure since mid-November.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.