Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Will FOMC end BTC’s 2023 bull rally?

- Bitcoin price fails to overcome the $29,630 to $30.480 bearish breaker despite multiple attempts.

- Ethereum price undoes April’s second-week gains as it subscribes to BTC’s weakness.

- Ripple price is likely to retest the $0.422 support level as weakness penetrates altcoins.

Bitcoin price shows a lack of buying pressure that has negatively affected some sectors of altcoins, including Ethereum and Ripple. But the upcoming macroeconomic events are key in helping frame the directional bias for BTC and put wind in its sails.

A hawkish stance from the Federal Reserve Chairman, Jerome Powell is likely to cause a whiplash leaning bearish in the short term. But if the inflation hedge narrative pops like the last time, BTC and the larger crypto ecosystem will see a bullish outlook.

Read more on Fed’s interest rate decision and FOMC conference: Week Ahead: Important week for Bitcoin’s 2023 rally

Bitcoin price faces intense selling pressure

Bitcoin price has been struggling to overcome the $29,630 to $30.480 bearish breaker for nearly two weeks. The recent retest of this setup was over the weekend which resulted in a 5.80% slide to the downside.

This bearish outlook is likely to continue until the Federal Reserve’s interest rate decision and the Federal Open Market Committee (FOMC) conference scheduled for May 3. This event should trigger a strong response for Bitcoin price.

An overly hawkish stance is technically bearish for risk-on assets like stocks and Bitcoin. In the short term, BTC might slide lower, but if the inflation hedge narrative gains traction traders can expect the big crypto to rally in the long run.

In such a case, Bitcoin price could eye a retest of the $35,000 hurdle.

BTC/USDT 1-day chart

On the other hand, if Bitcoin price fails to react to the Fed’s interest rate decision or FOMC conference and rally, it will indicate a lack of confidence. In such a case, BTC could crash down to the $25,000 level.

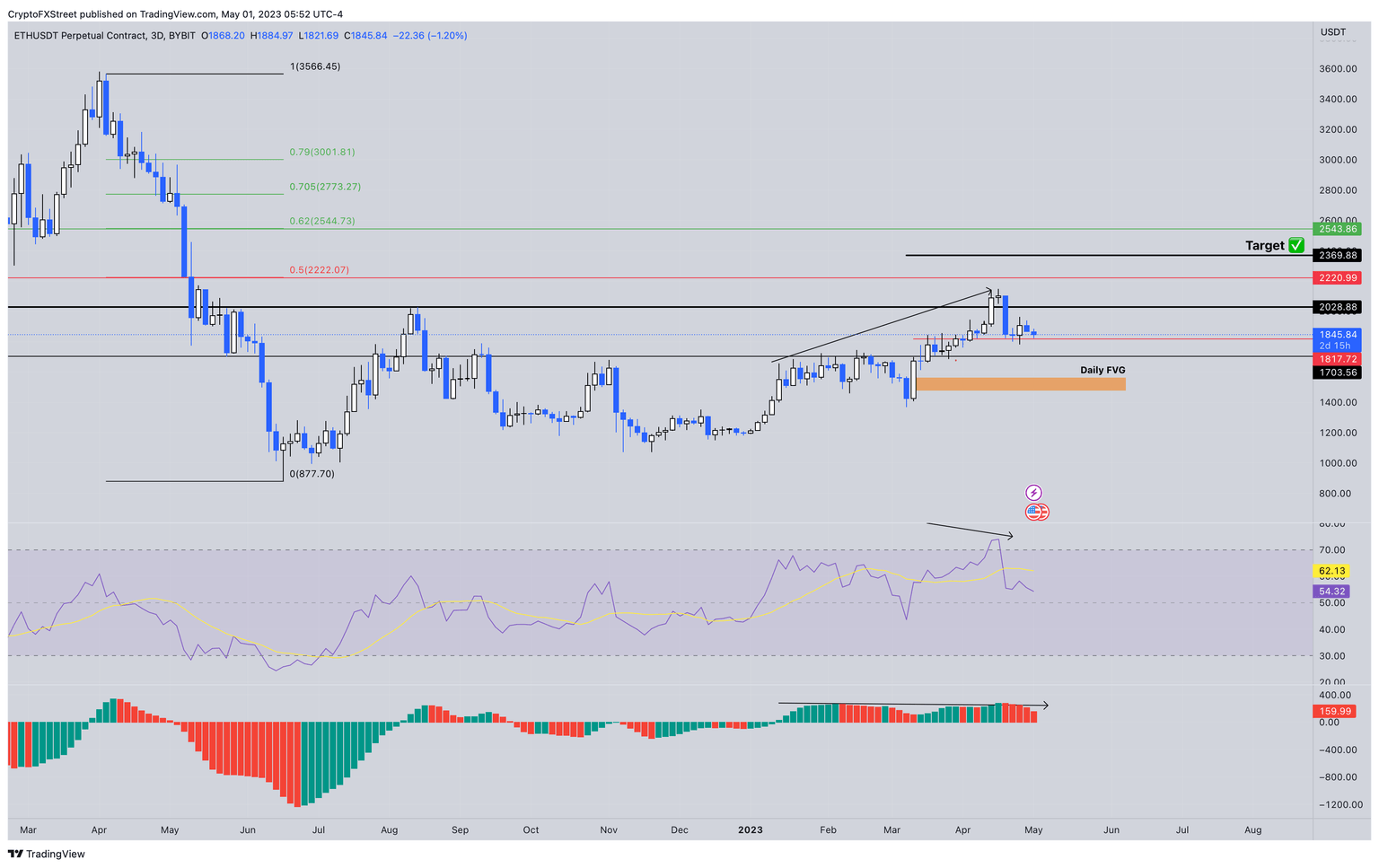

Ethereum price remains a puppet

Ethereum price moves have remained in lockstep with Bitcoin price for obvious reasons. ETH undid the gains it raked up over the second week of April. Despite its correlation with Bitcoin, the bearish divergence on the three-day chart is one of the reasons why Ethereum price crashed down by 15% in the last two weeks.

However, if the above mentioned outlook comes to reality for Bitcoin price, the smart contract token is likely to follow BTC’s lead and tag the $2,200 hurdle, followed by the $2,543 blockades.

ETH/USDT 3-day chart

While the outlook for Ethereum price remains largely dependent on Bitcoin price, a failure to hold above the $1,817 support floor will invalidate the bullish scenario. In such a case, ETH could slide down to inefficiency, extending from $1,478 to $1,564.

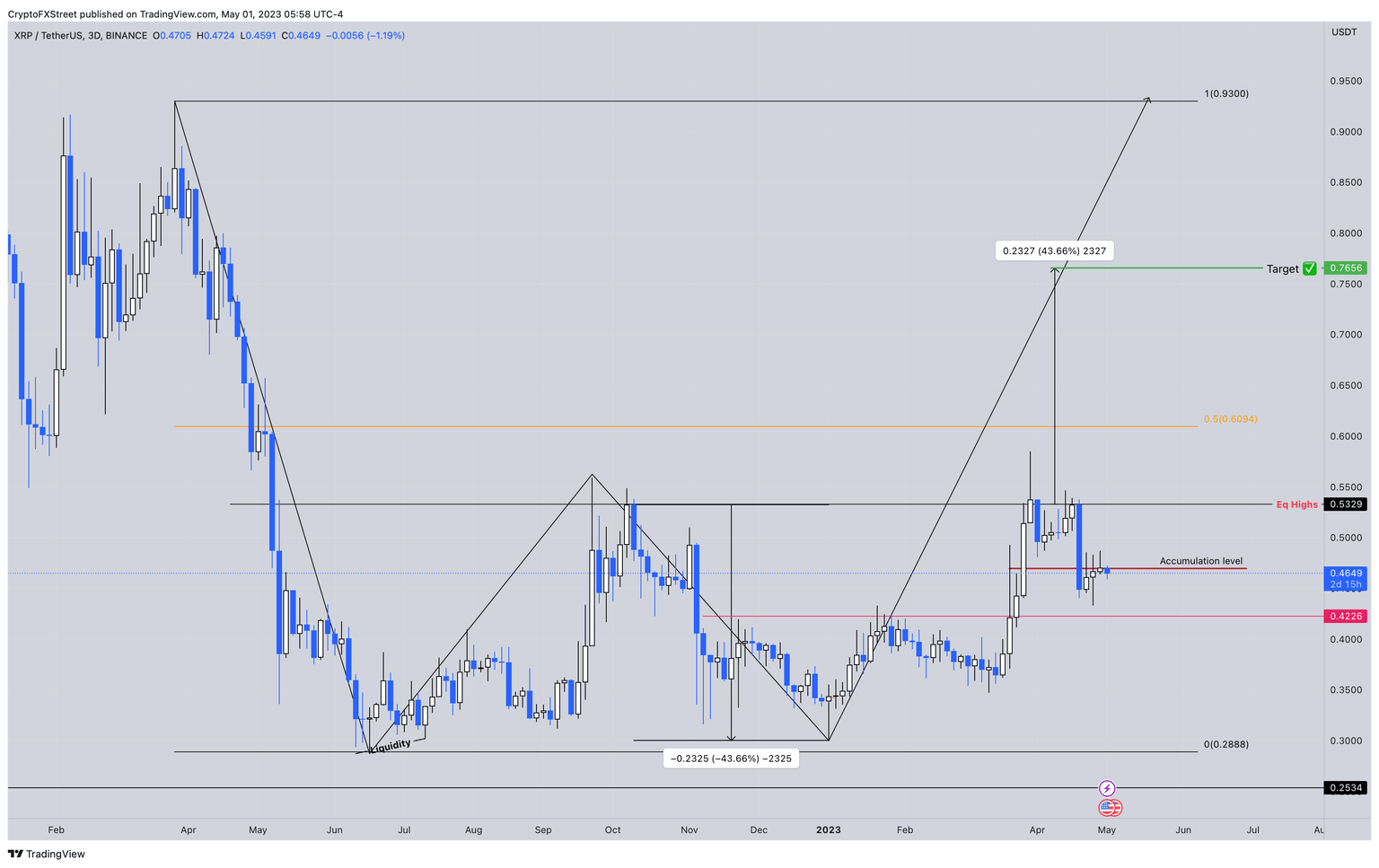

Ripple price remains at inflection point

Ripple price tried to remain bullish and complete the W-pattern as seen in the chart below. However, sever rejection at $0.532 level has paused the uptrend. Furthermore, a spike in selling pressure could likely knock XRP price down to retest the $0.426 support level.

If Bitcoin price kick-starts a rally, Ethereum and Ripple price are likely to follow its lead. In such a situation, XRP price could shoot up by 26% and attempt to overcome the $0.532 resistance level. A successful flip of this hurdle will open the path for the remittance token to retest the $0.609 barrier.

XRP/USDT 3-day chart

Regardless of the bullish outlook for XRP price, a failure in the SEC vs. Ripple lawsuit could have a serious implications on the token’s performance. If XRP price flips the $0.426 support level into a hurdle, it will invalidate the bullish outlook and potentially crash by 30% to tag the range low at $0.288.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.