Top 3 Price Prediction: Bitcoin, Ethereum, Ripple: Who will catch the falling knife?

- Bitcoin price fell below $20K over the weekend but quickly recovered as bears take a break.

- Ethereum price revisits historical indicator lows.

- Ripple price could induce a rally towards $0.40 if the $0.34 resistance level is successfully hurdled.

The crypto market is dependent on Bitcoin’s survival. The possibility of a market reversal is still valid.

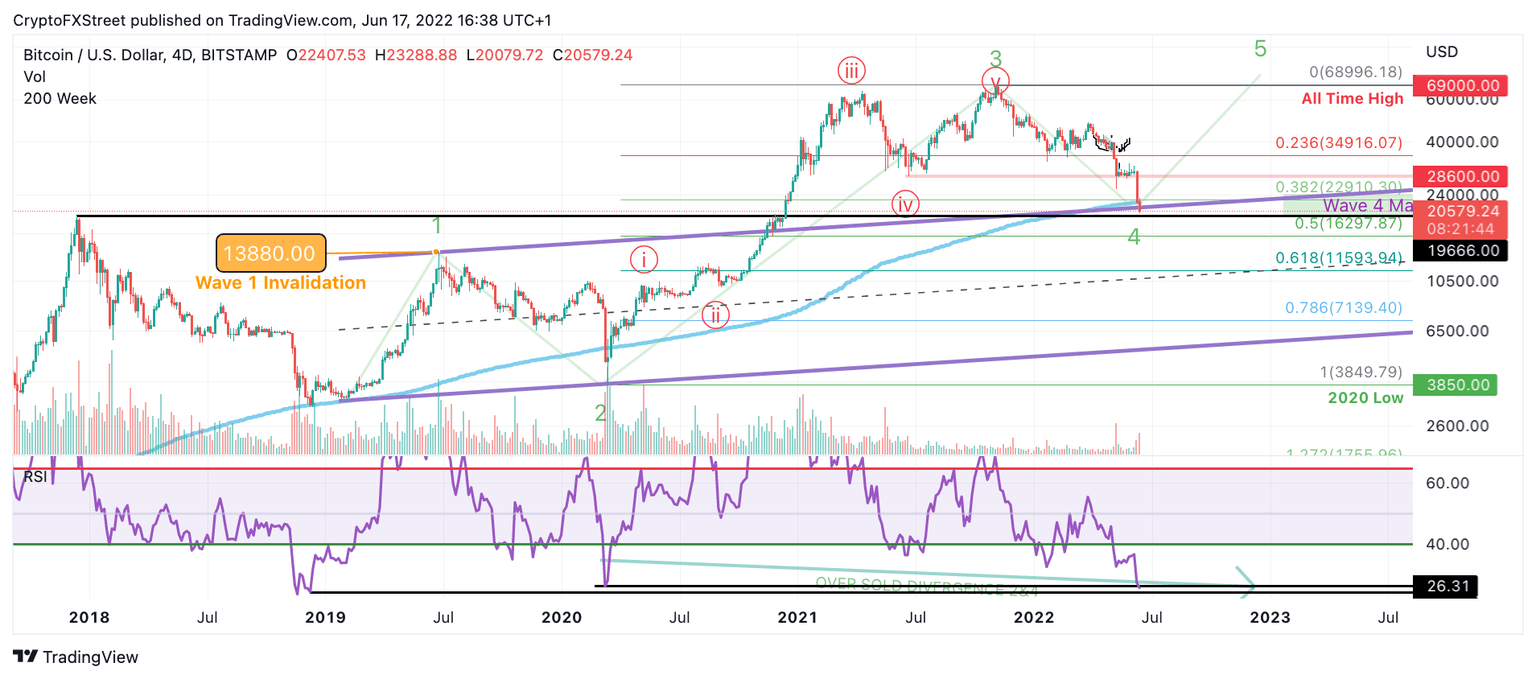

Bitcoin price is at a fork in the road

Bitcoin price currency trades at $20,646. The bulls are struggling to claim grounds on the 200-week moving average. An Elliot wave trend channel lies within the vicinity of the current market value price, which signals optimism as the first engagement is being witnessed on the 4-day chart. The Relative Strength Index revisits four-year lows and has subtle space to move lower, confirming that BTC price could fall into 2017 highs at $19,666.

Invalidation of the downtrend is a breach of $30,500. If this bullish event occurs, the bulls could push for new all-time high targets in the $80,000 range resulting in a 300% increase from the current Bitcoin price.

BTC/USDT 4-Day Chart

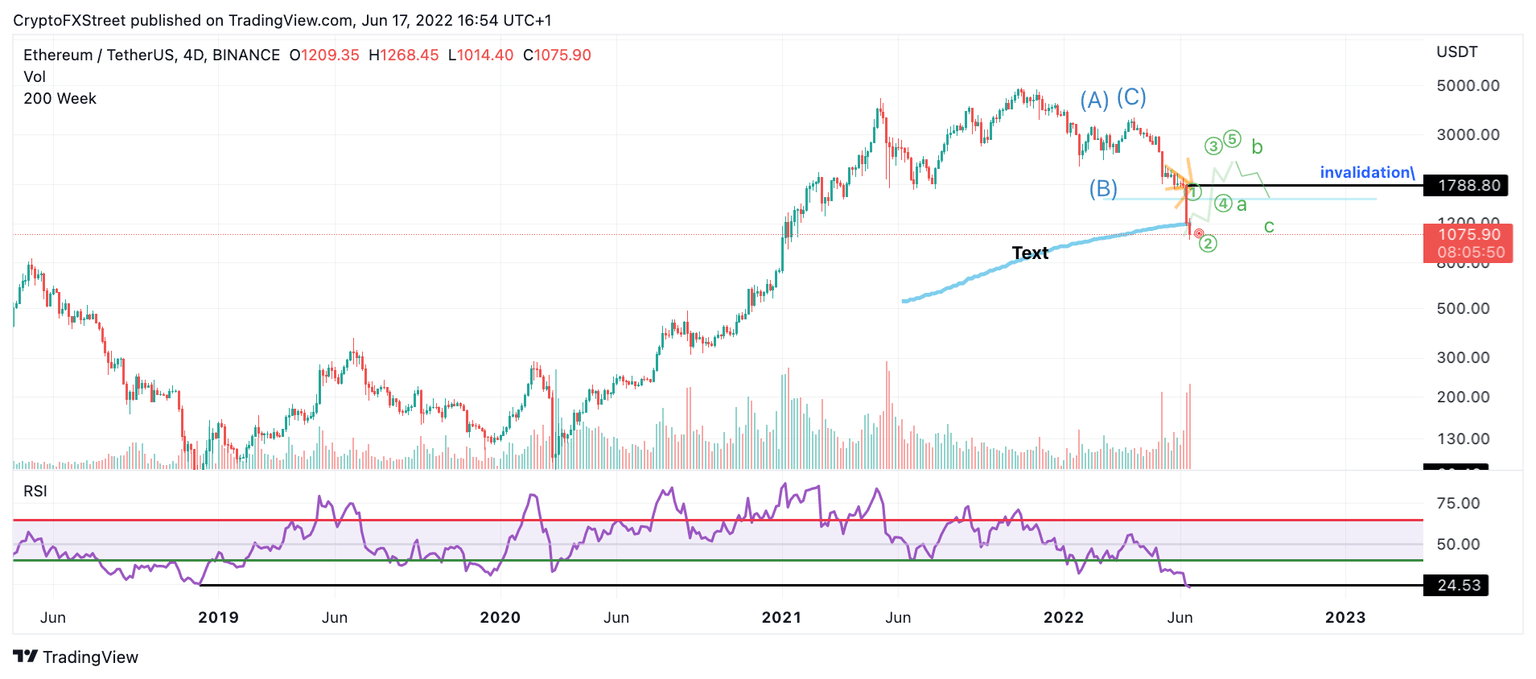

Ethereum price needs to recover soon

Ethereum price revisits historical RSi low last touched in $2018 when Ethereum traded at $81 on the 4-day chart. Ethereum price currency trades at $1,076. The anomalous indicator reading warrants significant belief that reversal could occur. Still, if the bulls have failed to rally support from the 200-week moving average, if they do not find support soon, a three-digit Ethereum will likely occur, targeting $800.

Invalidation of the bearish trend lies at $1760. If the bulls can accomplish this hurdle, new all-time highs in the $5,000 zone will be a confident target, resulting in a 365% increase from the current Ethereum price.

ETH/USDT 4-Day Chart

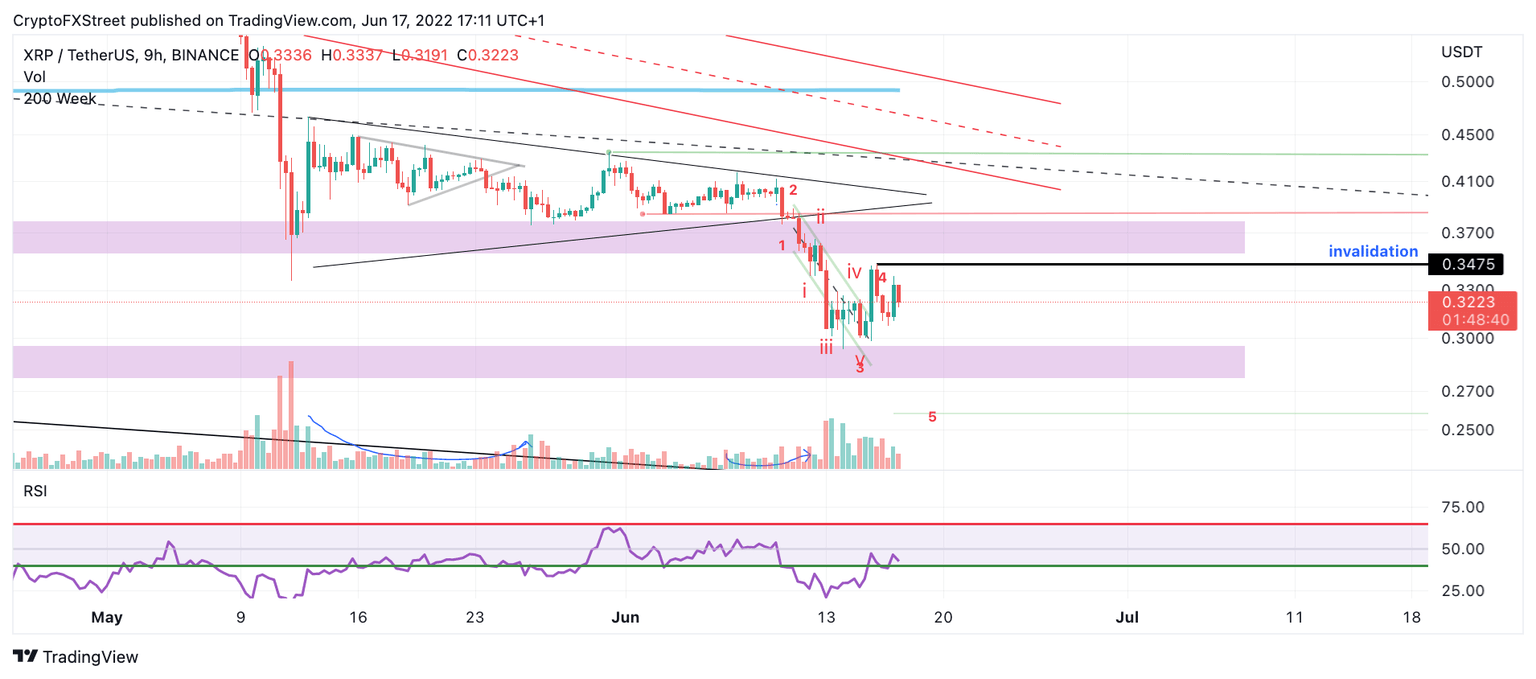

Ripple price could see a change in the trend

Ripple price is in a make-or-break decision as talks of an SEC settlement continue to linger within the market sentiment. A delayed hearing could be the catalyst to enable Investors to lessen their load. XRP seems to correlate with Bitcoin price and could continue moving lower towards $0.25 if market conditions persist.

Xrp price still trades within wave four territory, keeping the bearish trend intact. However, a simple breach of $0.34 could invalidate the downtrend and trigger a rally back into $0.40, resulting in a 25% increase from the current XRP price.

XRP.USDT 9-Hour Chart

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.