Top 3 Price Prediction Bitcoin, Ethereum, Ripple: What Wall Street doesn’t want you to know

- Bitcoin shows an uptick in active addresses. Sudden upticks have led to significant sell-offs this year.

- On-chain analysis suggests smart money is uninterested in holding Ethereum.

- XRP price shows the highest uptick in transactions for all of 2022.

The crypto market is in a critical spot. On-chain analysis tools, in addition to Elliot Wave and classic technical analysis, are being used to gauge potential market behavior.

Bitcoin price shows smart money involvement

Bitcoin price currently auctions at $24,051. Bulls should consider moving forward with caution as the BTC price action trades near the edge of an ascending wedge. In recent weeks, the peer-to-peer digital currency has consistently performed in staggered upward motion. Although profits have been made and intended targets have been reached, the uptrend has not been easily accomplished.

Santiment’s Active Transactions Indicator confounds the call for caution as the BTC price has shown a significant influx in daily transactions. On three separate occasions throughout this summer, BTC saw a similar upswing in transactions, which resulted in a large sell-off days after.

Santiment Active Transactions 1-Hour Scale

BTC/USDT 1-Day Chart

In the following video, our analysts deep dive into the price action of Bitcoin, analyzing key levels of interest in the market. -FXStreet Team

Ethereum price continues to ascend

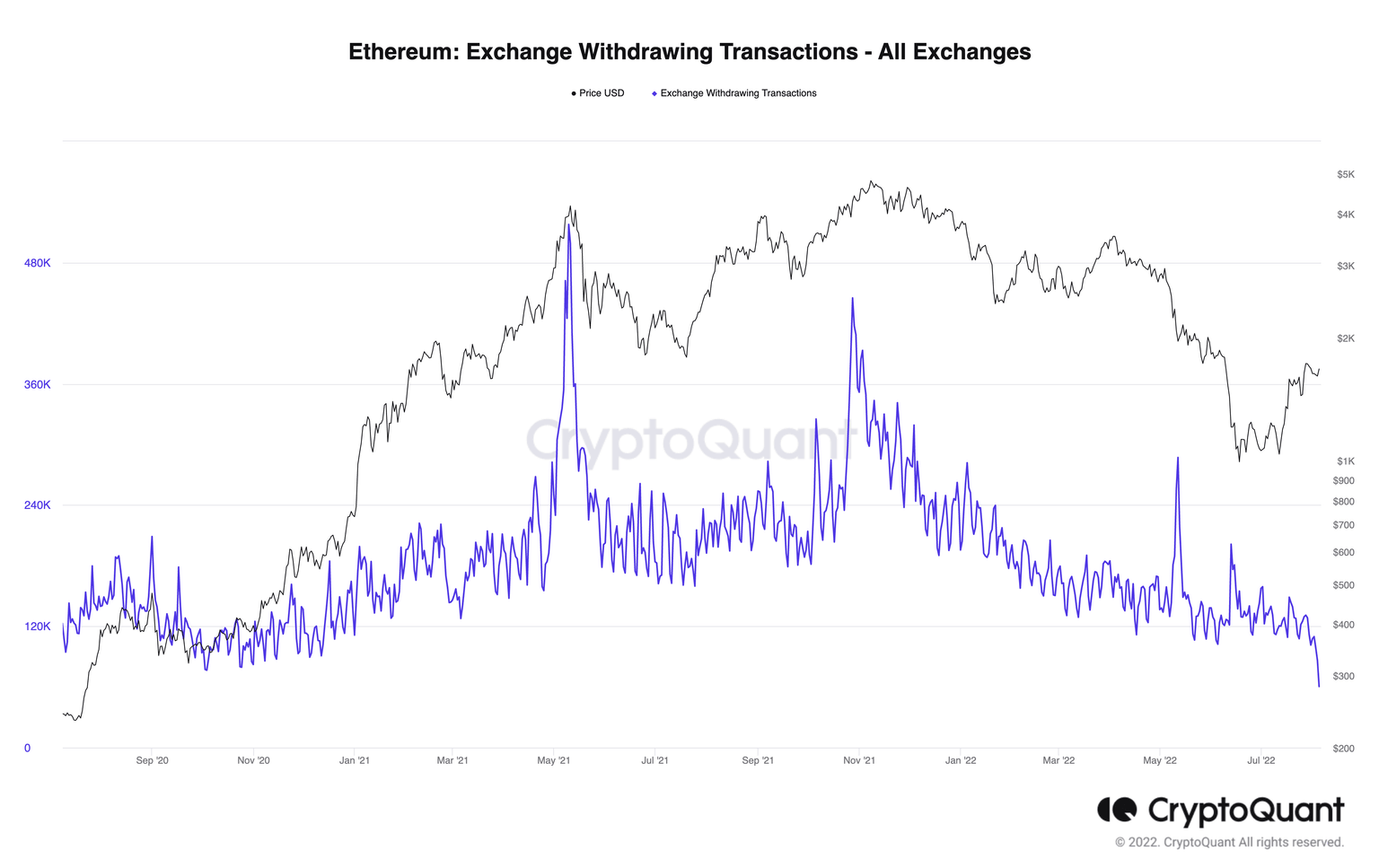

Ethereum price currently consolidates at $1,900. CryptoQuant’s Withdrawing Transactions on all Exchanges has recently breached new lows for 2022. The indicator may suggest that whales are uninterested in holding the smart contract token for more than a few weeks at a time.

CryptoQuant’s Ethereum: Exchange Withdrawing Transactions

ETH/USDT 12-Hour Chart

In the following video, our analysts deep dive into the price action of Ethereum, analyzing key levels of interest in the market. -FXStreet Team

XRP price shows concerning signals

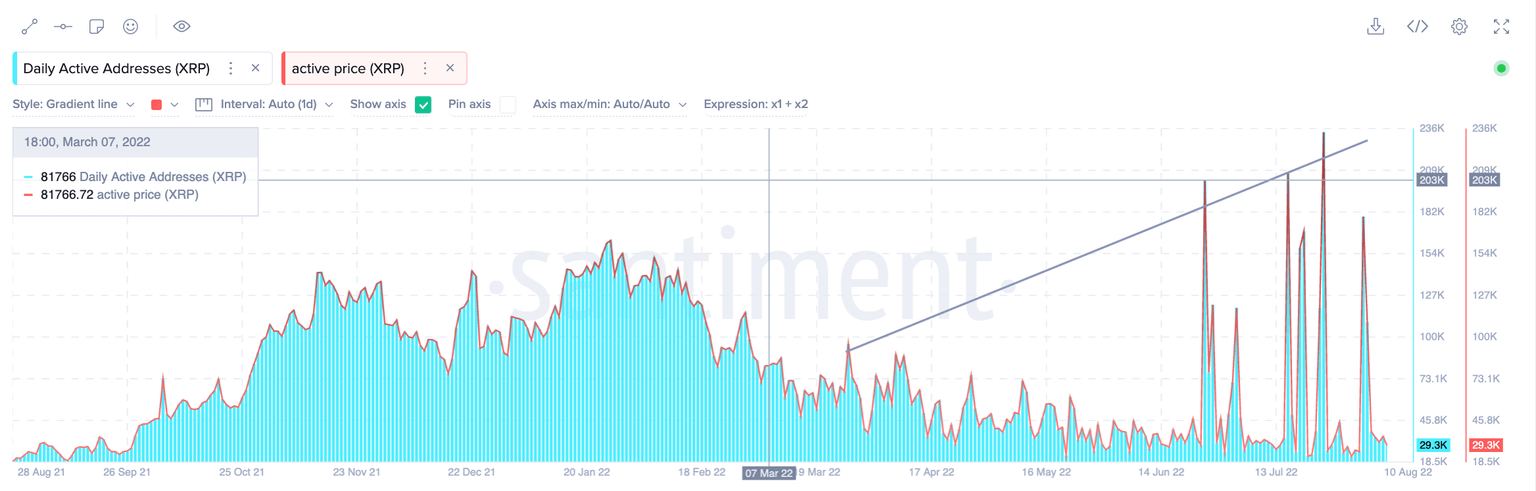

XRP price shows reason to apply caution. The digital remittance token has also shown an uptick in active transactions according to Santiment’s indicator. In fact, the indicator suggests the most amount of transactions have occurred this summer in retrospect of the last 12 months. Thus, a sharp decline could be in the cards for the XRP price.

Santiment Active Addresses Indicator

XRP price currently trades at $0.37 as the technicals are on their way to establishing a classical sellers’ pattern on the daily chart. At the time of writing, XRP price is two hours from printing a bearish evening star. This pattern will accompany a double-top formation on the Relative Strength Index, pouring gasoline onto the speculative bearish flame.

XRP/USDT 1-Day Chart (possible count)

In the following video, our analysts deep dive into the price action of Ripple, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.