- Bitcoin price sell-off was projected by glaring deteriorating technicals.

- Ethereum price rebound will be challenged by the broader crypto oscillations, not just Bitcoin.

- XRP price correction of over 40% shows no secure positions for speculators.

The announcement by WeWork that it will begin accepting payments in select cryptocurrencies, including Bitcoin, Ethereum, USD Coin, Paxos, and several others, is another sign of adoption and follows the decision by Tesla to do the same. It can be used to pay for membership if firms want to, and Coinbase, the cryptocurrency exchange, will be the first to pay for its membership using cryptocurrency, but with what currency is still unknown.

Additionally, WeWork will pay landlords and third-party partners in cryptocurrencies where they are happy to accept this via Coinbase. WeWork CEO, Sandeep Mathrani, is proud of the efforts by WeWork to be “at the forefront of innovative technologies, finding new ways to support our members.”

Moving forward, the collective crash in the cryptocurrency complex this weekend was a jolting reminder of the risk-reward dynamics that govern the market and the increased leverage in the prominent cryptocurrencies. Moreover, should not overlook that the complex was ripe for downside volatility in light of the deteriorating technical backdrop, as was the case with Bitcoin or the hyper-extended conditions, in the case of Ripple.

Bitcoin price sell-off was projected by deteriorating technicals

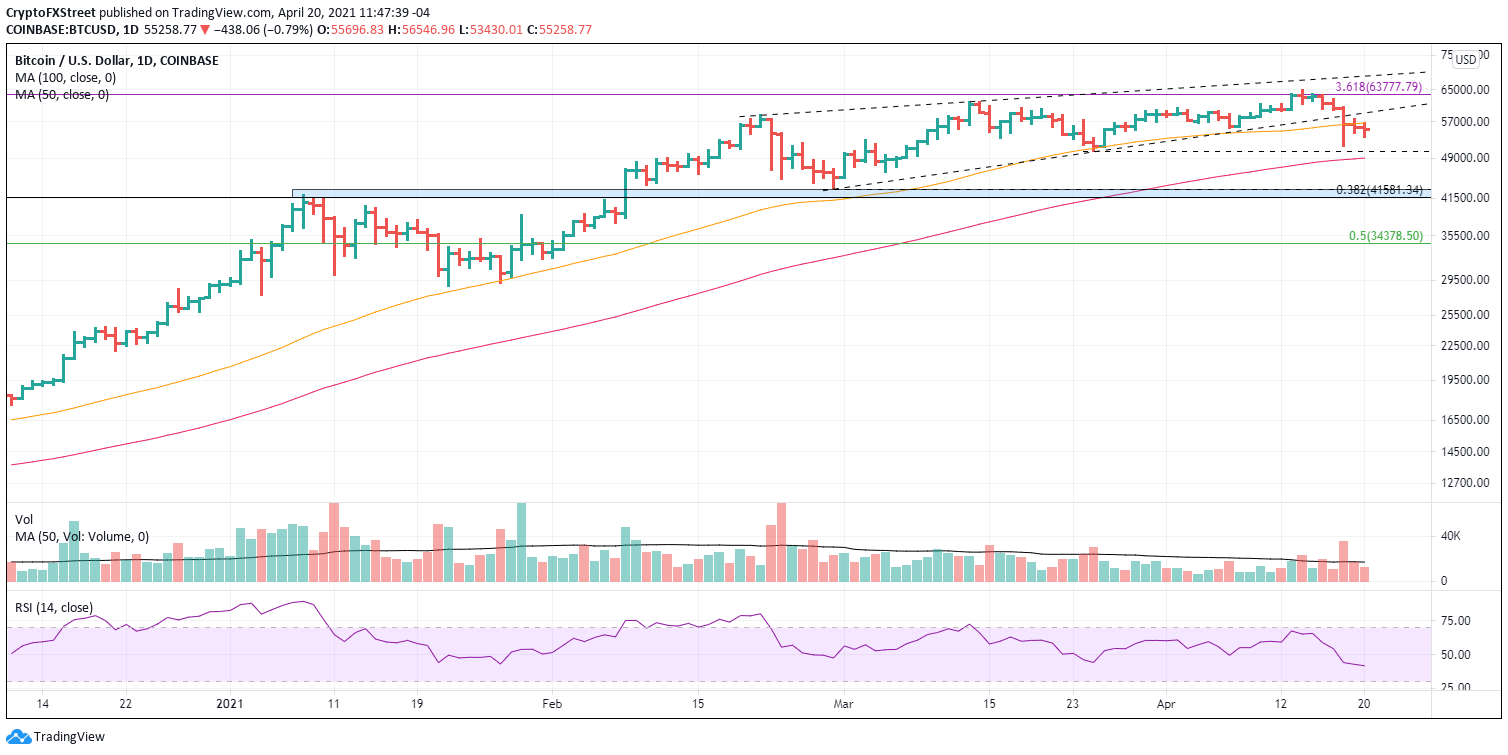

It was expressed in previous FXStreet Top 3 articles that BTC was illustrating a rising wedge and that it was vulnerable to a quick decline after struggling with resistance at the 361.8% Fibonacci extension of the 2017-2018 bear market at $63,778. Additionally, there was declining momentum as the weekly Relative Strength Index (RSI) was flashing a negative divergence with price for the second time since the February high.

Moving forward, BTC is in a highly vulnerable position on the daily chart. It is now locked below the lower trend line of the rising wedge and, more importantly, below the 50-day simple moving average. A moving average that the bellwether cryptocurrency has held since the beginning of October 2020. It is the first sign of a possible trend change.

Support still remains at the March low at $50,305. A decline below on a daily closing basis would be the first lower low in 2021, marking another bearish development for Bitcoin.

The next support is the 100-day SMA at $48,989, followed by the close interaction of the February low at $43,016, the January high at $41,986, and the 38.2% retracement of the 2020-2021 advance at $41,581. It would represent an additional loss of over 20% from current prices, but it would reset the daily RSI for a new rally.

BTC/USD daily chart

A switch to a neutral outlook can begin if Bitcoin price registers a daily close above the wedge’s lower trendline at $59,170. Again, the 361.8% extension of the 2017-2018 bear market is credible resistance, followed by the wedge’s upper trendline currently at $68,750.

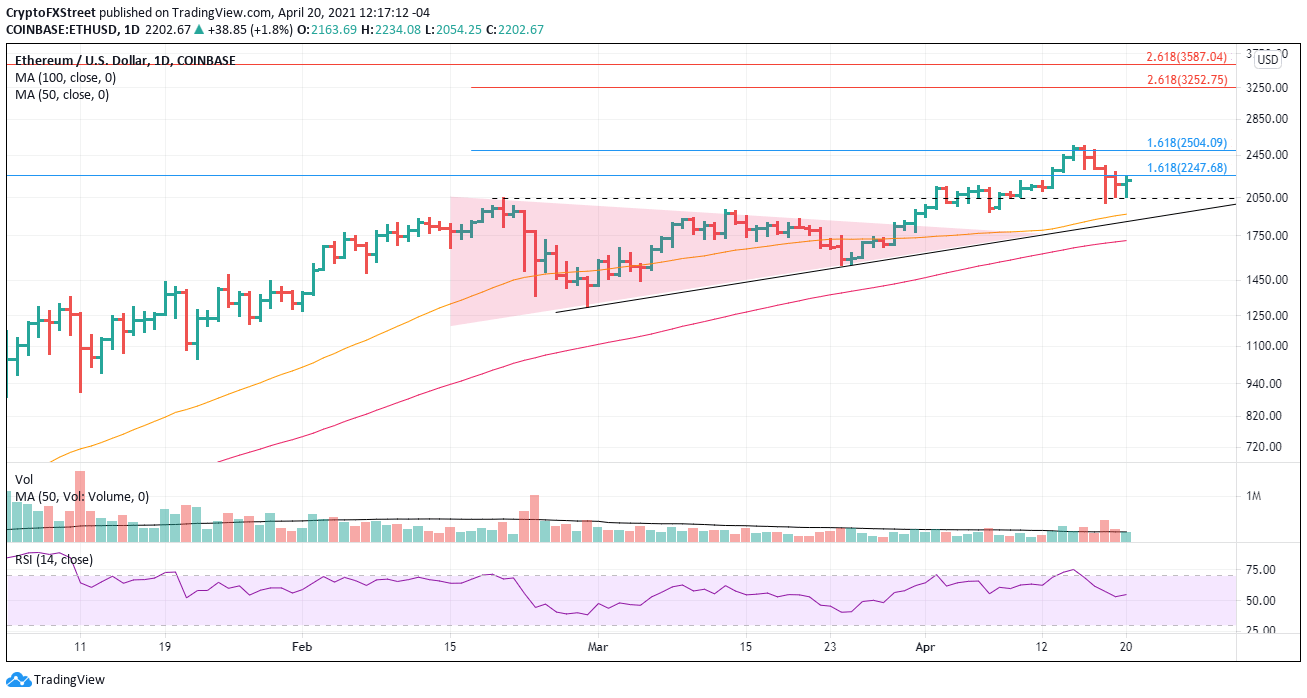

Ethereum price advance may endure, but not without a close call

Unlike Bitcoin, ETH did hold necessary support on the weekend and early this week, saving the bullish outlook from being downgraded. Currently, the smart contracts giant is bouncing from the February high at $2,041.42 for the third consecutive day. Immediate resistance is the 161.8% extension of the 2018 bear market at $2,247 and then the 161.8% extension of the February correction at $2,504, which is where the rally stalled.

If the Fibonacci cluster is cleared, ETH should rally to the 261.8% extension of the February decline at $3,253 and potentially the 261.8% extension of the 2018 bear market at $3,587.

It is important to note that Ethereum price may close today with two consecutive inside days, indicating selling exhaustion.

ETH/USD daily chart

With Bitcoin in a far more precarious technical situation, speculators need to be mindful of the downside support. Everything changes with a daily close below the February high. Ensuring support is at the 50-day SMA at $1,914.27, then the rising trendline from the February low currently at $1,850 and finally at the 100-day SMA at $1,713.

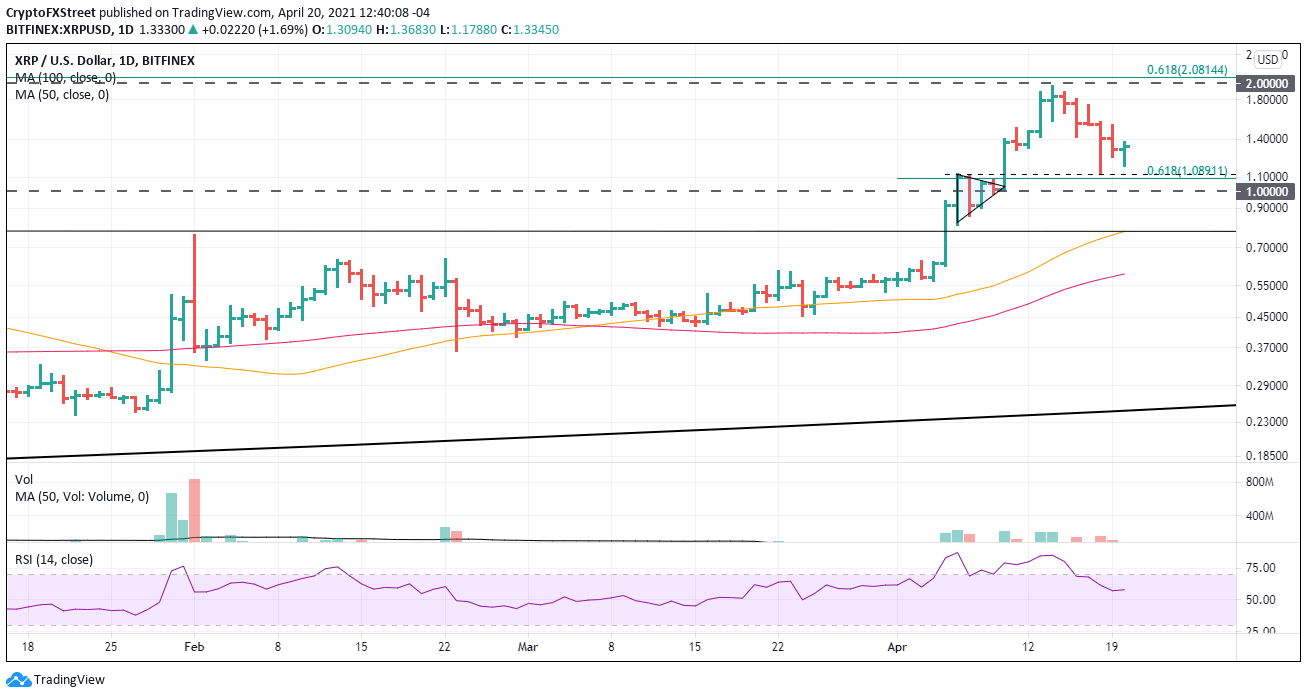

XRP price weakness should be bought around $1.10

It is difficult to argue that an uptrend is intact after falling over 40%, but that could be the case with Ripple. The international settlements token faces a challenge to test the rally high at $2 as equally sharp rallies rarely follow significant corrections. It is likely not to change with Ripple.

Speculators should use weakness to initiate new positions and focus on the convergence of the April 6 pennant high at $1.12 with the 61.8% retracement of the April rally at $1.09 as the entry point. If this is a correction, any downside should be limited at the psychologically important $1, thereby creating the possibility of a double bottom and a second entry point.

XRP/USD daily chart

A failure to hold $1 leaves speculators exposed to a quick collapse to $0.80, leaving a test of the all-time high for later in the year.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bulls target $100,000 BTC, $2,000 ETH, and $3 XRP

Bitcoin (BTC) is stabilizing around $95,000 at the time of writing on Wednesday, and a breakout suggests gains toward $100,000. Ethereum (ETH) and Ripple (XRP) followed BTC’s footsteps and hovered around their key levels.

Tether mints 3 billion USDT on Ethereum and TRON as markets stabilize

Tether ramps up its minting activity amid surging demand for stablecoins, often signaling heightened trading and liquidity needs. The issuer of the leading stablecoin by market capitalization has minted 2 billion USDT on Ethereum and an additional 1 billion USDT on the TRON network.

SEC delays decision on Franklin Templeton’s spot XRP ETF to June 2025

The Securities and Exchange Commission (SEC) has postponed its decision on Franklin Templeton’s spot XRP ETF, extending the review period to June 17, 2025. XRP traded at approximately $2.24 at press time, rising 7% over the past week, according to CoinGecko.

Trump Media announces new token launch and native crypto wallet in latest Shareholder letter

Trump Media unveils plans to launch a utility token and crypto wallet to monetize Truth Social and expand its streaming services. Markets react with a 10% drawdown on the Solana-hosted official TRUMP memecoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.