- Bitcoin takes a breather from the impressive rally to new yearly highs; the mission to test $15,000 is intact.

- Ethereum might revisit $395 support levels before resuming the uptrend to $500.

- Ripple rejected from levels above $0.25 again as buyers rush to hold the ground above $0.24.

Bitcoin hit new yearly highs on Tuesday, shining a light on the possibility of a rally to $15,000. The liftoff carried some major cryptocurrencies upwards, including Ethereum and Ripple. A few decentralized finance (DeFi) tokens also towered above the crypto horizon, such as Compound (COMP) and Curve Dao Token (CRV).

The total capitalization of the cryptocurrency market has grown consistently over October. Data provided by CoinMarketCap shows the market size currently stands at $406 billion, up from $335 billion, recorded on October 1. Digital assets are likely to be getting ready for a significant bull run towards the end of the year.

Crypto market capitalization chart

Bitcoin impending rally to $15,000

The flagship cryptocurrency is holding marginally above $13,700 after a minor rejection from levels slightly above $13,800. BTC/USD appears to be seeking support before continuing with the rally above $14,000.

According to the 4-hour chart, Bitcoin could suffer another rejection from June 2019's highs. However, moving past this hurdle will likely make Bitcoin jump on an upswing to the region between $14,700 and $15,000.

The TD Sequential indicator could present a sell signal in the coming hours, giving credence to a bearish outlook. If validated, the flagship cryptocurrency may retrace to $13,300 or even the 50 Simple Moving Average (SMA) in the 4-hour timeframe.

BTC/USD 4-hour chart

According to Parabolic Thies, a renowned analyst, Bitcoin is on the verge of breaking out to the highest level since January 2018. Interest in the flagship cryptocurrency is nearly hitting a five-year low as per Google Trends. All signals point to the beginning of an incredible bull run as soon as interest starts trending in the same direction as the price.

Ethereum short-term price action eyes $400

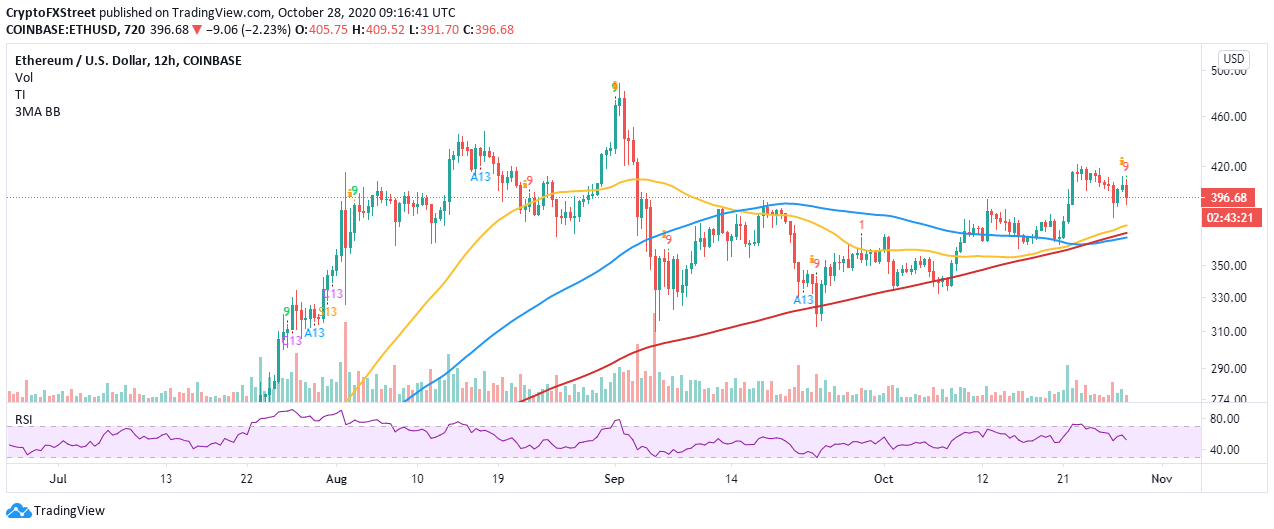

The smart contract cryptocurrency rallied in tandem with Bitcoin on Tuesday. Ether built upon the support provided at $390. Before that, ETH/USD embraced support above $380 after plunging from October highs at $420.

With the excellent price action on October 27, Ethereum retested the seller congestion at $410 before retreating towards $400. In the meantime, Ethereum is teetering at $397 and likely to retest the x-axis of the ascending triangle pattern. A rebound from the x-axis is likely to return Ether into the upward trajectory, with the upside eyeing $420.

ETH/USD 4-hour chart

The TD Sequential indicator gives credence to the bullish outlook after presenting a buy signal in the form of a red nine candlestick in the 12-hour chart. Therefore, price action above $400 is in the offing while the journey back to $420 is in its initial stages.

ETH/USD 12-hour chart

It is worth mentioning that Ethereum's bullish narrative could be sabotaged if Ether closes below the 100 SMA in the 4-hour timeframe. Consequently, a 20% correction into the picture with downside eyeing $306.

Ripple encounters yet another rejection

For a couple of days this week, XRP doubled down on the mission to push for gains above $0.3. The price action from descending parallel channel support stepped above $0.25 but failed to penetrate the seller congestion at $0.254.

The 100 SMA in the 1-hour range also added pressure on the cryptocurrency, culminating in another rejection. Meanwhile, XRP is contained within an ascending triangle pattern. Upward action from the current market could retest the x-axis of the triangle pattern around $0.26. A daily close above the triangle resistance might nurture a breakout to $0.3.

XRP/USD 4-hour chart

On the other hand, if the price closes below the 200 SMA in the 4-hour timeframe, the bullish trend could be invalidated altogether. Such a move is bound to trigger a 15.5% correction to $0.21.

Daily takeaway

Bitcoin's outstanding rally to new yearly highs reminded investors that it is only at the beginning of an incredible bull run. As soon as the interest in Bitcoin, as seen on Google Trends, begins to trend upwards, the price is bound to start rolling to levels only seen in January 2018. Meanwhile, a minor retreat to $13,500 is anticipated before the rally to $15,000 begins.

Ethereum hit a snag slightly above $410 after making an impressive recovery to $390. For now, short-term analysis shows Ether is likely to revisit support at $395 before resuming the uptrend.

On the other hand, Ripple is dealing with another rejection after hitting a barrier at $0.254. The 50 SMA is in line to offer immediate support. Losses could also extend to $0.246 if the tentative support at $0.25 fails to hold.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The Cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin (BTC) holding steady at $82,584, Ethereum (ETH) at $1,569, and Ripple (XRP) maintaining its position above $2.00.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Can FTX’s 186,000 unstaked SOL dampen Solana price breakout hopes?

Solana price edges higher and trades at $117.31 at the time of writing on Friday, marking a 3.4% increase from the $112.80 open. The smart contracts token corrected lower the previous day, following a sharp recovery to $120 induced by US President Donald Trump’s 90-day tariff pause on Wednesday.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637394677723877275.png)

-637394760021575879.png)

- 2020-10-28T121705.992-637394734883607479.png)

-637394747804128161.png)